By Dr. Richard S. Appel – UniqueRareCoins.com ……

There was a time when Brilliant Uncirculated (BU) rolls of coins were available in large quantities. Coins of every date and denomination, minted in the 1950s, ’40s and even the ’30s could be acquired with little or no difficulty.

But that was 50 years ago. Today, the vast majority of those rolls, squirreled away decades ago by collectors and investors, have been either melted or broken up and used as single coins. The few choice rolls that survive likely number only two to three percent of what existed in 1964.

Yet old habits die hard–most numismatists still believe they exist.

Yet old habits die hard–most numismatists still believe they exist.

Therein lies the opportunity for the astute collector or investor. Because for the vast majority of dates, their prices do not nearly reflect their rarity.

The Boom Years

1963 and 1964 were boom years for the Brilliant Uncirculated coin roll market. The price of the scarcer-dated rolls of Lincoln Cents, Jefferson Nickels, Roosevelt Dimes, Washington Quarters and Franklin Half Dollars had risen for several years. And as strong as that demand was, their price increases further intensified as the result of the rising price of silver.

In 1964, the silver price rose sharply above its earlier $1.29 price. Uncirculated silver coins contain about 0.72 ounces of pure silver for each dollar of coins. Thus, when silver sells above $1.39 an ounce ($1.39 x 0.72 = $1.00), the metal value of the coins are worth more than their face value.

As the silver price continued to advance, it drove up the value of all circulated and uncirculated silver coins. This led to a scramble by the general public to pick out as many silver coins from circulation as possible. The public then sold them to coin dealers, who in turn resold them to smelting companies. The coins were then melted for their silver content, and everyone made money in the process. Mass melting of silver coins continues to this day.

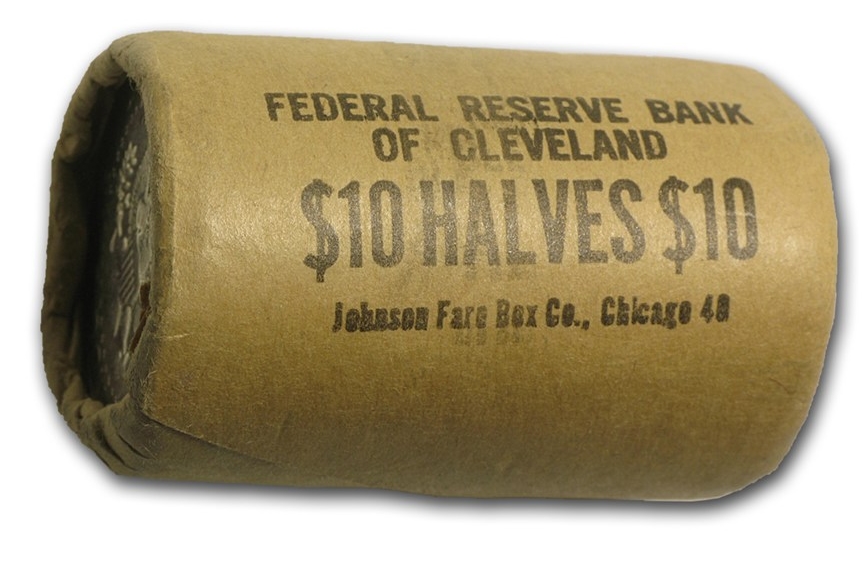

At the beginning of that period, most common Brilliant Uncirculated rolls of silver coins were available in quantity and traded at slightly above face value. Common $5.00 rolls of dimes were worth about $5.25, and $10.00 quarters and half dollar rolls sold for about $10.50. Then after a short time, rising silver caused these rolls to nearly double their earlier prices. Roosevelt Dime rolls sold for about $10.00 and Washington Quarters and Franklin Half Dollars sold for $20.00.

