By Charles Morgan with Hubert Walker for CoinWeek …..

When I got the idea to sell my collection, I didn’t know what to think. Was I bored? Had I lost confidence in the hobby?

Had my interests shifted so much that everything I’d put together so carefully before no longer appealed to me? Did I build my collection entirely wrong, requiring some kind of radical intervention? Had I given up?

Fortunately, the honest answer to each of those questions is no.

I still love coins, and I know that the buying decisions I made were the right ones (usually) for my taste and budget. But holding onto what I had accumulated up to that point no longer made sense to me – and since I’ve always trusted my gut when it comes to business and finance, I stiffened my resolve and set about to liquidate my holdings.

I still love coins, and I know that the buying decisions I made were the right ones (usually) for my taste and budget. But holding onto what I had accumulated up to that point no longer made sense to me – and since I’ve always trusted my gut when it comes to business and finance, I stiffened my resolve and set about to liquidate my holdings.

In this article I explain how I did it and why.

So why’d I do it?

Before I get to the exact reasons, first let me point out that this is my third distinct period of collecting coins.

Like many collectors, my introduction to coins happened when I was a kid. My grandmother Ruth introduced me to numismatics when I was 11 years old.

Red Book and roll of dimes in hand, I was hooked.

Clearly, any great rarity – and most coins over $5 – were beyond my reach. Which is just as well; I used to bury my coins in holes I’d dig in the ground, pretending to find them as part of some sort of archeological expedition. Eventually, though, I grew up, and became interested in other things.

My second period covered 1999-2001. I was enlisted in the U. S. Army, serving in the Intelligence Corps. Although I made only a meager soldier’s salary, I expanded my collection by buying silver dollars, proof sets, better grade circulated classics, and a handful of certified coins. I had neither knowledge nor a specialty. I tried to get everything I could afford, spreading myself thin, and wrong-headedly hurrying my way through as many coins as my budget would allow – as if time were running out for me to buy everything out there. But boy did I have the bug!

After I left the Army, I moved to rural Pennsylvania to find work in the civilian sector. Even though my new job brought in much more money than I had to play with before, the dearth of dealers in my area brought my second collecting period to a grinding halt. Gradually, I lost interest and sold my holdings off piecemeal to local antique shops (and later to a catalog wholesaler). I’m not sure how much money I lost, but I remember that when I cashed out, I had $1,600 to show for it.

Which brings me to my present collecting period and why I reached the decision to sell. I can best sum up the “why” in three parts:

1. A Desire to Better Understand the Coin Market

Over the past two years, my attention as a collector has shifted from what I have at hand and what’s available at my budget to a broader interest in the rare coin industry and the ways in which coins acquire (and lose) value. There is no shortage of so-called experts in the hobby, and no shortage of good investment advice. My approach is to not be afraid to take a contrarian view, and it’s my firm belief that you can’t know the true strength of the market if you aren’t willing to participate on some level.

About a year ago, Hubert and I provided tips on how to prepare for the possibility that your family might be left to sell your collection. I wanted to take that advice to the next level, and see how someone with numismatic experience and knowledge – but no dealer experience – would fare selling coins at retail prices on the open market.

2. Cashing Out as Much of My Equity as Possible

If you buy coins for the sheer fun of it, the comings and goings of the market are less likely to factor into the equation as they will for someone who buys coins as an investment. And while I never considered my approach to be purely one or the other, I didn’t get back into the hobby to lose money. That said, the coin market is only vaguely understood by most collectors and dealers. This means that, for the investor, the risk is huge.

There’s a scene in Martin Scorsese’s recent masterpiece The Wolf of Wall Street (2013) where Matthew McConaughey explains that investors only get paper gains, while the brokers work to get as much of their clients’ money as possible. A fugazi he calls it.

Something similar happens in the rare coin industry. A buyer typically pays retail or more for a coin only to sell at wholesale or below. It’s hard to see how a profit can be had using this economic model.

Selling online has changed this, but most of the traditional advantages still hold true. I wanted to find out if a motivated amateur could put forward a professional-looking product and cash out as much of the “paper” gains I’d made from the coins I so carefully assembled.

