CoinWeek Staff Reports….

Hat Tip to David Lawrence Rare Coin’s John Feigenbaum. On Sunday, Feigenbaum sent CoinWeek word of changes in Virginia state law that provide for exemptions for buyers of bullion products within the Commonwealth. Feigenbaum has worked with the Industry Council for Tangible Assets for more than two years to affect this change in state law.

In the following text, taken from an email sent to David Lawrence Rare Coin customers residing in Virginia, Feigenbaum explains the particulars of the new Virginia bullion law.

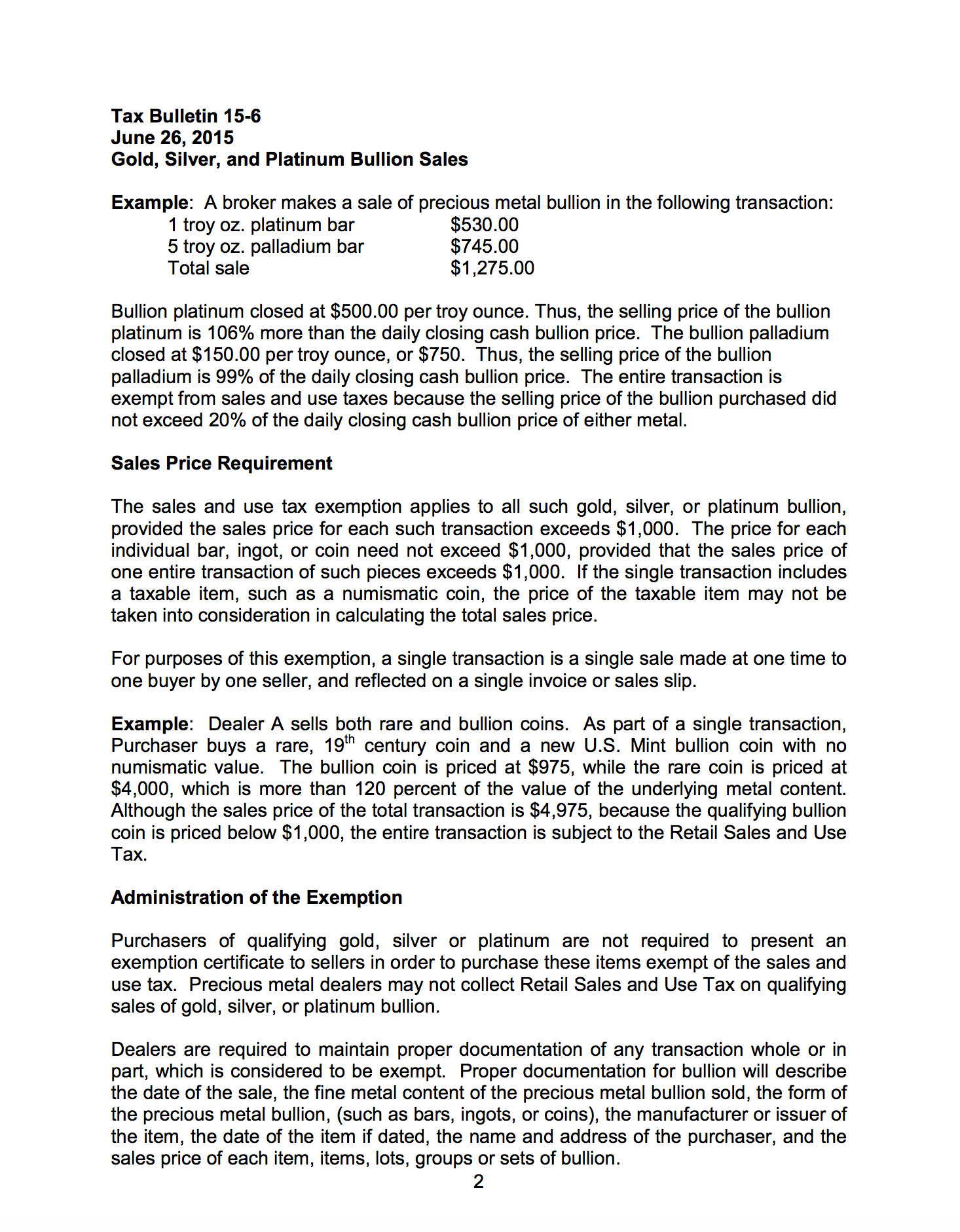

The VA Dept of Taxation has posted bulletin 15-6 with the specifications for our bullion tax exemption.

Effective July 1 the sales and use tax (either 5.3 percent or 6 percent) will not be applied to items which meet the following tests:

o The item must be refined to a purity of at least 90 percent precious metal. (this applies to all pre-1933 US gold and modern US gold bullion products like Silver, Gold & Platinum Eagles)

o The item may be a bar or ingot, a round, or a coin, including coins originally minted as legal tender (for example, pre-1933 U.S. gold and silver coins contain 90 percent precious metal).

o The sale price must depend on the metal value and be no more than 120 percent of the value of the precious metal content. For example if the item contains one ounce of gold and the daily price of gold is $1,200 per ounce, the item will not be tax-exempt if the price exceeds $1,440. If the item contains one ounce of silver and the spot price of silver is $16, the sale will be exempt as long as the price is at or below $19.20.

o The total transaction, which can include more than one exempt item, must exceed $1,000. Even if the individual items meet those tests, they are still taxed unless the transaction adds up to $1,000 in cost. Non-exempt items cannot help reach that total.

o The item may not be art or jewelry, and may not contain additional elements that add value.

CoinWeek was able to acquire a .pdf of the bulletin, dated June 26, 2015. The three-page bulletin is presented here: