Looking at the values of US gold coins over the last 15 years, lightly circulated is key

By Jim Bisognani – NGC Weekly Market Report ……

There’s an adage that goes something to the effect: Old age is always 15 years older than I am. I recognize much veracity in this, for no matter what your present age–teenager, young adult or retiree–if you tack 15 onto your numeric years, I think the consensus would be, “Oh, that’s old.” I suppose it’s simply a matter of perspective. Come to think of it, as I get older, I swear the second hand on the clock is moving faster.

With that in my mind, I swear 15 has been springing up everywhere! Yesterday, it was 55 degrees, and today it is 70 – 15 degrees warmer. My calendar reminded me that it was 15 years ago this week that I authored my first “This Week’s Market Report” for the Coin Dealer Newsletter (CDN) Greysheet. As I gazed into my inbox, I had 15 new emails waiting for me, and a quick glance at my desk clock beamed back 8:15 AM.

Back in the numismatic world, a bit of sage advice that I have doled out to collectors entered my noggin. If you acquire truly scarce and rare coins, I have always strongly advocated that, for the best returns (and maximum enjoyment), hold onto them for 15 years or more before contemplating their release back into the marketplace.

Because 15 was running rampant in my psyche, I decided it was kismet that I research how well my 15-year advice holds up, so I reviewed data from October 2004.

All Hail Saint-Gaudens

As I looked back a decade and a half, a few things stood out. One: I was much younger then. As for the numismatics, gold spot price was a rather lean $414 per ounce in 2004, and silver was $6.74 per ounce. Of course, over the past 15 years, the metals have been up and down. Yet based on today’s spot prices, gold is up 262%, and silver is up 160%.

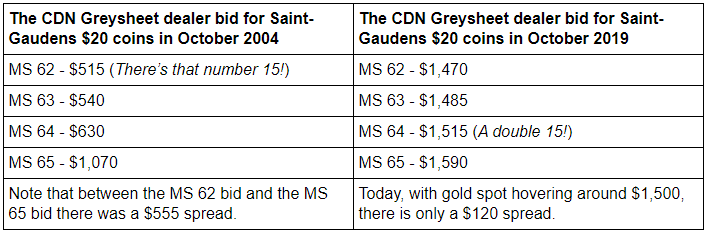

Knowing that, and taking into consideration the ever-eroding premiums for US gold coins, the proud gold bug favorite Saint-Gaudens double eagle reflects the following:

The winner here is the Saint-Gaudens $20 certified MS 62, delivering a 185% advance. The loser, though still carrying a 48% gain, is the MS 65 (yet neither of these options performed as well as gold bullion during the same timeframe).

Gold is Up but Down

The Saint-Gaudens double eagle was the positive performer in my research, as virtually all other “common” early 20th-century US gold type coins in MS 62 to MS 65 range have displayed market losses since 2004.

Even my favorite gold coin, the Indian Head $5, is in negative territory. A “type” coin certified MS 65 was bid at $9,200 in October 2004 versus today’s type bid of $5,900. This reflects a nearly 36% decline in value. Yet, while type has been disappointing for its return, many of the better and key dates in this series have performed well, chiefly.

Even my favorite gold coin, the Indian Head $5, is in negative territory. A “type” coin certified MS 65 was bid at $9,200 in October 2004 versus today’s type bid of $5,900. This reflects a nearly 36% decline in value. Yet, while type has been disappointing for its return, many of the better and key dates in this series have performed well, chiefly.

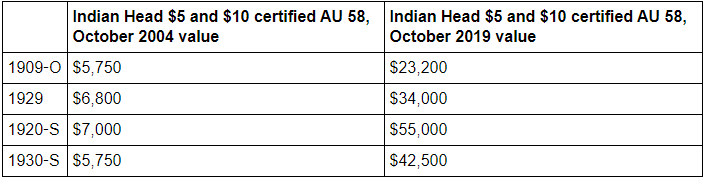

Example: The always-popular and rare final year of the series, 1929, certified MS 63 was bid at $8,250 in the October 2004 Monthly Supplement. Today, in the NGC US Coin Price Guide, the Chief is at $45,500—an over 450% increase! In 2004, MS 64 was bid at $12,200 versus today’s NGC Price Guide valuation of $58,000, or a 375% increase! I then reviewed the more affordable AU 58 grade, which was bid at $6,800 in 2004 versus $34,000 today, reflecting a 400% increase. Not bad, eh?

