By Harvey Stack – Co-Founder, Stack’s Bowers Galleries ……

Changes in the Numismatic World

The year 1979 featured several influential numismatic events, including heavy precious metal buying and the subsequent effects of a hyperactive investment sector. It also featured the birth of a multi-dealer auction event, the sale of several major collections at public auction, and a slowing of growth in the hobby. 1979 also saw the release of the last Carson City Mint State dollars from Treasury Department vaults, an event that upset Morgan dollar population reports and values.

Silver Jumps in Price

What happened in 1979 was that one family of very wealthy Texas oil investors–the Hunt Brothers–tried to corner the market on silver, as silver was in relatively short supply for the electronics, aviation equipment and other advanced technologies that were beginning to make larger demands of the world’s silver stockpiles.

Nelson Bunker Hunt, the oldest of the three brothers involved in the scheme, began looking for a way that they could increase the wealth they had accumulated in the oil industry. He was especially interested in commodities (monetary metals) that were typically steady in value for a long time. What the Hunts decided to do was to individually buy quantities of silver ingots (in Nelson’s case, he bought over 35 million ounces) and ship them to a Swiss vault as a hedge against inflation. Then, as the price of silver escalated, the brothers made a fortune by buying and selling silver coins in bags.

The Hunts, however, weren’t satisfied with the physical silver bars they owned (said to have been over 60% of all the tradeable silver in the world in 1979), and so they decided to buy futures, or calls, to drive up the markets because of the huge position they held. So from the beginning of 1979 to the early part of 1980, the brothers used the silver they already possessed as security and borrowed heavily from banks to trade further.

This had a large impact on the cost and availability of silver coins, leading to something like a “Wild West” atmosphere at coin dealerships, pawn shops, and local assayers as the general public began to sell their silverware, hoards of old coins, and junk silver at inflated prices that changed day by day.

Eventually, however, the banks that had loaned money to the Hunts started to call in their loans or refuse to renew their contracts. This generated a demand on the market that the Hunts had to cover or sell. Within a few months of these “calls” being made, the price of silver went from just over $10 per ounce to almost $50, and with the brothers no longer able to get coverage from banks or other speculators, the price of silver then dropped within a very short period from $50 to less than $10 per ounce.

Of course, this had a negative effect on the coin market. It also drove the Hunt family into bankruptcy.

There was also a flash abatement of the inflationary trends in the overall economy, affecting everything from food to cars and not just collectibles. So the value of numismatic items dropped accordingly, as fewer and fewer collectors and investors had enough money to continue supporting their hobby.

Yet even though the prices of coins dropped (as did the price of silver, as well as coins struck in gold), the overall collector of classic material held on to his collection – especially rare, very choice pieces. This helped the numismatic market avoid a deflationary state.

A Joint Partnership for a Special Auction

As a prime retailer of rare coins, Stack’s was frequently approached during this hard period by collectors interested in selling, either to us or at public auction. We did our best to maximize any collection offered to us, and because we were considered leaders in the field we had some very successful auctions sales in 1979. We also bought several well-known collections. Stack’s did not speculate, though many tried to induce us to be a marketplace for “bags, rolls, and quantities of silver coins”, because we would have sacrificed our coin business and become traders–and probably lost most of our capital as a result.

In order to keep our standing in the rare coin auction business, Stack’s decided to join with three other companies and have a summer auction seven to 10 days before the ANA National Show. In 1979 the ANA had chosen Boston, so we decided against holding it there (which might have disturbed the ANA event) and found a wonderful place to set up in Lawrence, Massachusetts It wasn’t too far from Boston and was still located in a perfect spot on the North East Coast, not far from all of New England, New York, New Jersey, and Pennsylvania.

The four firms that formed the alliance called the auction an “apostrophe” sale, naming the first event “AUCTION ‘ 79”. If successful, the group would number each summertime sale with the last two digits of the respective year.

The companies that joined together were all leaders in conducting sales, and all at one time or another were official ANA auctioneers. These companies were Stack’s, Rarcoa (Ed Milas), Paramount (David Akers), and Superior (the Goldbergs)

Each company was to consign to the sale no more or fewer than 500 lots. Hopefully, this number would include rarities and high-grade coins. Each company would catalog their own lots and send them to Dave Akers to organize, photograph and prepare for printing.

The four companies would submit each of our mailing lists to an independent mailing house, which would then compare the names on each list and mail a single copy of the catalog to each potential buyer. Bid sheets would be mailed and bids would be entered under the name of the company the client wished to represent them at the sale–though any member of the public that wanted to attend (which turned out to be almost 1,000 active bidders) could do so. Each potential buyer would get a bidding number that would be given to their representative. It was careful and private work, and with the experience, we all had it was accomplished with no difficulty.