3. Starting Fresh on an Uncharted New Course

The last and possibly most important factor is that by selling my collection on my own terms, I could re-enter the market a wiser man and go in directions I have yet to travel. I still have an eye for incredible pieces in series I know well, but what about the series I don’t know? What better way to move forward than to start with a blank slate.

Yes, I let go of some great material, but now I have the opportunity to look at coins with fresh eyes.

What ever direction my collecting takes, I’m sure it will be an exciting adventure and the many columns and articles I plan to write in the future will serve as my travelogue, allowing you to see the hobby as I see it as we experience it together.

How I Did It

My way may not be the way that’s right for you. Like a workout routine, results and goals may vary.

I split my collection into three parts:

- My high-end Eisenhower dollar set

- Various collector coins from a variety of series, all of which have numismatic value, and

- A nearly complete collection of modern commemoratives (which, believe me, I didn’t collect with any hope of profit).

Knowing that the commemoratives were merely bullion coins, I decided to hold onto them. I have no conditional rarities in that set and own them because I enjoy the designs (some more than others).

The high-end Eisenhower dollar set, being a specialty item and well-put-together, I offered to a nationally-known dealer in the field. We worked out a price that was in the ballpark of what I expected had I tried to sell them on my own. The difference being that I got paid in full up front, as opposed to waiting.

I decided to sell the rest of the coins (nearly 2/3 of the total material) on my own.

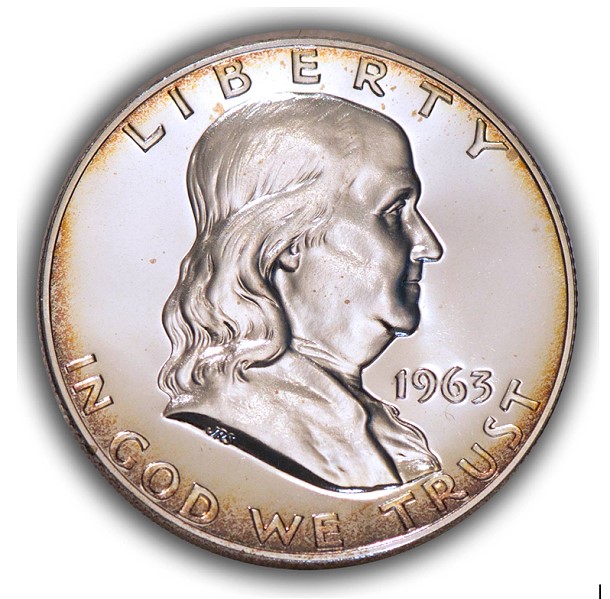

One of the “uncharted courses” I wanted to explore when I decided to sell was coin photography. I’m convinced that a strong image will excite buyers and brings more interest to your material. On the other hand, a weak image will hurt a coin’s chances at auction, no matter how unfairly. Need an example? Take any of the lackluster coin imaging that used to be found over at the recently departed Teletrade. Outside of eBay or some off-brand auction site, you’d be hard pressed to find worse coin imaging online.

In my opinion, of course.

Anyway, I wasn’t interested in taking snapshots of coins, either. I’ve studied the look of the better coin imagers for years, trying to figure out how they bring out the best details, color, and depth – the three elements I think are key to making a photo of a coin look realer-than-real.

I did my homework. I knew that I could do this one of two ways: the cheap way or the professional way. I chose the latter, sinking my profits into one of the best DSLRs on the market and a pro-grade lens.

Once I got my gear, getting up to speed took weeks and lots of trial and error. Some images turned out fantastic and the coins sold within hours. Other coins were harder to shoot. To me, learning the craft was more important than wasting time making sure that I made a profit from selling a low-value coin.

I used Photoshop to circular crop the coin out of its background and placed the image in well-thought-out templates of my own design.

I learned that photographing proof coins was difficult and required a different approach to lighting the coin.

Capturing a coin’s natural color is challenging, but highly rewarding for the numismatic photographer.

