By Louis Golino, special to CoinWeek …..

The United States Mint recently released its 2021 Annual Report, which showed that last year the Mint had a very successful year by most measures. But sustaining the level of sales and profits seen last year will be challenging with fewer products offered this year.

Bullion coin sales were the best in over 20 years almost doubling in total revenue from $2.1 billion in 2020 to $3.8 billion in 2021. Increased demand for bullion products was led by increases of 70.5% and 57.1% in sales of total ounces of American Gold Eagles and American Buffalo Gold coins respectively. Sales of Silver Eagles increased by 62.4% (again in total ounces sold), while American Platinum Eagle sales rose by 33.9%.

Numismatic sales, which in several recent years saw a net loss rather than a profit, were the best in nine years, rising 66% from $346 million to $577 million in revenue. The biggest sellers in terms of specific products were the 2021 Proof set (with 482,676 units sold) and the 2021-W American Silver Eagle 1-ounce Proof coin (with almost 800,000 coins sold of the two reverse types issued), while the largest drivers of increased revenue in this area were gold and platinum numismatic products.

And when it comes to the Mint’s primary responsibility of producing circulating coinage, it achieved 100% on-time delivery of 14.7 billion coins to the Federal Reserve, which distributes those coins needed for commerce to banks and other financial institutions. And it did this despite continuing to operate under special safety restrictions due to COVID-19.

The United States Mint also grew its customer base for numismatic products (which had been in decline in several recent years) by 15% from 455,000 in Fiscal Year 2020 to 521,000 in Fiscal Year 2021.

Overall, the Mint’s total revenue grew by 49.4% over 2021 to $5.4 billion with net profits that allowed it to transfer $120 million to the United States Treasury General Fund, which funds the daily and long-term operations of the federal government. In FY 2020, the amount transferred was $40 million. The U.S. Mint receives no taxpayer funding to operate and is totally self-funded yet still often manages to return money to the Treasury Department.

Circulating Coinage

While the Mint managed to generate seigniorage and net income from all coins that totaled $556.4 million (including $381.20 million from circulating coins), this represented a decrease of 30% compared to the prior year.

The main reason for that is that the cost to produce the cent rose to 2.1 cents and the nickel to 8.52 cents from 1.76 and 7.42 cents respectively the prior year due to rising zinc and copper costs. In addition, shipments of pennies and quarter dollars decreased during this period.

Despite ongoing calls to follow most other countries and eliminate the one-cent coin, there are no plans to do that in the U.S. or to cease production of nickels–neither of which has much purchasing power today. The reason for this situation remains unclear but may be related to sentimental attachment to the Lincoln penny and opposition from some to rounding transactions up or down as would be required if those coins were eliminated. Others claim that the zinc industry opposes the move (cents are mostly made of zinc today). Besides, if we only get rid of the penny, that means making more nickels, which would still be produced at a loss. If it were up to your columnist, we’d just make both coins for collectors.

In addition, the United States Mint continues to explore the possibility of making those coins from alternative metals or even plastic (as it has since the 1974 aluminum cent), but so far no solution has been found that would substantially decrease total costs.

The one coin whose costs decreased in 2021 was the half dollar, which more than halved from 25 cents last year to just 11.67 cents. In addition, 2021 was the first year that Kennedy half dollars were issued for circulation since 2002 when the Mint ceased making them for circulation.

The U.S. Mint, which struck 12 million half dollars in 2021, never made a formal announcement about this change. Collectors initially began noticing the coins were available from banks on the West Coast and later elsewhere, which they reported to the numismatic media. Yet the Mint still sold bags and rolls of the 2021 halves at a premium through its website, with the 200-coin bag that sells for a premium of $47 having sold out.

In terms of the wide range of bullion and numismatic coinage issued, 2021 was definitely a banner year (as discussed here recently) between the introduction of new reverse designs on the Silver and Gold Eagle, the debut of the first silver dollar program in a hundred years and preparations for the launch of the American Women circulating quarter series that just debuted this month with the release of 2021-P and 2021-D Maya Angelou quarters.

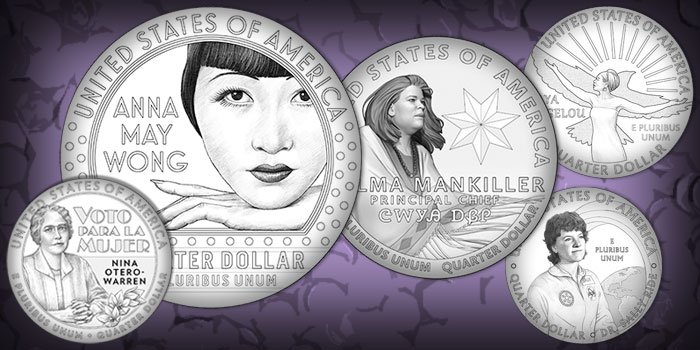

American Women Quarters

While not every collector is interested in those coins, the very first circulating coin series that honors a wide range of American women is an historic moment in our coinage that has seldom featured actual American women other than the first spouses (and those only on gold collector coins and medals) and a few prominent figures like Susan B. Anthony and Hellen Keller on circulating coins, or Eunice Kennedy Shriver on a commemorative dollar.

And the Mint and Congress understand that collectors no longer want series that run for a decade or more like the 50 State and America the Beautiful quarters, which is why the new series will run for just four years with no more than 20 coins issued altogether.