Two days before the sale the viewing room was crowded. The auction was divided into four sessions over two days: one in the afternoon and one in the evening, with the companies serving lunch and dinner. It was a great numismatic event, with a very friendly crowd of dealers and collectors. Hospitality dominated the event.

The Carson City Morgan Dollar Hoard

The distribution by the United States Mint of all the silver coins they may have stored (along with the change from silver to clad that started in 1964) affected the silver dollar market as late as 1979–especially the Carson City Mint silver dollar market.

The distribution by the United States Mint of all the silver coins they may have stored (along with the change from silver to clad that started in 1964) affected the silver dollar market as late as 1979–especially the Carson City Mint silver dollar market.

The United States, in the late 1870s, had issued a series of paper currency that was intended to replace the “heavy silver dollars” then in circulation. One would no longer need “leather lined pockets” to carry a few dollars for general purposes. And when the Mint found silver coins in its vaults, they sent them back to be remelted into silver ingots. For some reason that has never been explained, some three million dollars–primarily the Morgan dollars struck at Carson City–were not melted and were rediscovered in the early 1970s, still in the vaults.

The Mint then engaged the General Services Administration (GSA) to have the coins inspected, sorted, and marketed. The publicity of the find, especially for numismatists, was astounding. The GSA engaged a group of professional dealers and staff members to sort the coins by branch mint and date and also put an arbitrary grade on those examined.

Most of the coins were MINT STATE. Those that had the fewest bag marks (nicks and abrasions from contact with other coins in the same bag) got the highest category; the rest were sorted by the amount of bag wear. Dollars that were overwhelmingly scratched and nicked were melted.

The United States Mint then, in 1972, started a publicity campaign, with each coin was encased in a blue plastic holder. The Mint thought they would sell more than one million because of the publicity, but “THE GREAT SILVER SALE”, as it was labeled, of some 1.7 Million coins was not as successful as the GSA thought it would be: only one million coins were sold.

Silver Dollar Sale Continues

Since it wasn’t a “sell-out”, the Mint tried again in 1973, this time using the sales pitch “THE COINS JESSE JAMES NEVER GOT!” They offered a greater selection of dates from 1878- to 1885-CC and even added a few 1890- and 1891-CCs to sweeten the “pot”, with categories such as “Potluck”, “Silver Bonanza”, and the “CC Tripe Choice”. Bidders snatched up some 453,000 slabbed coins, hoping to get better-quality or scarcer dates in the out of this sale, but the government was still left with 1.7 million coins unsold!

Near the end of 1973 and going into the year of 1974, the GSA tried again with yet another promotion: the “30-Day Surplus Dollar Sale”. And, again, the GSA was disappointed, with a mere 213,000 sold, (a mere 15% of what they still had). The GSA also offered what they considered the rarest 1879-CCs of some 3,600 that they had, and this SOLD OUT!

But a huge quantity of silver dollars was still laying in their vaults, so the GSA tried again.

But a huge quantity of silver dollars was still laying in their vaults, so the GSA tried again.

Another sale in late 1974–the “Last of a Legacy”–only sold 420,000 coins.

The GSA waited to the end of 1979 and early 1980 for a sixth sale, entitled “90% Silver, 100% History” (I like that one). With the price of silver rising rapidly during ’79 and early ’80, the GSA was able to sell 925,000 coins in as few as two weeks.

Though it took some seven years to sell close to three million silver coins from their vaults, the Mint earned about $100,000,000 USD from the sale. Of course, the many millions that the GSA had spent in direct mail advertising, plus the mass media advertising in local and national newspapers and magazines, PLUS the cost of sorting, inspecting, encapsulation, packaging, and mailing, meant that while the Mint and the GSA made money on the sales, it was far less than they had expected.

It also should be mentioned that, after silver reached almost $50 an ounce and then crashed to $10 per ounce, those who bought coins from the GSA hoard on speculation tried to sell them at original cost. But to whom? As the price of silver dropped, there was NO DEMAND to acquire them!

Public Coin Auctions

By 1979, Stack’s was the leading coin public auctioneer, as we sold many of the major collections being offered each year.

And many of our important clients, after building their collections, would bring or award Stack’s the opportunity to “return their collections” to the marketplace so that collectors who followed them would have the opportunity to add to their collections. Not only did we sell for the collector himself, or his estate or family, but also we were selected to sell for banks, trust companies, colleges, and universities, as well as museums. The number of sales and rare coins we were given to sell through our auctions kept us busy during the year, and the “name” sales added to our reputation and our ability.