I used HTML to construct a uniform theme for my item descriptions, and, unlike most sellers, I used my numismatic knowledge to write informed descriptions. If a coin had a scratch that was worth pointing out, I noted it. If a coin was top-end for the grade, I made that clear as well. Anything I said about the coin could be seen in the imaging.

At the end of the day, the price I got for my coins after purchasing the equipment was a little more than the price I would have gotten by selling the whole lot to a dealer. But the knowledge I gained, and the fact that now I have the right equipment for the job, means that I can enjoy coins in a whole new way and not be concerned that I can’t sell them for a fair price if need be.

Flip of a Coin

- Caveat Emptor: 2013 is just behind us. Look for a short-lived buyer’s premium for the year’s commemoratives if the numismatic media begins to trumpet “low mintage numbers”. But it won’t last. Presently, there are no non-gold issues in the modern commemorative series that are priced out of reach for most collectors. This will continue to be the case in perpetuity, as coins that don’t go up in value over the long term tend to cycle through the market when collector/investor types realize that they have dead weight in their collections.

- He Demands Respect ‘Cause He Was Great: The fact that more than 40 years have gone by without one single coin commemorating Martin Luther King, Jr., one of our nation’s finest and most enduring civic figures, is a disgrace. When the Mint announced the designs selected for the 2014 Civil Rights Act commemorative silver dollar coin, King was once again absent. Need we remind those in charge of our nation’s coin design process that without King there might be nothing to commemorate?

- All but one 20th century coin type was produced in business strike and proof qualities. Can you guess the one that wasn’t? If you guessed the Peace Dollar, you’d be wrong. Although extremely rare, approximately 100 or so were pressed in 1921 and 1922. And it’s a real event any time one is offered for sale. The correct answer is the Standing Liberty quarter, produced between 1916 and 1930. Proofs of this timeless classic were never struck for public consumption, and the existence of any struck for mint purposes is not known.

Regarding MLK, I think a lot of people agree it’s way past time to honor him on coin.

But I have heard there may be an issue in terms of his family having some kind of control over use of his image. Have you heard anything about this? I would think that if this is the case his family would surely agree to have his image reproduced on coins.

Your article falls just short of being useful. Please tell me, who is in exactly the same shoes you were in, what venue you used to “sell” your coins this last time around. I can handle the photography, with some practice, and I can describe the coins (been collecting since I was 12), but now I drastically need to thin out my collection; literally hundreds and hundreds of nice certified coins need to go. I’m not clearing out completely, but I have to get back to a displined approach, instead of buying everything that strikes my fancy. Where did you sell,and can you give more details (Buy it Now, True Auction, Reserve Auction)on how you offered your coins for sell. Did you pay the grueling 15% plus seller’s fee that one auction house has? eBay?

Steve- I listed my coins at buy it now or best offer- the buy it now is what i thought was market retail for the coins and the offer I accepted was what I felt was fair. I usually got close to my asking price. The key is the presentation. I subscribed to an ebay store to lower the fees. since i knew i was selling a good volume- i was able to spread the monthly fee across all of my sales.

Also, the key to selling right is buying right. Always negotiate a buy price!

Charles~Thanks for the article, I too have been in the position to liquidate parts of my coin collection. The only thing I will change the next time, is when dealing with Ebay is using the subscription to a store and the “make offer” mode. As for my photos, you are right. I put a lot of time into getting high quality picture, it took going into my Sony camera settings and making changes to allow the camera to take extreme close ups.

The coins I sold earlier this year on Ebay were commemoratives, wheat pennies, proof silver eagles, plus some rare coins such as my 1932 S washington head and a pcgs graded ms65 1968 s penny minted on a clad dime planchet, plus some gold coins, which are difficult to sell for me. One piece of advice I have for anyone selling on Ebay….Always follow Paypals policy’s!!!! It will save you from being scammed. Paypal requires you to ONLY send to “verified addresses,” this is important because scammers know that all they have to do is call their credit card company and claim that they hadn’t made the purchase, that credit card co. will honer the request and return the money to the card holders credit line and you will be screwed. Live and learn.