by Dana Samuelson – American Gold Exchange

Gold is now in a technical break-out. After surging nearly 5% last week and bolting through several key resistance levels, it has gained more than 9% so far this year, the best annual start since 1986, and 13% since in November, when it hit a cyclical bottom of $1,140. Rising volatility in equity and currency markets, slowing global growth, worries over Greece’s possible exit from the euro, the near-certainty of massive quantitative easing in Europe, and uncertainty about central bank policies worldwide are just a few of the drivers behind gold’s impressive rally.

Into that potent mix add the 65% plunge in the oil prices since last summer, which is radically undermining the economies of oil-rich nations Brazil, Venezuela, Russia and OPEC members, not to mention our own states like North Dakota and Texas, and you can see why instability is again gripping the markets and volatility is ratcheting up. The S&P 500, for example has undergone daily swings averaging more than 1% this year, twice as much as in 2014.

Rising with the Dollar

Furthermore, after months of falling while the dollar rose, gold is now rising alongside the buck as investors seek safety from global instability. Since August, a tsunami of money has flooded into the dollar as China, Japan, and the Eurozone have weakened. Foreign investment must be converted into dollars in order to purchase U.S. stocks and Treasury bonds, and this conversion has helped to drive the dollar to multi-year highs. Speculation that the Fed may raise interest rates by mid-2015 also boosted the dollar’s relative attractiveness.

What many people don’t realize is that, while the dollar was the world’s strongest currency in 2014, gold was the second strongest, outperforming the Chinese yuan, British pound, Swiss franc, euro and yen. Although gold was falling in dollars in the second half of the year, it was rising in these other currencies. Now gold is rising sharply in dollars, too, alongside a strengthening dollar, and this is a very powerful signal that the gold market is entering a new and more bullish phase.

Swiss Bombshell

Last week’s shocking move by the Swiss National Bank underscores the forces now supporting gold. Virtually without warning, the SNB jettisoned its three-year policy pegging the value of the Swiss franc to the euro. Coming just three days after SNB vice-chairman Jean-Pierre Danthine reaffirmed the euro-cap as the cornerstone of Swiss policy, the abrupt reversal spread near-panic throughout global currency markets and sent the Swiss franc skyrocketing against the euro and dollar. To limit inflows into its suddenly stronger currency, the SNB had to slash interest rates further into the negative, to minus 0.75%.

Notably, this stunning announcement was made the day after European Union courts greenlighted the ECB’s plan to launch quantitative easing, the Fed-style program of purchasing government bonds to drive up inflation and stimulate economic growth in the Eurozone. The ECB’s program is now expected to be even bigger than previously thought—closer to one trillion euro rather than 500 billion. Tantamount to printing money, QE will further devalue the woebegone euro. The SNB, it seems, no longer wants to be tethered to a sinking ship.

The Swiss franc promptly surged over 30%, causing billions of dollars in losses to Swiss investors, and gold surged by $30 an ounce. But a lot more is at stake. By removing the peg without warning, the SNB lost the trust of the international community. Even more important, if the SNB, famous for financial probity, can reverse a cornerstone financial policy without warning, any central bank might do the same. Suddenly, investors have to face the threat of deeper instability in the very institutions that, since Lehman Brothers, have been relied upon to save a deeply damaged world economy. It’s no wonder gold is surging again as a hedge against upheaval and volatility.

Latest One-Year Charts

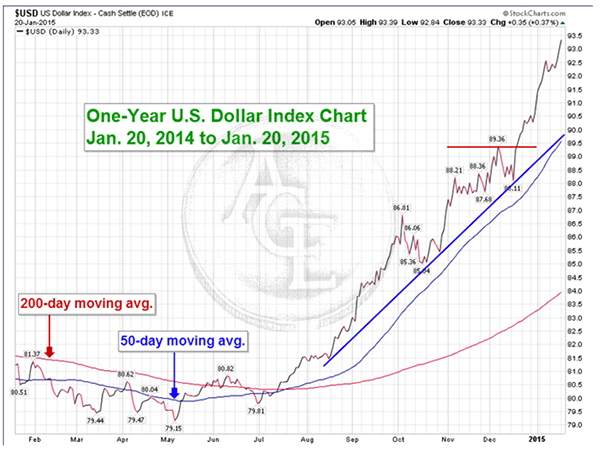

U.S. Dollar

The U.S. economy had its strongest third quarter in 11 years, coming in at a revised 5% growth rate and considerably beating expectations. This news, coupled with steady job creation in 2014, confirmed that the U.S. is the only major world economy showing signs of strength. Conversely, Japan and the Eurozone are fighting recession and deflation, and China’s growth fell to a 24-year low in 2014. This disparity, as we said above, has caused huge inflows of cash into U.S. assets, bidding up the dollar in the third and fourth quarters.

As you can see in the Dollar Index chart above, the buck surged more than 12% against major rivals from June through December. It then pushed higher still, breaking resistance at just under 90 to a six-year high of 93.30. It’s now up almost 15% since June and due for a correction, probably soon.

