In the second half of the year-end roundup, collectors and dealers consider how the coin market is affected by increased internet browsing, decreased face-to-face interaction, and a new president

Numismatic Market Review by Jim Bisognani – NGC Weekly Market Report ……

I am sure that I am not the first (nor the last) to do so, yet let me wish all of my fellow Coindexters a happy 2021! With vaccines finally reaching the populace, there is concerted hope that the deadly pandemic that has effectively devastated our lives, economies and placed otherwise mundane daily activities on hold for nearly a year will finally be under control.

A new US president soon taking the oath of office will not be a “cure-all” here at home, but there is hope that a change for the better is at hand. Through all this unprecedented and historic upheaval to our daily lives, measures have been adopted and adapted for our safety, and we are better for it.

As I touched on in my last installment, the rare coin market and collectibles segment as a whole remains hotter than the equator at high noon.

The metals are simmering too, exhibiting strong momentum early into the new year with both gold and silver revisiting levels seen in late summer. Platinum, the strategic and rare white metal, has quietly muscled to heights last witnessed four and a half years ago.

The metals are simmering too, exhibiting strong momentum early into the new year with both gold and silver revisiting levels seen in late summer. Platinum, the strategic and rare white metal, has quietly muscled to heights last witnessed four and a half years ago.

This week would normally have been the scene of the exodus of many snowbird collectors and dealers migrating to the Sunshine State for the winter FUN show. Yet due to COVID-19, this bellwether venue has been canceled. The Long Beach Expo slated for next month has also been nixed. There is still hope, however, that some semblance of order will return that will allow major venues to return in a modified attendee-safe version later this year. Until then, online major auctions continue to be the supply chain.

Well, enough of this drivel. If you enjoyed Part 1 of my year-end report, you are in for a new year treat — It’s time for my 10th Annual NGC Year in Review Part 2. Take it away…

With many employees relegated to working remotely from home, there has been a huge increase in internet browsing, shopping, etc. Numismatic and related websites have registered an enormous increase in traffic, too. Has this activity resulted in more tire kickers or business?

John Brush – President of David Lawrence Rare Coins

Far more business. We’ve actually seen far fewer tire kickers, but maybe that’s due to our focus on collectors and not dealers.

Ian Russell – President and Owner, GreatCollections Coin Auctions

Our website traffic, unique bidder count, new bidders and basically every statistic has increased since March. It’s definitely resulted in more business and more inquiries about 1969-S Doubled Die pennies that are clearly not the major Doubled Die error. (Interesting side note, we’ve handled three new discoveries in 2020 of this particular Doubled Die, including one that recently sold for $48,874).

Charles Morgan – Editor of CoinWeek

Charles Morgan – Editor of CoinWeek

Good information never goes out of style. One of the things we have tried to do is to take more risks in terms of subject matter and finding ways to engage collectors. The past year has seen us publish some of our most adventurous articles and multimedia programs.

Bob Green – Owner of Park Avenue Numismatics

We’ve worked our tails off making sure we bring a good buying experience to our customers via our website at parkavenumis.com and auction.parkavenumis.com Sales are up and we have a lot of long-term repeat buyers.

Jeff Garrett – Founder of Mid-American Rare Coin Galleries, Inc.

Our volume of online sales has increased tremendously, and most rare coin dealers with an online presence have reported the same. Collectors are very active and the results of most public auctions can verify this.

Brian Hodge – Partner of LMRC

Tire kickers often come with the territory of expanding online, but you take all the good with the bad, and the response for us has been overwhelmingly positive.

Ira Goldberg – Co-Owner of Ira & Larry Goldberg Auctioneers

The answer to this is both. More new clients for sure, but more questions and, of course, more scam artists.

Lianna Spurrier – Creative Director of Numismatic Marketing

Most of our business has come from connections within the industry, whether it’s someone we met at a show, worked with before, or who was referred to us by one of our other customers. We’ve had a few inquiries from people who found us online, but most of those haven’t amounted to anything.

Q. David Bowers – Numismatist, Author and Co-Founder of Stack’s Bowers Galleries

Q. David Bowers – Numismatist, Author and Co-Founder of Stack’s Bowers Galleries

There are always “tire kickers” as people like to look around to assess the possibilities. This is desirable and is part of the spectrum. Many such people become buyers.