Lightly Circulated is Key

Next, I took a look at another key coin in the series, the wildly popular 1909-O Indian Head $5. This half eagle has the distinction of being the last gold coin struck at our southernmost mint and, with only 34,200 produced in New Orleans, it is the lowest-mintage regular issue of the series.

A quick review of the 2004 CDN Monthly Supplement reveals some dynamic advances across the grading spectrum. Fifteen years ago, the nearly mint state AU 58 bid at $5,750. Today, the Chief is revealing an impressive 303% advancement, according to the current NGC US Coin Price Guide’s $22,300 valuation!

Another extremely popular series, the Indian Head $10, offers some excitement in the ranks as well. While the type coins–in this case, 1932s–were bid at $3,025 in 2004 versus a $2,850 NGC US Coin Price Guide valuation in 2019, several of the popular San Francisco deliveries are clamoring for attention and recognition.

Another extremely popular series, the Indian Head $10, offers some excitement in the ranks as well. While the type coins–in this case, 1932s–were bid at $3,025 in 2004 versus a $2,850 NGC US Coin Price Guide valuation in 2019, several of the popular San Francisco deliveries are clamoring for attention and recognition.

For example, a 1920-S certified AU 58 was bid at $7,000 15 years ago. Today, in the NGC US Coin Price Guide, the valuation is $55,000. This amounts to an astounding 685% escalation! Another coveted San Francisco delivery, the 1930-S certified AU 58 was bid at $5,750 in 2004 versus $42,500 today in the NGC US Coin Price Guide, an equally impressive 639% increase in value.

Don’t Buy the Best you Can’t Afford

The takeaway here is that virtually Mint State and rare 20th-century gold coins have performed exceptionally well to put it mildly! One of the reasons these four coins have all hit the afterburners is that 15 years ago, each of these coins certified MS 63 or better would have set the collector/investor back at least in the low- to mid-five figures! This effectively knocked coins of this grade out of the equation for many numismatists of average or even more serious means.

While the old coin maxim has always been “buy the best grade you can afford,” at least for this exercise, the values today reflect the enormous market demand for these respected key coins and the series as a whole. Prices are driven up across the grading spectrum due to heavy activity.

A quick tally of these four coins bought in 2004–a $25,000 expenditure–would barely cover the market price of the 1909-O Indian Head $5 today! Also, this quartet carrying $154,700 market value is equal to 511% profit from the investment (there’s that 1-5 again).

As more collectors gravitate toward series (any series, for that matter), the key coins will always be in greater demand. In turn, the coins in the more affordable but still desirable grades are bound to achieve greater advancement.

“15” Reasons to Buy

While there will only be a limited number of collectors with the wherewithal to aspire to assemble a complete MS 63-MS 65 caliber Indian Head $5 or $10 set today, acquiring a nearly full set of either series in a choice, but lightly circulated, AU 50 grade will become much more enticing and highly affordable.

It also helps that currently many of the coins in either tribe are available for very little (if any premium) above melt.

A quick review of the Indian Head $5 series discloses that, aside from the 1909-O and 1929, only the 1908-S and 1911-D will set you back more than $1,000 in AU 50. In fact, with a few limitations, the beautiful Indian Head $10 series is still a viable option. If you were to abandon hopes of corralling the 1907 Periods varieties, the ultra-rare 1933 and the aforementioned 1920-S and 1930-S, 19 of the remaining 27 coins fall into the little or no premium category, and only the 1911-D and 1915-S will set you back more than $1,500.

If the past 15 years are any indication, a virtually complete set carefully curated in the nearly mint state of either or both series should bode quite well.

Until next time, happy collecting!

* * *

Jim Bisognani is an NGC Price Guide Analyst having previously served for many years as an analyst and writer for another major price guide. He has written extensively on US coin market trends and values.