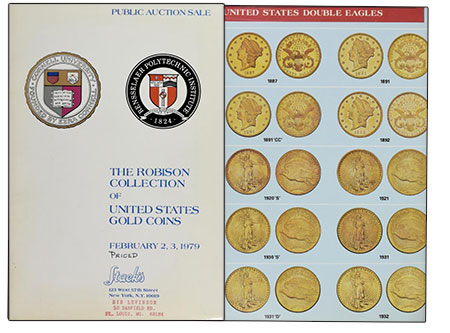

The Fabulous Robison Collection

JANUARY 1979: The fabulous ROBISON COLLECTION OF U.S.GOLD COINS.

The Robison Collection was formed as a family affair with Ellis and Doris Robison as partners. Ellis was a successful pharmaceutical distributor in upper New York State. Ellis headed the John L. Thompson and Co., of Troy, NY, and was one of the country’s oldest wholesale pharmaceutical firms in America, having served New England drugstores for close to two centuries. Robison was a dedicated educational fanatic, who contributed for decades to colleges and universities all around the country. Many an athletic field, herb garden, and foundation are named after him and his family. Being a graduate of Cornell University, he dedicated many of his endowments to his alma mater – though he contributed as well to Rensselaer Polytech Institute, for which he also had a special fondness.

The Robison Collection was formed as a family affair with Ellis and Doris Robison as partners. Ellis was a successful pharmaceutical distributor in upper New York State. Ellis headed the John L. Thompson and Co., of Troy, NY, and was one of the country’s oldest wholesale pharmaceutical firms in America, having served New England drugstores for close to two centuries. Robison was a dedicated educational fanatic, who contributed for decades to colleges and universities all around the country. Many an athletic field, herb garden, and foundation are named after him and his family. Being a graduate of Cornell University, he dedicated many of his endowments to his alma mater – though he contributed as well to Rensselaer Polytech Institute, for which he also had a special fondness.

To visit Ellis in Troy was like turning back the clock, for his company occupied a huge red building on Main Street that looked like it did a century prior. When you entered the building at street level, it seemed as though you had gone back to the company’s original location.

Walking in, you found yourself in a large workroom surrounded by many desks, all exposed to the public. A large, waist-high wooden gate protected the office from unwanted visitors. You were greeted by the phone operator, who sat behind an early-20th-century phone board that used the early “plug-in” system to make calls, answers, and pages. The lighting was incandescent within early American shades.

Once you were announced to Mr. Robison, you entered his vast office, which was almost as long as the depth of the building. Ellis sat at a large mahogany desk covered with papers, and before that was a giant conference table where the Board held its meetings. Ellis was a wonderful host, who always greeted me with a warm smile and conversation. He would ask what I brought, and I delivered the last group of coins that he’d won at one of our sales.

He would bid either over the phone or through the mail, but delivering the coins was a ritual that I thoroughly enjoyed. I would arrive at his office by 10 am after driving directly to Troy. We would review the coins, discussing many of them in-depth, and at exactly 12 noon we would leave the office and go to the famous Troy Club for lunch. Ellis knew everyone there, and he enjoyed introducing me as his special guest for the day. He told them that I made the trip to assist him while he was building a major collection of U.S. coins, how much he valued my visits, and the fact of the place my company held in American numismatics. We would leave by 1 pm and work on the collection a little more until about 3 pm since Ellis wanted to be sure that my drive back to New York City was still in daylight. Each visit was an experience in itself, and the “time machine” worked every time I went through his door.

Now, to relate the story of the Robison Sale in January 1979. Ellis Robison set himself a goal of obtaining one coin each of those minted by the United States Mint from 1793 to date, including mint marks. He wanted coins that graded from Very Fine to Mint State (or Proof if available), but he liked the fact that the coins he desired were made for circulation, for he was able to envision who might have had it before him.

The first Robison Collection of U.S. Gold Coins included the following highlights:

- GOLD DOLLARS: A virtually full set, including 1855-D, 1856-D, 1861-D, 1870-S and 1875

- QUARTER EAGLES: 1796, 1797 (both types), 1808, l841, 1843-C, 1848 CAL, 1856-D, and 1875, making almost a full set

- THREE DOLLAR GOLD: 1854-D, 1875, 1876… virtually complete

- HALF EAGLES: 1795 Small and Large Eagles, 1796, a long run from 1807 to 1837, 1861-D, and 1929

- EAGLES: An almost complete set from 1795-1804, 1858, 1907 Rolled and Wire edges, plus other scarce and rare dates from the 1920s and ’30s

- DOUBLE EAGLES: An almost complete set highlighted by the 1862 Proof, 1870-C, 1881, 1882, 1883, 1885, 1886, and 1887, together with the 1920-S, 1926-D, 1927-S, 1930-S, 1931, and 1932

Overall the sale contained 1,042 Lots, making it one of the most complete offerings of gold in the year 1979.

