By Nigel West for CoinWeek.com …..

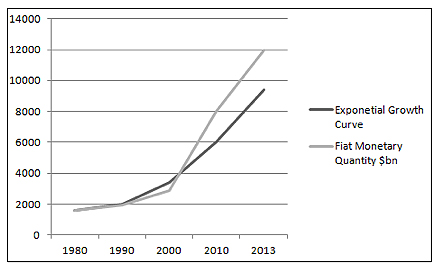

At the close of 2013, the USD Fiat Money Quantity (FMQ) had reached $12.48 trillion. The figure itself is staggering, especially when we consider that such a figure is $5.05 trillion more than if it has grown in line with the established growth rate from 1960 until the financial crash in 2008.

The upwards trend, however, doesn’t stop there and currency inflation currently sits at 68% above trend level since recovery from the financial crash began in 2009. The growth it seems is unstoppable because of the growth in FMQ valuations. This article will look at the lasting implications that FMQ will have on gold prices, looking at what it is, why it has skyrocketed and why it has been affecting gold valuations over the past few years.

What Is The FMQ?

Essentially, FMQ intends to measure the difference between our currency (measured by deposits or cash) and sound money.

This means that, by its very nature, it is fundamentally different to all other measures of money supply which are inherently inward looking as opposed to the outward facing nature of the FMQ; with so called conventional methods only comparing changes within themselves and the FMQ comparing both sound and unsound money.

FMQ and The Impacts Of Quantitative Easing

FMQ $bn average over time

When we look at such a sharp price increase in FMQ over such a short period of time, we have to understand why it has occurred, with understanding its occurrence being pivotal in understanding FMQ’s relationship with the bullion market and gold prices. As the graph shows, the sharpest increase in FMQ comparative to the exponential growth curve occurs over the past 12-24 months, a period which has been marked with volatility due to the perceived importance of federal tapering of the quantitative easing program; an issue that Fed chair Joanne Yellen spoke about only this week.

Analysts believe that the $85 billion quantitative easing programme has been the cornerstone of the FMQ bounce. Tapering/ quantitative easing has become a cornerstone of the markets over the course of the past couple of years and has had a particularly profound effect on the emerging markets in the East, having a large impact on liquidity.

To move on and understand how such liquidity impacts on the bullion market, we must look towards the gold and silver markets and see how the excess liquidity the Fed pumped into the markets has affected FMQ prices on both gold and silver.

FMQ And The Price Of Gold and Silver

With today’s astronomical gold prices per ounce, it can seem hard to believe that in 1960 gold was fixed at $35 compared with the dollar price. Fast forward just over 50 years to the close of the 2013 markets and gold had reached $1,200 and showed no signs of slowing down. The adjusted rate for this gold would be $76 without inflation, but even this would be more than double the 1960 rate.

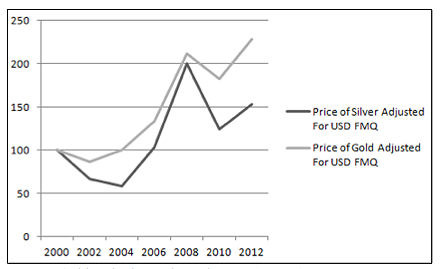

Gold and Silver Adjusted For USD FMQ: 2000 = 100

When rebasing the rate of gold in 2000 to 100, we can very clearly see that, by the close of 2012, gold had reached 124% of its 2000 price. Many believe that this is due to so call FMQ hyper-inflation but, in truth, although this has had a definite impact on market pricing structures, it does not tell the entire story and gold was in the midst of a relatively bearish market back in 2000.

However, in spite of this, hyperinflation of the FMQ has undoubtedly played a huge part in this alongside the Federal tapering programme coming into force post 2010, bolstering the gold market in the process. A recovery from a bearish market coinciding with a FMQ has proved to be the perfect storm for gold, especially alongside the tapering strategy, with gold quickly becoming the go to commodity for investors, causing prices to skyrocket.

To conclude, it is apparent that the FMQ is currently impacting hugely on gold prices, but to fully understand the current price level, we must also look towards the impact of federal tapering and the emergence from a bearish market. For now, the FMQ is contributing towards a bullish market, but rumours seem to suggest that once tapering comes into full force, we may see a bearish turn once more.

***

Nigel West is an international financial and economic journalist from the UK, currently studying the fortunes of emerging markets in Southeast Asia, alongside economic and financial crises in the Western world.