Fourth-quarter GDP in the U.S. is expected to be quite a bit softer than Q3. Growth in the services sector fell off in December and new orders for manufactured goods dropped for a fourth straight month in November, signs the economy lost some momentum. December retail sales fell short of forecasts, and real wages surprisingly declined, indicating slack remains in the labor market despite the 5.6% unemployment rate.

Perhaps most alarming, inflation remains stubbornly low, adding to concerns that deflationary pressures in Japan and Europe could cross the seas. U.S. consumer prices recorded their biggest drop in six years in December and a gauge of underlying inflation was flat. While not drastic in themselves, falling prices could cause the Fed to postpone any increases in interest rates until late 2015 or even 2016.

And while tumbling oil prices are giving U.S. drivers a break at the pumps, the knock-on results could mean fewer jobs and slower growth. The fracking boom, which has been one of the largest job-creators for the last five years, is already feeling the effects. Goldman Sachs recently warned that nearly $1 trillion in planned oil-field investments would be unprofitable at under $70 a barrel—oil is now under $50—meaning more jobs lost.

Combined with slowing growth and falling inflation, a downturn in payrolls would almost certainly cause the Fed to postpone rate increases, taking the wind out of the dollar’s sails. And they know that if the dollar gets much stronger, U.S. exports will lose competitiveness in foreign markets, undermining GDP. Typically, a stronger dollar pressures gold because it is denominated in dollars for international trade, becoming more expensive to users of other currencies. When this extraordinary run by the buck stalls, gold’s already-strengthening fundamentals should receive a major boost.

Gold

Pressured by the rallying dollar, gold was in a steady downtrend from July to November, as you can see in the chart above. After failing to hold major support at $1,180 in October, it plunged briefly to as low as $1,140 in early November before rebounding sharply in what traders call an outside reversal, which is normally a bullish sign. The subsequent lows of $1,165 and $1,175 were attributable, respectively, to the non-passage of the Swiss Gold Initiative and to normal year-end liquidation.

Since that November low, gold has been in a steady uptrend with short-term resistance at $1,220 and major resistance at $1,240. Although it failed in its first attempt to breach $1,220 in December, it set a higher low two weeks later at $1,175, holding the developing uptrend intact. Last week, it moved decisively over both resistance levels, surging to a new four-month high of $1,283, and this week pushed above $1,290.

In the January issue of their highly-regarded newsletter, The Aden Forecast, our friends Pam and Mary Anne Aden wrote: “it’s possible the bottom may be now in for gold at $1,140 and it will be a bullish signal if gold moves over its 65-week moving average at $1,263.” Having made that move with gusto, gold is now in a technical break-out with room to move higher still, potentially challenging $1,300. A move over $1,300 puts $1,350 into play. Conversely, short-term support is now at $1,240 and $1,220, with major support at $1,180.

Short-term support for higher prices remains solid, with events pending this week that could have major ramifications for the Eurozone. The ECB is expected to announce Fed-style quantitative easing at the end of its policy meeting on Thursday, to the tune of as much as a trillion euros, further eroding the currency’s value. On Sunday, Greece will hold a general election that may decide whether it remains in the Eurozone. If the anti-austerity Syriza party gains power, as polls indicate it will, Greece may renege on the terms of its agreement with the ECB, resulting in its likely departure from the common currency. Both of these events could push gold substantially higher.

Dr. Steven Sjuggerud, acclaimed author of the investment newsletter True Wealth, has said repeatedly over the years that the best time to buy any investment is when it is cheap, out of favor, and in an uptrend. Gold fits all three of these criteria right now. Last Friday, Dr. Sjuggerud recommended getting out of the dollar and into gold, believing the dollar’s gains are unsustainable and its rise is coming to an end. We highly recommend both The Aden Forecast and True Wealth if you are not already a subscriber.

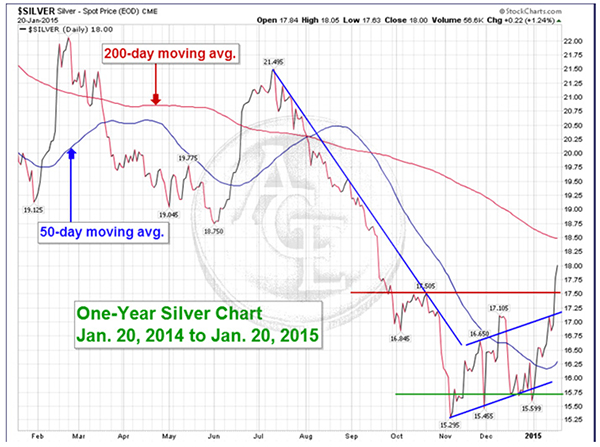

Silver

As usual, silver has been subject to greater percentage swings than gold, but otherwise its charts look quite similar. After strong downtrend from July to early November, when it set a low of $15.29, silver has been establishing a solid uptrend. Like gold and for the same reasons, it’s had a couple of downdrafts, first to $15.45 when the Swiss Gold Initiative was defeated, then to $15.59 on normal year-end selling.

