The Royal Canadian Mint has reported its financial results for the third quarter of 2016. The contents of this release should be read in conjunction with the Mint’s Q3 Quarterly Financial Report available at www.mint.ca. All monetary amounts are expressed in Canadian dollars unless otherwise indicated.

“Consolidated profit of $4.2 million in the quarter demonstrates the strength of our diversified business model which continues to generate significant value for the Mint and our shareholder and also positions us for growth even as we face challenges in today’s marketplace,” said Sandra Hanington, President and CEO of the Royal Canadian Mint. “The strong performance of our Bullion and Circulation Products and Solutions businesses helped sustain profitability in the quarter while we repositioned our Numismatics business.”

“We’ve taken a fresh look at our Numismatics programs and related accounting treatments and made a strategic choice to move away from the Face Value program which has brought hundreds of thousands of new customers to the Mint over the past five years. As the Mint continues to execute on our strategy and enhance our capabilities, we are developing a plan to strengthen and grow our Numismatics business, which includes a robust program to celebrate Canada’s 150th anniversary,” continued Ms. Hanington. “We are encouraged by the results that our new customer-driven strategy has already produced and we look forward to further achievements and improved profitability.”

Financial and Operational Highlights

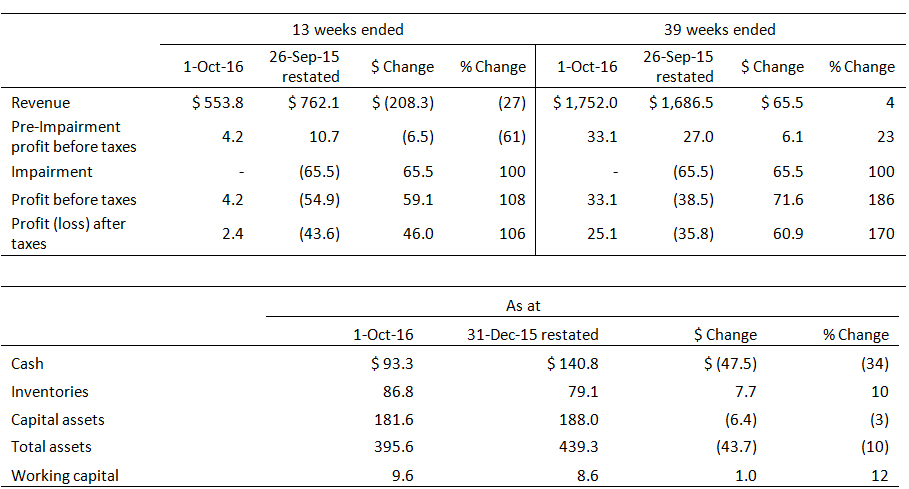

- Consolidated profit before taxes and impairment decreased to $4.2 million in the quarter (Q3 2015 – $10.7 million).

- Consolidated profit after taxes increased to $2.4 million in the quarter (Q3 2015 – loss of $43.6 million).

- Consolidated revenue decreased to $553.8 million (Q3 2015 – $762.1 million).

- Reduced availability of recycled coins resulted in increased Canadian coin production – 182.6 million pieces in the quarter (Q3 2015 – 58.2 million pieces).

- Shipment of a total of 517.7 million circulation coins and blanks in the quarter (Q3 2015 – 336.6 million).

- Lower bullion demand contributed to reduced sales volumes in the quarter compared to 2015 near-record levels. Gold and silver volumes were 201.0 thousand ounces (Q3 2015 – 336.5 thousand) and 6.1 million ounces (Q3 2015 – 9.5 million) respectively.

- Sales of numismatic gold products increased 30% while sales of numismatic non-Face Value silver products decreased 13% in the quarter compared to Q3 2015 resulting in a net decrease in revenue of $2.6 million.

- Operating expenses were carefully managed, down 9% for the quarter to $31.4 million in the quarter (Q3 2015 – $34.5 million before impairment).

- Cash declined to $93.3 million at October 1, 2016 from $140.8 million at December 31, 2015. In this period, the Mint declared and paid a dividend of $31.0 million to the Government of Canada.

Consolidated results and financial performance

(in CAD $ millions for the periods ended October 1, 2016 and September 26, 2015)

In the course of the preparation of the condensed consolidated financial statements for the quarter ended October 1, 2016, the Mint identified adjustments relating to prior periods requiring restatement, relating to the sale of numismatic face value products. In the past, these transactions were recorded as revenue along with a provision for expected returns. Upon further review it was determined that revenue should not be recognized until a reasonable estimate of returns and redemptions can be made. Accordingly, a provision representing the cumulative value of unreturned/unredeemed face value products and the costs of returns and redemptions, net of the value of the corresponding silver content, was recorded in Q3 2016 with retrospective adjustment to the inception of the face value program.

On a separate matter, the Mint has retrospectively adjusted its presentation of revenues and costs associated with bullion sales. The Mint now records revenues and costs on a net basis for all sales where both the supplier of key precious metals and customer of the bullion are the same party. This change in presentation has no impact on profit (loss).

To read more of the Mint’s third quarter financial report of 2016, please visit www.mint.ca.

* * *

FORWARD LOOKING STATEMENTS

This Earnings Release contains forward-looking statements that reflect management’s expectations regarding the Mint’s objectives, plans, strategies, future growth, results of operations, performance, and business prospects and opportunities. Forward-looking statements are typically identified by words or phrases such as “plans”, “anticipates”, “expects”, “believes”, “estimates”, “intends”, and other similar expressions. These forward-looking statements are not facts, but only estimates regarding expected growth, results of operations, performance, business prospects and opportunities (assumptions). While management considers these assumptions to be reasonable based on available information, they may prove to be incorrect. These estimates of future results are subject to a number of risks, uncertainties and other factors that could cause actual results to differ materially from what the Mint expects. These risks, uncertainties and other factors include, but are not limited to, those risks and uncertainties set forth in the Risks to Performance section of the MD&A as well as in Note 10 – Financial Instruments and Financial Risk Management to our Condensed Consolidated Financial Statements.

To the extent the Mint provide future-oriented financial information or a financial outlook, such as future growth and financial performance, the Mint is providing this information for the purpose of describing its future expectations. Therefore, readers are cautioned that this information may not be appropriate for any other purpose. Furthermore, future-oriented financial information and financial outlooks, as with forward-looking information generally, are based on the assumptions and subject to the risks.

Readers are urged to consider these factors carefully when evaluating these forward-looking statements. In light of these assumptions and risks, the events predicted in these forward-looking statements may not occur. The Mint cannot assure that projected results or events will be achieved. Accordingly, readers are cautioned not to place undue reliance on the forward-looking statements.

The forward-looking statements included in this Earnings Release are made only as of February 24, 2017, and the Mint does not undertake to publicly update these statements to reflect new information, future events or changes in circumstances or for any other reason after this date.