By Dan Duncan – Retired, Pinnacle Rarities ……

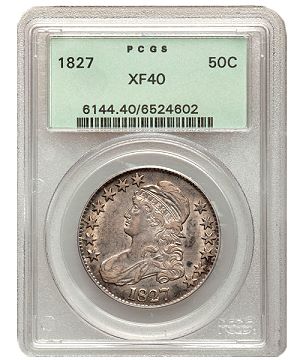

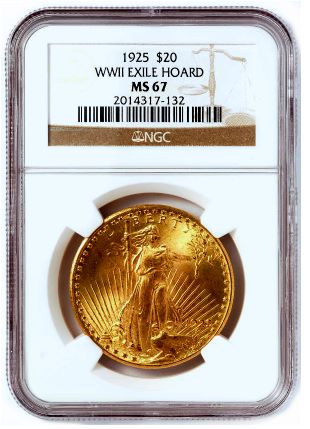

I began my career in numismatics during the late 1980s when rare coins were undergoing something of a renaissance. Third-party grading and encapsulation had begun in earnest. The Professional Coin Grading Service (PCGS), the American Numismatics Association Certifications Services (ANACS), and Numismatic Guaranty Corporation (NGC) were grading coins by the thousands. Many older collectors looked to find what these new unbiased entities had to say about their coins. And many of the older dealers frowned at what they felt was a question of their authority. I remember hearing an old timer say, “I don’t need someone to tell me what this coin grades.”

Regardless, third-party grading revolutionized the US coin market. The re-branding of rare coins from collectibles to investments forever changed the rare coin landscape. Certification made it possible for buyers unfamiliar with rare coins to test the tangible asset markets with somewhat of a safety net and speculators flocked into the market during the late 1980s. The result of this new wave of interest was skyrocketing prices. Unfortunately, it proliferated a breed of coin dealer that is soundly hated in most corners of the bourse floor – the coin doctor.

Regardless, third-party grading revolutionized the US coin market. The re-branding of rare coins from collectibles to investments forever changed the rare coin landscape. Certification made it possible for buyers unfamiliar with rare coins to test the tangible asset markets with somewhat of a safety net and speculators flocked into the market during the late 1980s. The result of this new wave of interest was skyrocketing prices. Unfortunately, it proliferated a breed of coin dealer that is soundly hated in most corners of the bourse floor – the coin doctor.

Rare coins have been altered in many ways throughout the history of numismatics. Silver, gold, and copper are volatile metals. These metals react with outside forces in sometimes wonderful and other times hideous ways. The latter have been cleaned, brushed, dipped, and re-toned for decades in feeble efforts to make less desirable coins saleable. But with the advent of certified collectibles and sight-unseen trading, never have these tampered examples been so easy to value and sell.

Fast forward 30 years.

After more than three decades of encapsulation, there are regrettably many doctored examples now in holders. This “dreck,” as it’s been called, undermines the value of quality rare coins available today. Additionally, the frequent discussions, meetings, articles, and such have blown this scandalous behavior wide open, and now many collectors remain gun-shy.

In a protracted knee jerk reaction, we see a new re-branding unfolding. Much of the negative press has highlighted the subtle nature of grading. With the value of a single grade point often equal to thousands of dollars, the final grades are under scrutiny from even the most novice of collectors – as they should have been all along. Overall PCGS and NGC do an outstanding job filtering out the problem coins. They’ve promoted the hobby and stability of their services by increasing prescreening and expanding the indicators on the holders (plus grades, stars, and even the “genuine” designations). Other companies have joined in recertifying the already certified. But all these efforts are not without their negatives. The results are a less cut-and-dry investment vehicle, a convoluted grading scale, and, of course, the inconsistency that is the subjective nature of numismatics.

In a protracted knee jerk reaction, we see a new re-branding unfolding. Much of the negative press has highlighted the subtle nature of grading. With the value of a single grade point often equal to thousands of dollars, the final grades are under scrutiny from even the most novice of collectors – as they should have been all along. Overall PCGS and NGC do an outstanding job filtering out the problem coins. They’ve promoted the hobby and stability of their services by increasing prescreening and expanding the indicators on the holders (plus grades, stars, and even the “genuine” designations). Other companies have joined in recertifying the already certified. But all these efforts are not without their negatives. The results are a less cut-and-dry investment vehicle, a convoluted grading scale, and, of course, the inconsistency that is the subjective nature of numismatics.

However, there is a silver lining. One thing remains constant – the coins. Collectors and investors need to look past the plastic and the stickers and remember what’s inside. The new re-branding efforts by PCGS, NGC, and, to some extent, CAC, are only the first steps. Buyers still need to learn about what they purchase – that is by definition numismatics. While doctoring techniques have changed, luster, toning, and strike characteristics remain constant. To protect yourself, three axioms come to mind here. They worked for collectors in the 1950s and they still work today:

1. “Buy the book before the coin.” Learn what you buy, learn how to grade them, and look at as many as you can. Digital photography allows collectors to view hundreds of examples online, and the vast number of coin shows gives individuals many chances to view coins in hand. Once you have a feel for grading, you can pass your own judgment on the numbers printed on the holder.

2. “When in doubt, pass.” There is no doubt that swill exists in third-party holders. Both top services admit to that. They are working hard to stop the games, but ultimately you are the end user. If you follow this simple rule, the doctors won’t have as many outlets for sale. If there’s something about a coin you don’t like –pass. No harm done. Let the dealer with the sub-par examples carry them around long enough and they won’t buy them either. Buy what you like and nothing else!

3. “Find a dealer you can trust.” Avoid closers – the coin should speak for itself, no one should have to “sell” it. Be sure your dealer has a return privilege. And more importantly, deal with sellers who buy back material they’ve sold at fair market values. A trustworthy dealer will help you grow within the hobby. There are many dealers out there, but only some share the same passion for coins that you do. Find one that does and forget the one that is just looking to sell his latest purchase.

Doctoring and the manipulation of rare coins is a problem, one that collectors have faced for centuries. I applaud the current work of numismatic interests to thwart unscrupulous behavior. But, before you get tied up in figuring out which is the correct holder or designation, let us remember what brought us here – the coins. We can learn about history, about economics, and even about pop culture through these little pieces of Americana. Enjoy the coins you buy. Learn about them and the stories that surround them. Strive to become in at least the slightest way a numismatist to protect yourself from the many pitfalls inherent to collecting. Learn from the experts; don’t simply rely on their opinions. Get educated and trust your own instincts. Don’t get caught up in the re-brand du jour. Look past the plastic and stickers and simply focus on the coin – after all, that’s what we’re all here for.

* * *

Thanks for the article.

However, like all the other Coin Week articles it jumps up and down a few inches every five or ten seconds, making it EXTREMELY annoying to read. This has been going on for weeks, and it doesnt matter which machine I read it on. It happens only with Coin Week. Therefor I conclude that the problem is at Coin Week’s end, not mine.

I hope you can do something about it. Thanks, Tom Bosworth. Aiea, HI

Agreed, Tom. I’m having a difficult time just writing and posting this comment due to all the screen jumping! I usually throughly enjoy reading CoinWeek on my phone, but lately it’s been a chore.