At the same time, the decision to finally use Laura Gardin Fraser’s profile of our first president, which is a widely admired design, was a nod to the ongoing appeal of classic American coin designs. Gardin, who was a prolific sculptor and coin designer, holds the distinction of being the first American woman to design a commemorative coin. Her best-known design other than the bust of George Washington that was originally recommended for the 1932 quarter is the very popular obverse of the Oregon Trail half dollar.

In 2021 the United States Mint also implemented a new pre-order system used for both 2021 commemorative programs – the Christa McAuliffe silver dollar and the Law Enforcement Memorial and Museum coins – which allows the Mint to produce just the coins that are ordered. This prevents it from having to melt coins that remain unsold after the year ends when they can by law no longer be sold, and that reduces net costs of those products since destroying the coins costs money. The Mint is continuing to use this system for its 2022 commemorative programs.

While these results are certainly impressive and show the Mint’s staff and management are achieving excellent results, for collectors 2021 was also a year when many experienced more than the usual degree of frustration ordering high demand, limited mintage products.

But as Mint officials explained in their last roundtable meeting with the media, they have made great strides in addressing that situation by managing to stop most use of bots and other automated ordering systems, by implementing pre-orders for more products and by planning to increase the products that can be ordered through their enrollment system.

2022

It will be interesting to see if the Mint can continue these positive trends in 2022. Bullion demand is likely to remain high, but numismatic sales might not be as strong as in 2021 since there appear to be fewer limited issue products that will be in high demand. 2021 was an unusual year since there were so many eagle products issued and a whole new numismatic line with the silver dollars.

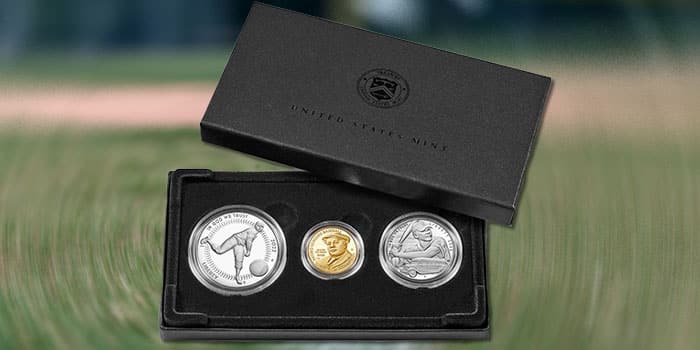

Initial sales for the 2022 Negro Leagues commemoratives were quite strong in dollar terms. Although only the privy marked silver dollar has sold out so far, the first 10 days of sales (January 6 to 16) when all products for this program are combined represented over $6 million in total sales.

Initial sales for the 2022 Negro Leagues commemoratives were quite strong in dollar terms. Although only the privy marked silver dollar has sold out so far, the first 10 days of sales (January 6 to 16) when all products for this program are combined represented over $6 million in total sales.

Finally, rising prices of the Mint’s numismatic products also remain a concern for many collectors, but last year collectors were apparently willing to pay them. For example, many people commented on the increased price of $105 for the silver Proof set that included three fewer silver quarters than prior years’ sets, but sales remained relatively strong at 275,344 sets sold. That was less than 2020’s 313,184, though the 2021 set is still on sale.

A significant unknown for 2022 is to what extent collectors will embrace the various versions of the American Women quarters that will be sold in bags and rolls and in the annual sets, and how that level of interest evolves over the course of the series. Widespread interest in space themes may help sales of the Sally Ride quarter. But having no large (five-ounce) silver versions of these coins because the Treasury has opted against doing that means that overall silver coin sales are likely to be lower than last year.

* * *

Louis Golino is an award-winning numismatic journalist and writer, specializing primarily in modern U.S. and world coins. His work has appeared in CoinWeek since 2011. He also currently writes regular features for Coin World, The Numismatist, and CoinUpdate.com, and has been published in Numismatic News, COINage, and FUNTopics, among other coin publications. He has also been widely published on international political, military, and economic issues.

Louis Golino is an award-winning numismatic journalist and writer, specializing primarily in modern U.S. and world coins. His work has appeared in CoinWeek since 2011. He also currently writes regular features for Coin World, The Numismatist, and CoinUpdate.com, and has been published in Numismatic News, COINage, and FUNTopics, among other coin publications. He has also been widely published on international political, military, and economic issues.

His column “The Coin Analyst”, special to CoinWeek, won the 2021 Numismatic Literary Guild (NLG) Award for Best Numismatic Column: United States Coins – Modern. In 2017, he received an NLG award for Best Article in a Non-Numismatic Publication with his piece, “Liberty Centennial Designs”. In 2015, “The Coin Analyst” received an NLG award for Best Website Column.

In October 2018, he received a literary award from the Pennsylvania Association of Numismatists (PAN) for his 2017 article, “Lady Liberty: America’s Enduring Numismatic Motif” that appeared in The Clarion.

Louis – Very nice roundup of FY2021, and always look forward to your column : my purchases did decrease in 2021 due to higher costs – and I focused on the 2021 Morgan-Peace issues, which I watched and desired much all through the program. While I applaud the increase in profits, (IMHO) would the US Mint refocus on coin programs which appeal to a broader base of collectors, and make availability a key advantage by offering reasonable mintage, while resolving their website issues ? I plan to limit my purchases this year and will select certain issues; I have also moved down to 1/10 Oz bullion for AGE.

All time low for customer service. End the bulk authorized purchase program.