Kevin Lipton – Owner of Kevin Lipton Rare Coins

Overall, the activity has been very positive, and we are selling a large amount of product through our “rare coin list”.

As the majority of coin business is being conducted via US mail, FedEx, etc., are you finding any resistance or reluctance from those customers wanting to buy or sell larger collections?

Ian Russell

No, we have not found any resistance, since we can arrange for a Brink’s truck to pick up or deliver collections and be fully insured up to almost any amount.

Jeff Garrett

Buyers seem to have no problem with receiving coins via US Mail or FedEx. A lot of business is conducted that way every day. Sellers, however, do show reluctance and understandably so. Many have no idea what they have and are nervous sending the coins by mail or FedEx. This has been one of the reasons for the disrupted supply chain in the rare coin market. Slowly, more sellers are risking a trip to a local coin shop and or arranging for buyers to visit them. I have bought a few large collections in recent weeks that required travel.

Charles Morgan

The dealers we are in contact with find it hard to source nice material at a rate even with demand. Fact is, this is a strong coin market.

Q. David Bowers

We here have not felt any adverse effect. Larger collections as well as rarities are usually sold this way.

John Brush

I think that we’ve seen reluctance by collectors to sell “bulky” collections of Proof and Mint Sets, etc. That kind of material doesn’t move well through the mail as it’s so difficult to ship, but with our focus being primarily on certified coins, we’ve allowed our customers to use our private insurance, and it’s made it easier for customers to ship coins to us. In today’s world of the internet and with so many delivery options, shipping coins isn’t quite as daunting as it was previously.

Bob Green

Bob Green

We’ve streamlined the selling process for our customers. We do all the heavy lifting regarding the logistics of shipping, and we expedite the process. Most deals are delivered via FedEx and are settled up within 48 hours with wires or overnight settlement checks. Collectors have grown to rely on our timely process. Our website offers easy details at www.parkavenumis.com/how-to-buy-or-sell-gold-coins.

Kevin Lipton

Fortunately, this has not affected our business at all.

Ira Goldberg

There is some reluctance from older collectors, but most clients understand the issues arising from COVID-19 and are accommodating.

Brian Hodge

None for us. Perhaps a little lost business from folks who feel more comfortable delivering their coins at a coin show, but people have been very accommodating overall given the circumstances.

The pandemic has effectively shut down the coin show circuit. With limited physical interaction between you and your clients, how have you been able to purchase and replace inventory?

Bob Green

Bob Green

We are a member of all of the dealer networks and private online groups of dealers such as Certified Coin Exchange and Coin Dealers Helping Coin Dealers. You’d be surprised how many deals go down on a daily basis among these trusted platforms. We broadcast our needs as well as our coins for sale to hundreds of the top dealers in the nation.

Brian Hodge

An awful lot of text messages and emails! Early on, I took on a tech-savvy approach to doing business. I buy and sell perhaps tens of millions of dollars annually via text and email alone.

Ian Russell

I’ve found that I’m spending more time on the phone with clients and friends. Although we attend all major shows, it’s only a small part of our business. We’ve missed seeing so many people at shows though. We do not miss the coin show fast food or delayed flights!

John Brush

It all starts with relationships. When you buy a wide variety of material, your checks are good and you handle things efficiently, it makes it easy for folks to ship packages to you. Our number of incoming packages from collectors and dealers has multiplied dramatically. While others have gotten back into traveling these days, we’ve declined to do that until things improve, and we thought that it would eventually become an issue, but we’ve been able to sustain our business and even grow it during this time.

Q. David Bowers

We miss the shows, but activity remains dynamic. No worries here.

Lianna Spurrier

We have been very fortunate that our company was never intended to rely on face-to-face meetings. We haven’t been able to do much video work, but other projects have been relatively unhindered. I’m sure we could have made some wonderful connections this year had we been able to attend shows as planned, but those will have to wait for another year.

Kevin Lipton

Long-term relationships as well as our ability to pay “on the spot” has kept our inventory constantly turning over.

