By Louis Golino for CoinWeek ….

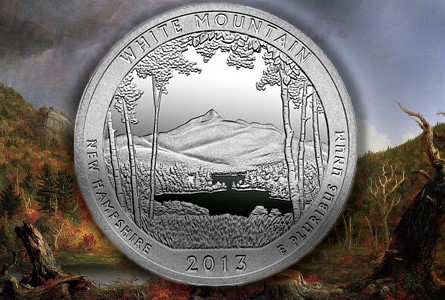

After a three-month delay while the Mint determined mintage levels for the coins, the first 2013 five-ounce silver America the Beautiful coin for White Mountain National Park will be released on May 16. The next two coins in the series will follow on June 6 and 27. The last two for this year will come out in August and November.

These coins will have a mintage limit of 25,000 units, the same as last year’s level. However, not all coins are minted at once, and the 2012 coins all sold between 15-17,000 pieces, making them the new series keys. It remains to be seen if the 2013 coins will sell the full maximum mintage. Also, although only the White Mountain mintage level has been set so far, the Mint has always made them the same for all collector versions in a given year.

The 2012 Chaco Culture coin, sold out on May 6, days after being repriced the previous week from $230 to $180 as a result of the decline in silver prices. I expect secondary market prices for this coin to increase soon, though not to the levels of the 2012 coins that sold out unexpectedly, especially the Hawaii Volcanoes coin, which is bring $600 and more.

The 2012 Chaco Culture coin, sold out on May 6, days after being repriced the previous week from $230 to $180 as a result of the decline in silver prices. I expect secondary market prices for this coin to increase soon, though not to the levels of the 2012 coins that sold out unexpectedly, especially the Hawaii Volcanoes coin, which is bring $600 and more.

The 2013 coins, at least for now, will also be priced at $180, and most collectors are very pleased with that development, which should stimulate sales of the new coins, especially after all the pent-up demand for them that has been building all year. Plus the 2013 designs appear to be very popular with collectors, and should look great in the large format.

When you consider the high premiums on all forms of physical silver at the moment with bullion Silver Eagles going for $30, bars selling for almost as much, and premiums on 90% silver coins in bulk the highest I have seen them probably since 1980, the $180 price tag is a good buy. Besides, these are collector coins with limited mintages.

Contacted for this article, John Maben, owner of John Maben Rare Coins, which has a retail coin web shop called Modern Coin Mart , and co-author with Eric Jordan of Top 50 Modern Coins (Krause, 2012) said “The vapor-blasted editions have been a pleasant surprise. After a fairly slow start interest in the series has been strong and prices for the most part are well over issue price.”

He added that “It’s as though collectors just decided these are pretty cool, especially when graded SP70 by NGC and PCGS, and with the low relative mintages worth buying and keeping for the long haul.” He also sees no reason these trends will reverse in 2013.

The ATB series started off with the 2010 bullion coins, which were not released until the beginning of the following year due to production issues and controversy that arose over the high secondary market premiums authorized purchasers were charging for the coins, which led the Mint to implement an unusual requirement that the AP’s could only charge 10% over spot for the coins and had to sell them to retail customers. 33,000 were made of each coin.

But it was difficult to obtain them from the AP’s, and people who managed to get their coins early started selling them for even higher premiums that the prices that sparked the initial outcry. But once the coins became easy to obtain, their prices dropped sharply, and they have remained mostly low since then. In fact, it is not easy to sell a set of the 2010 coins, especially to dealers because of low demand for the coins. Coins which are graded proof-like and deep proof-like 69 command stronger prices.

Complaints about the small mintage driving premiums too high led the Mint to overproduce the 2011 bullion coins, which have not acquired much premium over their melt value.

The 2010 collector versions caused some initial excitement when the Hot Springs coin sold very quickly, but then sales slowed down significantly for the remaining 2010 and 2011 numismatic coins.

But in 2012 things really started to change. The Mint lowered the maximum mintage for the collector coins to 25,000, but when sales of the Volcanoes, Acadia, and Denali coins reached about 15,000, they stopped selling the coins, and premiums for those coins have been rising. The El Yunque and Chaco Culture coins have mintages in the 17,000 range, making them and the other three coins the current keys to the entire series.

Plus the 2012 bullion coins were also produced in smaller numbers than coins from the previous years, particularly the Volcanoes and Denali coins, which have mintages of 20,000, and they have also seen their premiums rise. The Volcanoes bullion coin sells for around $350 in bullion form.

Sales of the collector coins have been hurt by numerous changes in prices the Mint charged, which at times were quite competitive, but at other times seemed rather high such as earlier this year when silver began to drop, but the Mint raised its price from $205 to $230 with plans to sell the 2013 coins at $245. But the Mint switched course recently and dropped the price to $180.

A good way to understand what is happening with this series is that it is still in the process of reaching what Eric Jordan calls “series maturity.” It is only just now beginning its fourth year, and there have been a lot of fits and starts along the way.

Michael “Miles” Standish, long-time grader at PCGS and co-author with John Mercanti of American Silver Eagles (Whitman, 2012) said: “Because of the smaller mintages the Mint is producing a better quality bullion coin. The proof-likes and DMPL’s (deep mirror proof-like) are very beautiful. It seems that there is a buying opportunity for these coins at a discount from other issues.”

The Mint now has more experience producing these coins, and like others I have noticed a major improvement in the quality of both the bullion and numismatic coins, especially if I compare the 2012 bullion coins with those from 2010.

On May 8 the Mint sent a memo to its authorized purchaser network which said that sales of the 2013 bullion coins will begin May 13 and will be done on an allocation basis similar to the procedure currently used for 2013 Silver Eagles as a result of the planchet shortage and record demand.

This is how the Mint explained the allocation process will work for the White Mountain bullion coins:

“Each Monday morning, the inventory available for sale that week will be divided into two equal pools.

•The first pool will be allocated equally to all active Authorized Purchasers (APs).

•The second pool will be allocated based on each AP’s sales performance of 2011- and 2012-dated America the Beautiful Five Ounce Silver Bullion Coins.

•Each AP will be advised via fax Monday morning (or if a Government Holiday, Tuesday morning) of their allocation, and they will have until 3:00 p.m. Friday to place orders for their allocated coins.

•Any unordered coins after 3:00 p.m. Friday will be put back into the pool for allocation the following Monday.

The allocation process will remain in place until demand for the 2013 America the Beautiful Five Ounce Silver Bullion Coin – White Mountain National Forest can be met.”

There is no official word yet on mintages for the 2013 bullion coins.

As of this writing and to the best of my knowledge, only APMEX, the American Precious Metal Exchange, has the White Mountain bullion coins for retail sale, and in the first 24 hours of sales, they sold 80% of the 500 coins they had in stock.

Louis Golino is a coin collector and numismatic writer, whose articles on coins have appeared in Coin World, Numismatic News, and a number of different coin web sites. His column for CoinWeek, “The Coin Analyst,” covers U.S. and world coins and precious metals. He collects U.S. and European coins and is a member of the ANA, PCGS, NGC, and CAC. He has also worked for the U.S. Library of Congress and has been a syndicated columnist and news analyst on international affairs for a wide variety of newspapers and web sites.

Louis Golino is a coin collector and numismatic writer, whose articles on coins have appeared in Coin World, Numismatic News, and a number of different coin web sites. His column for CoinWeek, “The Coin Analyst,” covers U.S. and world coins and precious metals. He collects U.S. and European coins and is a member of the ANA, PCGS, NGC, and CAC. He has also worked for the U.S. Library of Congress and has been a syndicated columnist and news analyst on international affairs for a wide variety of newspapers and web sites.