by Tony Davis – Atlanta Gold & Coin Buyers ……….

As a coin dealer that derives a good bit of our business from bullion coins, the last few months have been quite challenging, as gold and silver are down for the year approximately 24% and 38%, respectively. While bullion coins tend to be fairly liquid, allowing for a regular turnover of inventory, any significant change in the price of precious metals, whether positive or negative, tends to change individuals’ buying patterns. This is especially the case with significant declines in the gold and silver futures markets, as the fear associated with the potential for continued downward movement oftentimes causes paralysis.

Obviously, a coin dealer that is saddled with a good bit of bullion inventory in a declining market without buyers is going to experience issues staying afloat. While options exist in the marketplace to hedge against declining prices, these options aren’t widely known and utilized in the industry – at least not among local coin dealers. Fortunately, a significant number of coin dealers also buy and sell rare or numismatic coins; allowing coin shops to persevere during this turbulent market.

Obviously, a coin dealer that is saddled with a good bit of bullion inventory in a declining market without buyers is going to experience issues staying afloat. While options exist in the marketplace to hedge against declining prices, these options aren’t widely known and utilized in the industry – at least not among local coin dealers. Fortunately, a significant number of coin dealers also buy and sell rare or numismatic coins; allowing coin shops to persevere during this turbulent market.

While we’ve primarily discussed the state of the coin market thus far from a coin dealer’s perspective, the individual coin collector can also benefit from numismatic coins. Many individuals opt to invest in coins; both bullion and numismatic coins, rather than pursue traditional investment options, such as stocks, bonds and money market accounts. This is due to the familiarity of the coin market, which is less subject to factors that affect the stock and bond markets.

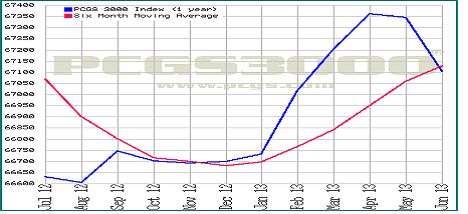

To help put things into perspective, we have provided a graphic illustration below of the year to date performance of the gold and silver markets as well as the annual performance of the PCGS 3000 Rare Coin Index. While we’ve seen significant fluctuations in the gold and silver market over the course of the year (primarily to the downside), surprisingly, the rare coin market has performed quite well over the past year. The strong performance has continued during 2013, with the six month moving average trending upwards.

2013 YTD Gold Performance

2013 YTD Silver Performance

PCGS 3000 Rare Coin Index (Annual Performance)

While we believe that the bottom is now in with respect to the gold and silver markets, and have recently written about it in a previous Coinweek.com article here https://coinweek.com/bullion-report/three-reasons-why-the-bottom-of-silver-is-likely-in/, the case still can be made for including numismatic coins in a well-diversified coin portfolio. As with traditional stock market investing, the goal is to include a number of high performing low correlated asset classes to not only reduce volatility in a portfolio but to also increase the long term returns.

Now that we’ve made the case for numismatic coins, will any coin do? Very few people can afford to purchase the 3000 coins that are included in PCGS’ rare coin index, so coins should be individually evaluated to determine how they’ve performed historically, what the market is today for those coins, and how the coins will likely appreciate in value in the months and years to come.

Fortunately for the rare or numismatic coin collector, there are a few good resources available to help with the evaluation process. One of our favorite websites is US Coin Values Advisor http://www.us-coin-values-advisor.com/, which provides the historical performance of some of the most popular numismatic coins. While past performance is no guarantee of future returns, this site will allow you to weed out those coins that have performed below the historical average of the rare coin market. Other good options include Heritage Auctions’ site http://coins.ha.com/c/index.zx, previous issues of the Coin Dealer Newsletter http://greysheet.com/, as well as researching the historical prices of coins on Whitman’s website https://whitman.com/redbook, all of which require a subscription.

In summary, we believe that gold and silver coins should be supplemented with numismatic coins to help reduce the volatility and increase the long term returns of a coin collection or coin portfolio. While the price of gold and silver have likely bottomed, the future is uncertain, so steps should be taken to insulate one’s portfolio. However, one should perform their due diligence prior to purchasing numismatic coins to confirm that they’ve historically performed well and that an active market exists for the coins that are of interest.

Tony Davis is the owner of Atlanta Gold & Coin Buyers, a full service Atlanta based coin and bullion dealer specializing in buying, selling and appraising coins and coin collections of all types and sizes. Visit his website at www.atlantagoldandcoin.com for additional information on the products, services and educational resources offered by his company. Tony can be reached at [email protected] or at 404-236-9744.

Tony Davis is the owner of Atlanta Gold & Coin Buyers, a full service Atlanta based coin and bullion dealer specializing in buying, selling and appraising coins and coin collections of all types and sizes. Visit his website at www.atlantagoldandcoin.com for additional information on the products, services and educational resources offered by his company. Tony can be reached at [email protected] or at 404-236-9744.