Jeff Garrett

Great question! Business is about relationships, and over 40 years, I have developed a lot of good contacts. We work the phones daily looking for material. I have also been participating more actively in auctions around the country.

Ira Goldberg

Yes, the invention we use is the telephone!

For the average collector looking to spend $1,000 or under, what US or World coin or coins would you recommend?

Ian Russell

Circulated Seated Dollars and Half Dollars. There are so many great examples under $1,000 that are real history. And they don’t turn up on the market very often. It’s a long-term goal of mine to collect Seated Dollars in VF condition.

John Brush

Putting together a set of Buffalo Nickels, Mercury Dimes, or Standing Liberty Quarters. From a collecting perspective, these are incredibly fun groups to put together in any grade, and it kind of brings me back to my roots as a collector. You can never go wrong with doing something that you enjoy!

Putting together a set of Buffalo Nickels, Mercury Dimes, or Standing Liberty Quarters. From a collecting perspective, these are incredibly fun groups to put together in any grade, and it kind of brings me back to my roots as a collector. You can never go wrong with doing something that you enjoy!

Lianna Spurrier

My company doesn’t deal with buying or selling coins, but I can answer this from a personal perspective as a collector myself. My recommendation would be to look into Japanese bar money, not for great investment potential but for the opportunity to own some incredibly interesting, unique pieces from the 1800s. It’s a series of rectangular pieces issued from 1599-1869 in Japan, and most of the issues from the 1800s are pretty inexpensive.

They’re pretty difficult to research, but I’ve put together a website to help new collectors get their foot in the door — rectanglecoins.com. The cheapest types (Kaei isshu) can be found for around $20 raw, with the heftier silver ichibu averaging around $50 raw or $100-$150 graded in MS. Rarer types or top pop pieces will edge closer to the $1,000 mark.

Q. David Bowers

A great way to start is to buy a common-date CC Morgan Dollar in MS 65 plus a run of golden dollars 2000 to date, and carefully study each. This will open the door to further study and research.

Charles Morgan

Charles Morgan

$1,000 or under? Buy ancients. $2,500 and up? Any US coin before 1838.

Bob Green

Many US Type coins can be acquired in that range in MS 63-MS 65 grade, and are an enjoyable search for attractive coins online.

Brian Hodge

I LOVE world coins this year. This area of the market has seen explosive growth. When you can add a high-grade, several hundred-year-old Ducat for less than $1,000, for instance, it just seems to be a no-brainer!

Kevin Lipton

I would start collecting Proof 65 3C Nickels and Liberty Nickels. Both sets are obtainable and just too cheap.

Jeff Garrett

MS 65 Type 3 Gold Dollars are great buys at today’s prices. I also like Gem $2.5 Liberty gold coins.

Ira Goldberg

For the average collector looking to spend $1,000 or under, stick to silver crown size coins of the World and US 90% silver coinage.

James Sibley – Collector

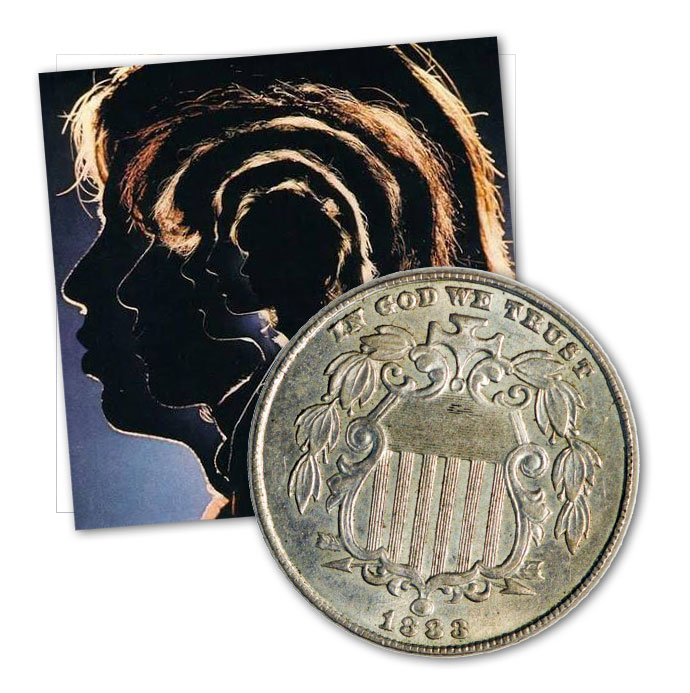

More than a few laugh at me when I say this (well, at least politely smirk), but I think one of the best values today are Proof nickel three-cent pieces and Shield nickels. You can buy most dates certified MS 66 or MS 67 all day long for $500 to $900. Now, I admit to being a James Longacre fan, but I also just bought the Rolling Stones’ Hot Rocks: 1964-1971 album too, so please consider the source.

