By Louis Golino for CoinWeek

In numerous pieces for this column over the past couple years, I have been to a large extent an advocate for the series of First Spouse Gold Coins. I have always believed America’s First Ladies deserve a series honoring them, though a strong argument can be made that the coins should have either been minted of silver or made in quarter-ounce gold size, as I argued a couple years ago in another publication. The bronze medals do provide a low-cost alternative, but they are not very attractive artistically, a criticism also leveled at the gold coin coins.

I have tended to take a more positive view of the artwork on coins in the series, although the quality of the reverse designs has declined substantially in the past year or so with far too many generic floral designs that are barely distinguishable from each other. I prefer designs that showcase the contributions of the particular spouse.

And there is of course also the draw of low mintage coins. The fact remains that this series has produced the lowest mintage U.S. coins of the past 100 years. How much that ultimately matters to collectors if hardly anyone really wants the coins remains to be seen. But there should be solid long-term demand for the series keys and for the Liberty subset of coins issued for presidents who were not married while in office.

And there is of course also the draw of low mintage coins. The fact remains that this series has produced the lowest mintage U.S. coins of the past 100 years. How much that ultimately matters to collectors if hardly anyone really wants the coins remains to be seen. But there should be solid long-term demand for the series keys and for the Liberty subset of coins issued for presidents who were not married while in office.

Finally, as many have noted, today’s sleepers can be high demand coins in the future after the series ends, and more collectors finally appreciate the coins. This remains a possibility, to be sure, but as the series begins its eighth year, I find myself increasingly doubting the likelihood that these coins, apart from those highlighted above, will ever be widely sought.* For one thing, likely higher gold prices in future years will continue to make the coins too expensive for many people, which in itself limits the market and demand for the coins.

I was speaking to my local dealer recently, an establishment with over 40 years in the business, and he told me that even when he offers First Spouse Gold Coins to customers for a lower premium than regular bullion American eagle gold coins, buyers want the eagles. He added that people “just don’t seem to connect to them.”

Even dealers who in the recent past did a fairly substantial amount of business in these coins seem to be largely uninterested in them now because of low demand from customers. If few dealers carry the coins, and few buyers want them, there is just not much of a market for the coins.

As we finally reach the post- World War II spouses that are more well-known, there may be something of a surge in interest for some issues, especially the coins for Jacqueline Kennedy Onassis and probably for Nancy Reagan and Hillary Clinton too. That is likely to solidify the status of the low mintage queens of the series, the Lucretia Garfield and Lucy Hayes coins, with mintages under 2200.

I have been trying to build a set of these coins since 2008 and recently decided that it made more sense to give up this pursuit and focus instead on the $5 gold commemorative series, which in my view has a brighter future. It is also a lot easier to collect since the coins are made of half as much gold as the First Spouse Gold Coins, just under a quarter-ounce instead of a half-ounce. And the $5 coins will always be widely collected, which means there is a well-established market for them. Plus the coins in the vast majority of cases have designs that most people find appealing, and though issued for over 30 years there are not that many coins in the series, making it much more realistic to complete than most gold coin series.

And yet, with all that it has going for itself, this series is largely undervalued with lots of coins with mintages under 10,000 that sell for a small premium over gold content. The 2013 Five Star General uncirculated coin is a new key coin with the second-lowest mintage in the series, but several other coins issued in the past couple years like the 2012 Star Spangled Banner uncirculated coin have mintages only a little higher, yet they do not carry much premium. This probably makes them good sleeper candidates.

And yet, with all that it has going for itself, this series is largely undervalued with lots of coins with mintages under 10,000 that sell for a small premium over gold content. The 2013 Five Star General uncirculated coin is a new key coin with the second-lowest mintage in the series, but several other coins issued in the past couple years like the 2012 Star Spangled Banner uncirculated coin have mintages only a little higher, yet they do not carry much premium. This probably makes them good sleeper candidates.