The Sawhill Collection

MARCH: The celebrated collection of ANCIENT ROMAN AND GREEK COINS, CONSISTING OF 1499 LOTS. AN IMPRESSIVE AND EXTENSIVE COLLECTION, FORMED BY DR. JOHN A. SAWHILL.

This collection was given to and sold by James Madison University, and was considered a major sale. The centerpiece of the collection was the 265 coins (out of 94l lots) that came from the Massachusetts Historical Society that Dr. Sawhill bought in 1971 at another Stack’s Auction. Sawhill taught ancient history, and his coins represented the story of money during those times.

Many of the coins from the Sawhill Collection reside in major collections even today.

Other Important Public Auctions

Stack’s was selected by the Charlotte Mint Museum to sell duplicate gold coins from the Charlotte Mint and others in order to refurbish and rebuild the mint museum with new and more effective exhibits. Many institutions that are given coins use what is appropriate for exhibition and sell off the duplicate items in order to raise funds. The sale had some 800 lots and attracted many collectors of Southern mint gold.

The museum had about 800 gold coins, many from their own original mint, established in 1838 and which ran until 1861 and the start of the Civil War. They maintained one specimen of each design and mintage, plus varieties that they had, and the museum was pleased that we provided them a way to sell the coins so successfully. The offering was somewhat larger than the one we sold in 1962 in our noteworthy and exciting George O. Walton Sale.

MAY: Stack’s was selected, once again, to serve as the official auctioneer for the Metropolitan New York Numismatic Convention, which we served for many years. The sale of some 1,123 lots offered a wonderful selection of classic U.S. coins in all metals, as well as paper currency and a large offering of ancient and foreign gold, silver and copper issues. The sale was designed around the theme “Something for Everyone”, and attracted many hundreds of collectors as active bidders.

JUNE: GOLD COINS OF THE UNITED STATES. This collection featured 848 lots of rare and choice gold coins, an addendum of early U.S. rolls and early proof sets issued prior to 1915, and rare patterns.

The sale was highlighted by the extremely rare St. Gaudens 1907 Ultra High Relief $20 Double Eagle, almost unique in public action. This coin alone attracted many gold buyers. The audience applauded the price of some $220,000, which was a record for a single gold coin during this period.

The Sale also boasted 1920-S and 1930 $10.00 gold, and in $20.00 gold an almost complete set including very choice 1854-O, l856-O, 1881-85 in proof, and almost all the rare date mint marks issued in the 1920s through the ‘30s. Since quality was a major factor for this consignor, he only bought what pleased him, and was willing to wait for examples that were exceptional.

JULY: A UNIQUE JOINT VENTURE. I have written about the Apostrophe Auction(s) previously, as well as earlier in this article. David Alexander has also written an exceptional history of the sales for CoinWeek.

SEPTEMBER: Just after Labor Day, we offered a large, specialized collection of high-quality and rare colonial coins of the United States formed by Donald S. Fleischer, a noted collector at all of the numismatic clubs in the New York metropolitan era. He worked for decades with collectors in the New York area, which gave him the opportunity to collect and learn about this magnificent series. The sale contained hundreds of colonial coins and currency, and had some classic early American issues to support the offering. A large group of collectors attended the sale.

OCTOBER: Another great numismatist passed away in 1979.

The family of Martin F. Kortjohn awarded us with the sale of his extensive collection, which yielded 1,235 lots of outstanding and quality coins of the United States. Martin was a dedicated numismatist, who collected for well over four decades and was extremely active in starting local coin clubs like the Bronx Club and the aforementioned New York Metropolitan Club. He and a number of friends–including Harold Bareford, Ed Hessberg, Vernon Brown, and Ray Gallo–met almost weekly at Stack’s to discuss their latest acquisitions and trade duplicates. Martin also served on many committees for the American Numismatic Association (ANA) and was Chairman of the annual ANA convention held in New York in 1952. Kortjohn was a great asset in developing new collectors.

His auction sales catalog became a source to determine many pedigree coins.

DECEMBER: In our desire to serve all collectors, the regular guy as well as those who amassed World Class collections, we offered a group of outstanding consignments assembled during the summer and fall in our December sale. We wanted to get them to market quickly due to the sudden collapse of the silver market (almost 80% of its value) of months earlier. It was a very hard market to determine, as so many collectors also speculated in silver.

Overall, the year was a very successful and gratifying one for us, since we were able to work with collectors to build their collections and increase those same collections’ values. And we tried to console those who lost money on the silver market

* * *

Links to Earlier Parts:

1928-35 | 1935-45 | 1945-51 | 1951-52 | 1954 | 1955-56 | 1957 | 1958-59 | 1960 | 1961-62 | 1963 | 1964 | 1965 | 1966 | 1967 | 1968-69 | 1970-71 | 1972 | 1973 | 1974 | 1975 | 1976 | 1977 | 1978