By Victor Bozarth for PCGS ……

Unprecedented demand has forced rare coin prices to record-high levels across virtually all series of U.S. coinage. As auction prices climb, dealers are asking higher prices for coins in their inventories and selling has never been easier for them.

However, replacing that inventory has been a huge problem for dealers. Yes, they’ve been having to pay ever-increasing prices, but that’s not the real problem. Simply locating nice coins to purchase is where the real problem lies.

The market is starved for choice coins.

This situation, which started gaining momentum during spring 2020, is a fundamental change for the U.S. coin market. Previously, we were in a more normal market with natural buying and selling taking place in an orderly two-way manner. Now, the market is being fueled by the huge amount of COVID-related stimulus money sloshing around the economy and people’s flight to tangibles for inflation hedges. Coins and precious metals are perfect for that.

This situation, which started gaining momentum during spring 2020, is a fundamental change for the U.S. coin market. Previously, we were in a more normal market with natural buying and selling taking place in an orderly two-way manner. Now, the market is being fueled by the huge amount of COVID-related stimulus money sloshing around the economy and people’s flight to tangibles for inflation hedges. Coins and precious metals are perfect for that.

Typical rare-coin price increases can be illustrated by changes in the ever-popular Morgan Dollar series. In the online version of the PCGS Price Guide, you can click on “Price Changes” at the top of each series to see data for “Gainers” and “Losers.” The top 10 gainers have risen by about 125% to 175% during the past year. During the past two years, those percentages range from approximately 175% to 225%.

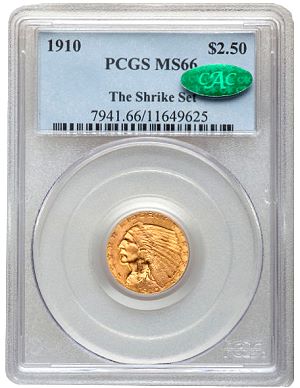

The popular $2.50 Indian series shows results for the top 10 gainers during the past year in the approximate range of 80% to nearly 130%. The two-year results for this series range from around 120% to about 160%, as of this writing. Even more momentum is illustrated by the Walking Liberty Half Dollar series. One-year top 10 gainers range from about 250% to more than 600%! Two-year top 10 gainers for this series show similar results. The “Walker” series is one that has received incredible demand during this period. After all, it’s one of America’s most beautiful and popular coins.

Along with the flight to tangibles — namely, rare coins — prices for precious metals soared during the first quarter of 2022, adding even more stimulus to the rare coin market. Rising precious metals prices bring excitement to the coin market, as well as new buyers who begin by buying metals and then become attracted to collectible coins — frequently, nice-looking modern coins.

The market for moderns has held strong, with many realizing record prices at auction.

One example is a never-before-offered 1971-S Eisenhower Dollar prototype, graded PCGS SP67. It was sold in Heritage Auctions’ official Florida United Numismatists (FUN) Show sale in January. Billed by Heritage Auctions as “one of the rarest of all silver dollars struck since 1794,” this Ike Dollar prototype brought an astounding $264,000.

Overall, the market for modern coins has seen increased demand across all the denominations and finishes, which include Mint State coins, Proof coins, and even special strike (SP) coins. Price increases for moderns have taken place in grades ranging from MS65 to the “perfect” 70 grade.

Another important driver for the modern coin market is the PCGS Set Registry. Collectors of top-grade modern coins have the ability to check the PCGS Population Report to find out how scarce PCGS-graded modern coins are. Generally, the lower the population, the more competitive buyers will be at auction.

Price premiums over the spot silver price have increased during the past year for modern silver collector coins. Likewise, modern bullion coins are also showing strong demand and higher prices. American Silver Eagle coins struck by the United States Mint, as well as privately minted silver rounds, are also experiencing higher price premiums over their melt values.

Finally, the PCGS Price Guide team is running across occasional high-outlier auction prices for circulated PCGS-graded collector coins that exceed our price guide values. These include coins in series such as Liberty Seated and Barber coinage in the VG to VF grades, for example. Collectors are stretching in competitive auctions to land the coins they really want. Indeed, demand for U.S. coins is exceedingly strong across the entire range of coin series and grades.

* * *

2010-W proof lady liberty silver eagle has historical significance. Not only did the mint not make silver eagles in 2009 but, and this is for the ladies out there, Katherine Bigelow was the first female “Best Director”. Remember the “Hurt Locker”? 2010. In my humble opinion that blows the rest of the series away!

I’ve taken some of these coins too dealers and they tell theyvare nit worth anything!! Told me to give too grandkids! So are the Eisenhower 1971-S worth $264.00 ???

The value of the Eisenhower 1971-S dollar depends on the condition of the coin. If you have a coin in government packaging it carries the prevailing value of the coin in that state. Search eBay for recent results. If it is a loose coin that is worn or mishandled, it carries only a nominal value of over face.

If it has been professionally graded and earns a high grade, it will have a higher value.

Not all coin dealers want to market your coins. They are under no obligation to pay you any price for a coin if they don’t want to bother trying to sell it.

Yes, the Market Fundamentals are changing. Now is the time to sell. Interest rates are on the rise, gold and silver prices have declined 10-20%. A recession is looming. I can get a first release 2022 graded 70 Uncirculated silver Eagle at less than $50.00. Tips are drying up. Gas and food prices are up. Disposal income is down. Just like the last 2-3 recessions, it spills over to the coin market. The market is changing, from a Seller’s market to a Buyer’s market, are you ready? Cycles. The next cycle is for coin prices to go south. It will be a good time to buy, not sell. It will take a few months for the small sellers to realize prices are down. Large coin sellers already know this (coin prices are heading down). Volume is down. More coins are on sale.

agree with the article – for example, i have been attempting to obtain certain Ikes that are a bit rate – i recently saw a 77-D MS-66 for sale, and just decided to pay a crazy premium because I just did not want to wait another 5 years/

I have (2)71, 72, 74, 77, all unc

I have two of them how do I sell? They are old. Also few more coins want see how much they are worth.