Collectors need to give considerable thought to what they collect, and there is nothing wrong with changing course when it makes sense to do so. Higher gold prices, especially compared to the first couple years of the series, made finishing the spouse series a daunting prospect for me, and doing so would have meant giving up any other coin interests. Plus the $5 gold coins are not only half as expensive or less, but they are not issued every year, and no more than two different ones are ever issued in one year because of the two commemorative coin program limit Congress imposed in response to the over-abundance of commemoratives in the 1980’s.

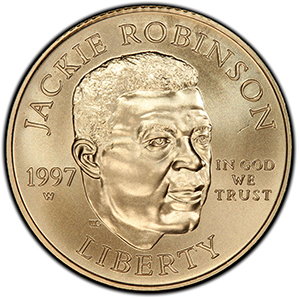

Most of the earlier $5 coins, except a few that have very low mintages such as the series key, the 1997 Jackie Robinson coin in uncirculated condition, are available for close to melt, or as slabbed 70’s for just a little more.

I recommend building a set of the uncirculated coins if you want the ones with the best long-term potential for appreciation because they always have the lower mintage compared to the proofs, and you can always substitute the proof version for the uncirculated issues that are very expensive. Then later if you are able to, you can sell the proof and buy the uncirculated coins.

I recommend building a set of the uncirculated coins if you want the ones with the best long-term potential for appreciation because they always have the lower mintage compared to the proofs, and you can always substitute the proof version for the uncirculated issues that are very expensive. Then later if you are able to, you can sell the proof and buy the uncirculated coins.

In addition, prices on many of the higher-premium $5 commemoratives have come down in the past couple years, and now is a good time to consider picking up some of those if your budget permits.

I admire those who have stuck with the First Spouse Gold Coins and plan to see it through to the end, but even if I could afford to do, which I can’t, I consider it too risky to invest so much on coins with such weak demand almost a decade into the series. Some coins just never catch on with collectors.

*An additional factor that decreases interest in the series is the production problems that delayed the release of the coins over the past two years. It appears that this year the coins may once again be issued later in the year, which frustrates people who want to buy the coins and stagger their purchases as well as those who would have liked to purchase while gold prices were lower.

This politically correct series was created to the detriment of the more popular fractional Buffalo gold and Platinum Eagle programs. While there are a few attractive coins in this series, most of them are hideous and as such the series will never have a substantial collector base. This series is a perfect example of government mandated stupidity.

Dead on, but you will find that most people will not agree whilst themselves following a pathetic politically correct path!

Very well-written and informative article that gives one a good perception into the current and future marketplace for these $10 gold spouses.

Hats off to Louis.

Thank you very much. Good to hear you found it informative.

It is certainly a well-meaning series, and I think it will eventually have appeal because of its low mintage. Still, I’m collecting instead 19th century gold, which has even lower population figures. For only a mild premium over bullion value, XF to AU type I half eagles have survival estimates in the low hundreds; for the cost of a First Spouse coin, one can instead have a 160+ year-old rarity with less than 250 in existence. That said, I suspect the First Spouse series is a sleeper that will suddenly gain a lot of value some twenty or thirty years from now when people suddenly notice it.

I own a Dolly Madison proof in silver, and that IS an attractive coin. Also I wonder, if Hilary Clinton is elected president (insert appropriate sentiment here) will she get a coin as first lady and as president? It seems the mint has already gone a long way to making this series somewhat absurd. Nothing personal against Bill Taft as president either, but from what I’ve read if you gave his wife Helen a gold coin, whether it had her face on it or not, she’d probably lose it gambling. Presidents are chosen by the people and that helps to take some of the sting out of seeing them on a coin even if you didn’t agree with them; but their wives aren’t, and the majority of them did little more for the country than to show up at the presidents sides from time to time. Plus, some of the more active first ladies were positively detrimental to the presidency. It seems absurd to commemorate the bad ones as well as the good, and snobby to only commemorate the good ones. That says to me they shouldn’t have even begun this series. Maybe I’m wrong, but I don’t think so

Funny you say that about the Dolly Madison coin. I was recently robbed and that was one of the coins they took. It was one of my favorites so I replaced the stolen one. Dolly was a amazing woman. You probably already know this but the Dolly Madison coin was designed by Tiffany & Co. They did a fine job.

