The World’s Fair of Money is underway! All that glitters isn’t always old gold coins

By Jim Bisognani – NGC Weekly Market Report ……

The so-called dog days of summer are at hand. Although the overall coin market has been, at best, status quo for most of the year, the metals market and gold coins truly hit its stride just before all of the major market makers and numismatic brethren descended upon the Land of Lincoln for this year’s ANA World’s Fair of Money in Rosemont, Illinois.

Gold, as of this writing, is at $1,515 USD per ounce. It was just the end of the month of May that saw gold spot trading at $1,295 per ounce. The resurgent yellow metal is showing a 17% boost in the last 10 weeks! The last time gold visited the $1,500-per-ounce benchmark was nearly six-and-a-half years ago.

Silver, too, has come along for the ride, rising from $14.48 per ounce to over $17 in the same amount of time — nearly 18% higher.

Buy? Sell? Or Hold?

Of course, any movement in prices sparks new-found demand for gold coins. Buyers, especially those collectors who want to latch on to some semi-numismatic US gold coins, are motivated to claim their bounty before they climb out of their price range.

Others, having bought the metal early this year, might be content just cashing in for a profit. Still another faction, having bought bullion and related semi-numismatic holdings at even higher levels, might decide to bring some to market to try to recoup some losses.

Twitter Talk Takes Toll

Yet, for most numismatists, the question is: Just what is behind the percolating metals’ resurgence?

A quick response from the pundits is that it all seems to have hinged on the fears of the US enacting and leveraging bold tariffs on China. As one bullion trader put it, the tweeted threats and the “ensuing political unrest” have caused Treasury bills to flounder.

Yellow Metal Has Legs

This scenario has played out many times before. Yet this time the run-up seems to have been inevitable and possess considerable legs.

Another major market trader offered some corroboration.

Another major market trader offered some corroboration.

“The specials of various certified US gold coins offered by some firms to us traders have been complete sellouts over the last few months. The demand for new metal is very, very strong; dealers just don’t want to be caught short.”

[Photo Caption – RIGHT] The spread for NGC MS 62, MS 63 and MS 64 coins are at the lowest levels in decades. In particular, MS 62 $20 Liberties are a roaring bargain.

Golden Value!

The gold coins in question here are predominantly $20 Liberty Heads and Saint-Gaudens. This has been written about numerous times, yet the spread for MS 62, MS 63 and MS 64 coins are at the lowest levels in decades. In particular, MS 62 $20 Liberties are a roaring bargain. Take a look at a few offerings I found on one electronic trading network this week.

(For perspective, with gold spot trending at $1,515 per ounce, the melt value of these Double Eagles is $1,465.)

- NGC MS 62 $20 Liberties at $1,510, or about 3.25% over melt.

- 1896-S $20 Liberties, graded NGC AU 58, at $1,473 per coin. That is $8 over melt!

- NGC MS 62 $10 Liberties being gobbled up at $775 per coin, only 6% over their melt value of $732!

The spreads for $10 and $20 Liberties are truly miniscule and rather remarkable considering this robust market.

My associate on the NGC US Coin Price Guide, Kevin Stoutjesdyk, shared an interesting fact regarding $20 Saints.

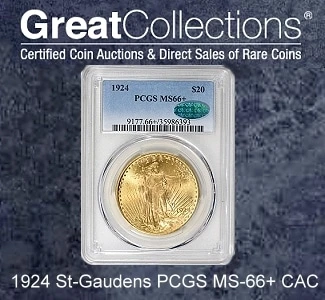

“With bullion getting increased attention, I think it is important to point out something I have found to be often overlooked, that being how extremely common some of the pre-’33 gold is,” Kevin said. “For example, the NGC population for the 1924 Saint-Gaudens in MS 63 is nearly a staggering 113,000, and MS 64 is closing in on another 108,000. People, especially the newcomers to numismatics, often conflate the price of a coin with rarity, and, in this case, the numismatic value has long since been surpassed.”

My learned associate is correct in pointing this out, especially when one is contemplating the purchase of a semi-numismatic coin versus bullion. Consider this, too: As a series, the NGC Census shows that just over 1 million $20 Saint-Gaudens (1907-1933) have been graded to date. The 1924s alone account for an astounding 325,781, or 32.5%, of all Saints graded to date!

My learned associate is correct in pointing this out, especially when one is contemplating the purchase of a semi-numismatic coin versus bullion. Consider this, too: As a series, the NGC Census shows that just over 1 million $20 Saint-Gaudens (1907-1933) have been graded to date. The 1924s alone account for an astounding 325,781, or 32.5%, of all Saints graded to date!

[Photo Caption – LEFT] NGC MS 62 $10 Liberties are being gobbled up at $775 per coin, which is just 6% over their $732 melt value.

For contrast, let’s visit the $20 Liberty Heads (1850-1907) series. NGC has graded 737,060 double eagles. The “type coin” for this issue is easily the 1904, reporting in with a total of 235,773 graded. Yet in the MS 63 and MS 64 columns combined, there are just over 120,000. While a stout population, the Census shows that the 1904 has about 46% fewer coins in the same grades as the 1924.

Conversely, the 1896-S $20 AU 58 Liberties mentioned earlier report in with a total census of just 9,625 coins, with 478 at AU 58. So, in my estimation, at $8 over melt these were absolutely tremendous buys! Further — for comparison with the 1904 and 1924 — only 1,148 appear in the Census in the MS 63 and MS 64 columns!

Of course, not all that glitters is old gold. Yet armed with sales and census data, the buyer can be selective in acquiring many slightly better $20 Liberty gold coins at remarkably low premiums when compared to their actual gold content.

Certainly, this dynamic price push leading up to this week’s ANA show should bolster attendance, not only for the mavens of bullion and semi–numismatic gold coins but for the average collectors anxious to plug holes in their respective albums. Of course, a host of wonder coins will be waiting for the registry-minded and for those with unlimited coffers looking for the iconic prizes we plebians can only dream of. So, as this article posts, I expect that the Donald E. Stephens Convention Center will be buzzing throughout the show’s run.

Enjoy the Greatest Show on Earth

As always, a bit of advice for first-time visitors to the greatest coin show on earth. Enjoy the wealth of educational displays. Spend time taking in the fabulous ANA Museum Showcase, which is where you will find the iconic 1804 dollar and 1913 Liberty nickel along with a host of other rare US and world gold coins, patterns and paper money, all sure to help stir the imagination and perhaps set you on a collecting path.

Be sure to attend educational forums. I urge you not to be shy. Find and talk to dealers, pick these professionals’ brains for insights and recommendations; learn from their wealth of experience and knowledge. While traversing the massive bourse, you are sure to encounter numerous compatriots, and some will no doubt become confidants and comrades! Memories are sure to last a lifetime.

I know, to this day, I have fond detailed memories of my first ANA in Boston back in 1973! Enjoy the show, my collector friends!

Until next time, happy collecting!

Jim Bisognani is an NGC Price Guide Analyst, having previously served for many years as an analyst and writer for another major price guide. He has written extensively on US coin market trends and values.