Understanding how credit works in the coin industry can be critical to every collector

By Jeff Garrett for Numismatic Guaranty Corporation (NGC) ……

Around this time of year, my bank requires an annual review of my credit line. They want last year’s tax returns, both personal and corporate. I need to provide a detailed personal financial statement and information about recent activity in my company. The information is reviewed carefully, and hopefully sometime in May my credit line will be renewed. This is an annual occurrence and this is with a bank that I have been with for years.

Around this time of year, my bank requires an annual review of my credit line. They want last year’s tax returns, both personal and corporate. I need to provide a detailed personal financial statement and information about recent activity in my company. The information is reviewed carefully, and hopefully sometime in May my credit line will be renewed. This is an annual occurrence and this is with a bank that I have been with for years.

You’d think they would trust me by now!

Contrast this with the credit environment at a typical coin show or auction. I can safely state that I could easily do a million-dollar deal, with credit involved, on a handshake. No messy paperwork, financial statements or tax returns involved. My 40 years in the business counts for much more in the numismatic industry than it does with a financial institution.

Credit Where Credit Is Due

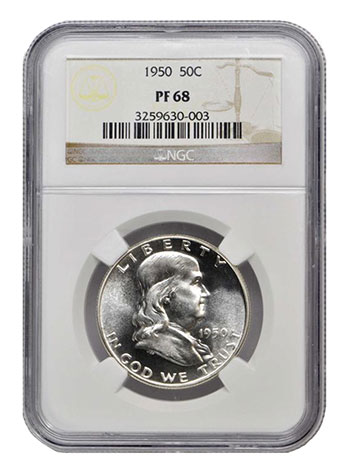

A coin dealer’s word is one of their most valuable assets. Many rare coin deals involve large sums of capital, and the parties need to know they can trust one another.

The coin business is quite large, but most of the long-term players know one another. The same can be said for many longtime collectors. I would have no problem sending a $25,000 coin to someone I have dealt with for years.

Credit in the coin business is a very important part of the industry. When Heritage Auctions conducts a $65 million sale, such as the recently completed FUN auction, much of that business will be done on terms.

Years ago, the standard in the industry was to get 30 days interest-free to pay for auction purchases. In recent years, that has been modified by most companies to 15 days interest-free or 45 days for a 1% fee. The auction companies typically pay consignors in 45 days, so they are picking up an extra point in fees. Every little bit adds up when selling hundreds of millions of dollars worth of coins each year.

For really large auctions, some companies will offer extended terms for qualified buyers. They realize that the market may have trouble digesting huge amounts at one time, and the extended terms can be beneficial for consigners, buyers, and the auction house.

For really large auctions, some companies will offer extended terms for qualified buyers. They realize that the market may have trouble digesting huge amounts at one time, and the extended terms can be beneficial for consigners, buyers, and the auction house.

Times Have Changed

Years ago, most auction houses were pretty loose with credit. This had predictable consequences, and many auction houses lost considerable money when the market tanked.

Bad credit is one of the reasons I exited the auction business 25 years ago. From what I can tell, the auction houses have all become more sophisticated and they monitor credit much more carefully. This can be a huge task when conducting a giant sale. The credit managers at Heritage and Stack’s Bowers have my deep admiration.

The Inside Scoop

Any collector purchasing a large number of coins needs to understand how credit in the numismatic industry works. I have seen more than a few passionate collectors buy coins using credit cards when they felt they absolutely had to have a certain coin. More than a few had to pay the credit cards back in installments with huge fees attached.

These same collectors could probably have purchased the coins from dealers with credit terms if they had asked. It would pay for any serious collector to establish credit well in advance with dealers who specialize in the material they collect. This way, they can pull the trigger with less financial pressure when that “must-have” coin shows up.

Another issue that comes up quite often is asking a dealer to accept your check during a coin show. At every convention, I have absolute strangers coming to my table to buy coins. Many want to pay by check. Our company policy is to accept personal checks if we are provided with a solid reference. Hopefully, this reference will be on the bourse floor for a quick check.

Luckily, our casual acceptance of checks has been quite successful over the years. So far, we have not experienced a loss from bad checks.

One aspect that gives me some comfort when accepting checks is that local law enforcement usually takes bad checks very seriously. Prosecutors will put someone in jail for writing a bad check.

They will not, however, help you if you offered any credit terms. Regardless of the amount, this would be a civil offense and your only recourse is the courts. No fun there!

It’s Your Reputation on the Line

As most long-term players in the numismatic industry can tell you, the business is a close-knit group. If someone goes bad, the word spreads quickly. This is especially true now that social media has become an important part of the business. The Facebook group Coin Dealers Helping Coin Dealers touches on this subject almost daily.

Unfortunately, there are a few bad apples in the business and everyone does their best to avoid them. The coin business is forgiving, however, and it’s surprising how some guys have deep financial troubles and a few years later are back in the thick of it.

Unfortunately, there are a few bad apples in the business and everyone does their best to avoid them. The coin business is forgiving, however, and it’s surprising how some guys have deep financial troubles and a few years later are back in the thick of it.

Years ago, the dollar amounts were much smaller than today. I predict that many more in the industry will begin to adopt more rigid financial controls. The auction companies have already started this process and others are sure to follow.

Collectors should also work to establish themselves in the industry. This will save considerable money and provide more acquisition opportunities. Even the richest collectors can sometimes have trouble moving money around for a purchase.

Most rare coin companies will work with you if you have prepared in advance. Some may even offer generous terms cost-free if asked. The business is competitive and credit is just one aspect of any transaction. The next time that really cool coin shows up, you might reconsider how you pay for it!

Be Smart About Credit

A note of caution: use credit wisely. I have known several dealers and collectors who would buy almost anything if you gave them credit. Credit can be an extremely useful tool when used properly, but it can also lead to financial stress if abused.

Knowing how credit works in the business is just one more bit of important numismatic knowledge that can help collectors and dealers alike.