By the way, good article. I really could never understand the draw of this series and I guess by the low mintages neither did anyone else.

Thanks, Todd.

I happened to have sold my Dolly proof recently, and I only got melt value, as this coin does not have a low mintage. But I agree the design is good, and she is one of the more imp. first spouses. For me part of the draw of the series is that it encouraged me to learn more about the history of first ladies.

nice essay. Thanks

Thanks, Joe.

Clinton will not get a 1st spouse coin. The act for minting the presidential and first lady coins says that the president must be dead for two years, and the last thing I heard from the Mint about the program was that they were not skipping any presidents. As it is unless Carter dies very soon, the series probably ends with Ford.

Thanks for the clarification, Rysomy.

I used to collect first spouse gold coins, in both proof and uncirculated. I finally gave up because it became too expensive, and my local coin dealer clued me in that this series is probably not a good long term investment. That said, I have heard that the first spouse series might be a sleeper candidate.

Still, given my limited means, I need to set priorities, and, for the money, I would rather buy genuinely rare 19th century gold coins than the faux rarities the U.S. mint creates today (this point applies equally to modern commemorative issues).

Check out the prices, mintages, and survival estimates on some of the coins from the Charlotte and Dahlonega mints to get an idea of what genuinely rare, historical ninteenth century gold coins you can purchase for a surpisingly small premium.

Also, why buy the faux “Liberty short set” of first spouse coins when you can get the real thing for not that much more?

Well said, Jerry. Thanks for your perspective.

There are many types of non-circulating mint products, aimed at the general public. Years ago, a mint director candidly admitted that very few of these have proved to be good investments. These First Spouse coins fall in the category ‘coins R8, customers R9.’

I”m growing tired of these coins too. I first was collecting them all, then only collecting the designs I like (some of the reversed are actually pretty nice, including the recent Mrs. Teddy Roosevelt and Mrs. McKinley coins), but I think I’m giving it up now.

I think Hillary is ineligible except for the unlikely event Bill Clinton dies this year. The FS are tied to the president, and a president has to be dead two years to make it onto one of the coins. This means Nancy Reagan will make it, since her husband’s dead, but the other living first ladies won’t.

Maybe I will still get the Eleanor R., since she’s an important historical figure, unlike for most of these coins.

To repeat a previous articles notes:

#1

First, those contemplating taking up the series are faced with the prospect of having to buy about 40 half once gold coins whose metal content alone is well over $25,000, thus discouraging much of the broad middle class from taking an interest.

#2

Second, the series has poor cohesion because of the complete lack of consistent design elements present in traditional series or the more recent changing reverse/stable obverse issues.

#3

Third, beautiful and inspiring designs with natural magnetism are a blessing to any series, and while this set has some bright spots like Julia Tyler and the Liberty short sets, many of the issues are so ugly people just simply don’t want them.

#4

Fourth, dealers both small and large have largely abandoned buying first spouses as carry forward inventory due to the abundance of faster moving and more popular series like gold buffaloes, silver & gold eagles etc.”

#4

Finally, to be successful “series need strong key dates that have much lower populations than their common date siblings. Pronounced staggering of the mintage chart is what causes most established series top 3 keys to acquire about 50 percent of the entire sets value by the time it reaches maturity. Unfortunately first spouse gold issues appear to have fallen into a very tight sales range of 2200 to 2900 uncirculated coins and about 3500 proofs this year and last year. There is no reason to believe the Mint is going to adjust its anticipated demand assumptions on these coins any time soon. If a single country has 8 equal kings, then they are all weak monarchs.

#5

All these problems are very real, lasting and structural, but they may also be the reason that they become serious coinage in the out years. Troubled infants can rise up to become tomorrow’s kings. Buying these coins at or close to Mint issue price is a very low risk proposition in their current mintage range.”