Like gold, silver has now moved into break-out mode. In the last two weeks, it has risen solidly past short-term resistance at $16.65 and $17.10. As of last Friday, it pierced major resistance at $17.50, giving it room to run to $18.00 and beyond, perhaps as high as $18.75, before encountering its next major resistance. On the downside silver should find short-term support at $17.00, $16.50 and major support at $15.75.

How high silver can move on this breakout and where the bottom is on the subsequent correction will be interesting to see. Like gold, silver is now setting a series of higher lows and higher highs and it continues to look bullish.

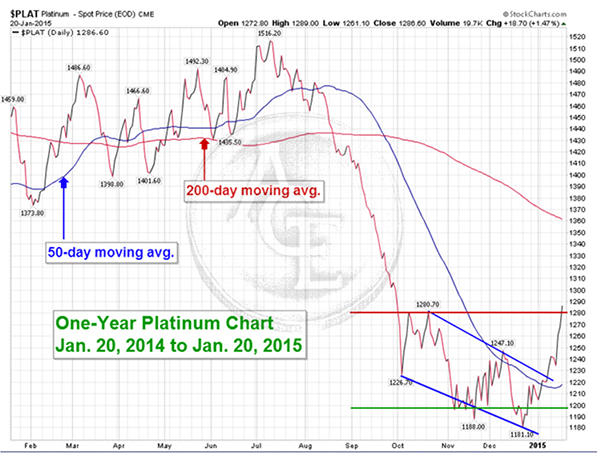

Platinum

On the surface, the markets for platinum and palladium are something of a conundrum. Both metals have been in severe supply-deficits for over two years. Johnson Matthey, one of the world’s largest refiners, projects even deeper shortfalls in 2015, more than 1.1 million ounces for platinum and 1.6 million ounces for palladium. Yet neither metal is keeping up with the gains of gold or silver. The main reason is that demand for these two metals is tied largely to industry, especially the auto industry, so they tend to trade more like commodities than gold and silver, which enjoy stronger investment demand as currencies of last resort.

Neither of the PMGs trades wholly as a commodity, of course, unlike copper, which has tumbled to a six-year low in the last six weeks because of cratering demand for commodities, especially in China. But their demand fundamentals are certainly more closely tied to trends in commodities than are those of gold and silver, so they have suffered more with faltering world economy. Deep supply-deficits have helped to buoy prices somewhat but cannot overcome the drastic fall-off in global growth.

Platinum has been in a downtrend since last July, as indicated by the blue trend lines on the chart above. This trend moderated quite a bit in early November, but until last week it continued to set lower highs and lower lows. While platinum has now rebounded sharply over short-term resistance at $1,240, it has yet to eclipse major resistance at $1,280.

Like silver, platinum should follow gold’s course in coming weeks but its gains may be muted. In the current market, it should enjoy short-term support at $1,220 and $1,200. As we go to press, platinum is just breaking over this major resistance at $1,280. If it can hold above this level it has room to run.

Currently, platinum is pricing at parity to gold and even at a modest discount, which is a rarity. It normally trades at a healthy premium to gold, usually from $100 to $400 per ounce. For long-term investors who are willing to persevere until global growth returns, platinum is presenting an excellent buying opportunity, especially given its fundamental supply shortfalls.

Palladium

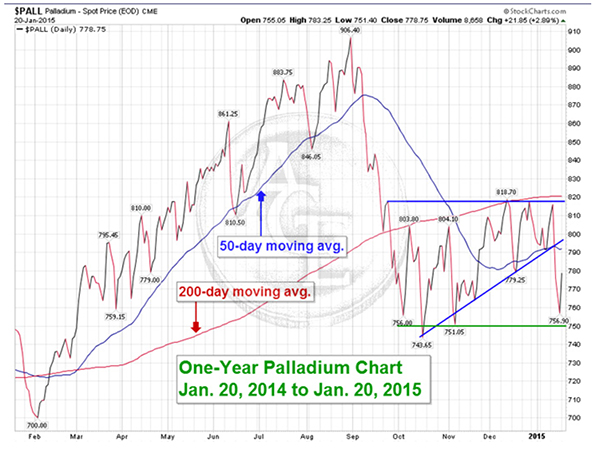

Since mid-September, palladium has largely held its price range between $750 and $815, resisting the declines seen by the other precious through early November. And while its top has remained constant at $815, its bottoms have been rising, which is normally a bullish pattern.

However, in the past two weeks palladium has fallen below its bottom trend-line, back to just above major support at $750. Why? One reason is that, lying to the commodity-side of platinum along the spectrum from commodity to currency, it is reacting more negatively to lower forecasts for global growth in 2015. Also, having resisted some of the price declines experienced by the other precious metals last fall, palladium had more downside room now. Relative to gold, palladium is still less undervalued than platinum.

As we go to press, palladium is rebounding but remains range-bound. Like platinum, despite incredibly bullish fundamentals, its gains may be muted in the short term.