More than a few laugh at me when I say this (well, at least politely smirk), but I think one of the best values today are Proof nickel three-cent pieces and Shield nickels. You can buy most dates certified MS 66 or MS 67 all day long for $500 to $900. Now, I admit to being a James Longacre fan, but I also just bought the Rolling Stones’ Hot Rocks: 1964-1971 album too, so please consider the source.

In your opinion, how will the Biden presidency affect the numismatic market?

Charles Morgan

We’ll probably be better off than we were in the last year of the Trump presidency… Many collectors are small business entrepreneurs, and they’ve been absolutely let down by the government in the past year. Gold and the collectible coin market also typically perform well in less-friendly tax environments. I think the fear of where the government will be heading policy-wise in the coming years is overblown. NEVER let someone sell you coins as a political play. It’s risky and dangerous, and most of those that use that angle aren’t your friends.

Bob Green

We don’t really like to talk politics, but historically metals and hard assets do seem to attract folks concerned with inflation due to Democratic spending. It’s not unreasonable to think this historical pattern of increased buying activity as a hedge against potential inflation will not continue, boosting our market again. I’ve seen it time after time for many decades.

Q. David Bowers

I don’t think the current occupant of the White House has ever had any effect on the coin market.

Brian Hodge

It probably helps a little as people look for alternative arenas to place their money.

Ian Russell

I didn’t believe the outcome of the recent election would affect the numismatic market one way or another. The coin market has continued to be strong, and since the distraction of the election is over, I think more people are focused on coins again.

John Brush

Well, gold has dropped a bit, but it’s really too early to tell. It’ll certainly be an interesting transitional period over the next few months.

James Sibley

I have little doubt that taxes are headed in only one direction, and a fast and furious skyward ride it will be [at least for the top 10%]. So… will the folks who don’t bat an eyelash writing a six- or seven-figure check for a coin think twice when a portion of their wealth is in the process of being redistributed? Who knows. It will suck liquidity out of the pockets of anyone who is currently chasing the finest of the fine.

Contrarily, I believe that the greatest reason for the hot market we’re seeing today in better coins, notwithstanding the pandemic putting more time in our hands to pursue our hobby, is the desire to shift money to hard assets, knowing that hyper-inflation can’t be too far off (anyone remember the late 1970s?).

Kevin Lipton

I think premiums on all different gold products will rise dramatically as the conservative right runs to precious metals to “protect themselves” from the liberal left.

Jeff Garrett

The biggest issue will be the lingering hangover from massive federal spending on COVID-19. As long as interest rates stay low, alternate investments should continue to shine. Tax increases by Biden could have a negative impact on wealthy collectors if they feel like they have less to spend on coins.

Ira Goldberg

Your last question regarding the Biden presidency is the most interesting. I think that what the Dems are proposing, to tax the hell out of anyone making $400K or more and raising taxes on the rich, is going to hurt the buying of coins. People do not need coins and if the philosophy is to make the rich pay the price, Churchill was right in saying: “You don’t make the poor richer by making the rich poorer.” Poor people do not buy coins, certainly not expensive coins.

With that said, the “trophy coins” will probably keep going up due to the simple truth of supply and demand. On the other hand, if the US keeps spending, borrowing, and printing money — trillions more during the Biden administration — gold and silver will explode and go much higher. I do know one thing, gold has been a measure of wealth for going on 3,000 years and this is not going to change in my lifetime.

* * *

Thanks again to all of my insightful, expert friends for making this annual exercise so much fun and a valuable resource for Coindexters everywhere.

Until next time, be safe and happy collecting!