#6

There are certainly plenty of modern Mint coins that have followed that trajectory, from coins that were in low demand when issued to coins that years later sold for a major premium because of their scarcity. Examples includes the Jackie Robinson mint state $5 gold and the mint state Library of Congress $10 bi-metal gold and platinum coin.

#7

But for this to apply to the spouse coins, something more than low mintages will need to support long-term demand. Basically, the series will need more people collecting it.

#8

Potential bright spots include the 2013 designs that have generally received more positive reviews than many other recent issues, although it remains to be seen how they will look when executed on actual coins.

#9

Finally, as the series gets closer to the coins that will be issued for modern first ladies, interest in the series should pick up. The Jackie Kennedy coin is one that is often cited as a likely high demand issue.

#10

Those who are collecting this series either like the coins and their themes enough to stick with it through so many years, or they are hedging their bets that buying them today will pay off down the road when this series establishes itself as the likely lowest mintage modern U.S. gold coin series.

As a published historian in both fiction and non-fiction I must say that:

The current worldwide global economy is probably the worst since the 1600s. Certainly worst than 1907 with the PANIC that was actually worse than the great depression. Remember then that the coins from the GOLD PROOF mint are now the rarest – i.e. the Indians and the Saints.

With only about 500 serious collectors worldwide on these they probably are BOTH the unloved as well as the lowest coins issued by the US Mint ever in a series that MAY surprise many.

I consider the first spouce series “dead money” for the indefinite future, except maybe for speculation resulting from changes in the metal price and grade 70 buyers. Prior posts cover some of my reasons but the biggest one is the price. I simply don’t think that there is going to be a large enough collector base who can both afford and will be willing to spend this kind of money when there are so many better options. I also especially agree with the sentiments that these coins are not actually scarce. There aren’t any actually scarce coins that remotely have this many survivors in better grades. Finally, I also don’t see that if collectors disproportionately find the designs unattractive today, that future collectors are going to think much more highly of them either. Looking at other US coinage, the exceptions are few and far between.

Not a collector but was looking into one of these for my wife as a gift as she’s named after ones of these ladies… I was sort of shocked looking online at the premium of the new issue of the coins at +220 over spot versus earlier ones which seem to pretty much drop to +30 over spot. Shame her namesake wasn’t printed a year ago instead :) But appears to be a rather poor value for collectors at this time. Thank you for the insight.

I’m wondering if they are going to continue to mint coins as the Presidents currently alive die? The Act states they have to be dead two years, and currently Pat Nixon is the only one scheduled to be minted in 2016. Apparently they aren’t going to mint Mrs. Reagan while she is alive, and the same for Betty Ford. Does anyone have other news?

As for the collectors not completing the set, it would appear to me the fewer complete sets available the more they will be worth. I’m buying them to the end hoping that is the case…..if they mint in the future the dynamics get interesting as Hillary may be a double dipper and Obama being the first black first lady etc. What happens when we have the first woman President? DO they mint a male version of the first spouse coin? That would also be a kicker in my opinion.

In the end it has been a fun thing for the hobby and brought some conversations that may have never happened. I’ve enjoyed the series and the various perspectives etc.

I have collected the entire set. I do believe the complete collection will continue to increase in value as time goes on. The coins are beautiful when you actually can see them. My only complaint has been the changing of the boxes in the middle of the releases.

The unpopularity of the first spouse series may have a simple reason: Americans are neither interested nor familiar with the history of their own country. Personally, I like the series. Some of the coins are very attractive, some are less attractive. Buying a first spouse coin at spot + 12% is definitely better than buying the in comparison boring eagle coin at spot +5%. I feel that coin collectors have the moral obligation to support the artists who design these coins. There are too many boring coins on the market.

Watching the market, I also feel that there is an overproduction of all kinds of coins. The number of collectible coins issued by all the mints worldwide is mind boggling. Facing this abundance of coins may contribute to an indifference of collectors to coins like the first spouse series.