At the beginning of that period, most common Brilliant Uncirculated rolls of silver coins were available in quantity and traded at slightly above face value. Common $5.00 rolls of dimes were worth about $5.25, and $10.00 quarters and half dollar rolls sold for about $10.50. Then after a short time, rising silver caused these rolls to nearly double their earlier prices. Roosevelt Dime rolls sold for about $10.00 and Washington Quarters and Franklin Half Dollars sold for $20.00.

This drove great excitement throughout the rare coin market, but especially for Brilliant Uncirculated coin rolls.

BU rolls had been experiencing a Bull Market of their own during the previous few years. As the price of silver dimes, quarters and half dollars rose, collectors and investors who earlier acquired uncirculated rolls became even more impassioned. Their emotions swelled, as did their profits. Finally, any and all Brilliant Uncirculated rolls were worth a premium over their prices of only a few months earlier.

The enormous new demand and far higher prices for silver coins, spilled over to the lowly penny and nickel rolls. Their prices rose in tandem with the BU dimes, quarters and half dollar. Collectors, investors and speculators began scouring coin shops, coin shows and auctions for rolls of Lincoln Cents through Franklin Half Dollars. Brilliant Uncirculated rolls became the craze of the rare coin industry. The recognition that a nice roll of uncirculated coins would one day be broken up and its coins sold individually became the mantra of the day; the market entered a manic state.

When that occurred, everyone was convinced that large profits would accrue to the owners of any Brilliant Uncirculated roll.

Prices rose dramatically as 1964 wore on. It only took several months for uncirculated rolls of 1955-S cents and 1960-D small date cents to rise from $10.00 to $45 and $3.50 to $20.00 respectively. They were both available at banks only a few years earlier for $0.50 a roll. Numerous other dates similarly increased multiples in price from the year earlier.

The Boom Goes Bust

The Boom Goes Bust

Those heady days in 1964 did not last long.

Prices declined when many uncirculated rolls came out of hiding and entered the market. As for today, I believe that the overwhelming majority of early Brilliant Uncirculated rolls that existed in 1964 are gone.

Three primary factors are responsible for this. The great melting of silver coins consumed most of the uncirculated silver coin rolls. Next, those that escaped joined the Lincoln Cents and Jefferson Nickel rolls, and were broken up for single coin sales. Finally, attrition and the passage of time. More than 50 years have passed – ample time for these events to run their course.

So now, when someone wants or needs some Choice Uncirculated rolls of most pre-1965 dates, they either have a long wait ahead of them or they go begging.

BU Silver Rolls First to Disappear

The demand for silver pushed its price to the $2.50 per ounce range in 1964. It had earlier traded at $1.29, or sometimes less. A $2.00 to $2.50 silver price creates a substantial profit for the holders of silver dimes, quarters and half dollars. The result was the beginning of the massive melting of our silver coinage, both circulated and uncirculated.

In 1973, the price of silver again began to substantially rise. By late 1973 it passed $2.00 an ounce, and never looked back. It has since traded between $3.50 and $52.50 an ounce. The uninterrupted melting of silver coins that began in 1964 continues to this day. During this 50+ year period, the vast majority of pre-1965 uncirculated silver coins met their fate in the melting pots.

Choice uncirculated silver coin rolls were rarely spared during this multi-decade-long destruction of our silver coinage. This was due to the lack of demand for uncirculated rolls at that time, which kept their prices low. Other than for brief periods, they could seldom be sold for more than rolls of “junk silver” – circulated silver coins – so they were all melted together.

Lincoln Cent and Jefferson Nickel Rolls

Demand for uncirculated single coins from the 1930s through the ’60s has seldom waned over the last 50 years. Thousands upon thousands of collectors desired every date and mint-marked Lincoln Cent, Jefferson Nickel, Roosevelt Dime, Washington Quarter and Franklin Half Dollar as they worked to complete their collections. Roll upon roll of these coins were broken up for their individual coins to fill this need.

Today, few intact BU rolls of these coins remain to satisfy the demand of present and future coin collectors.

I believe that prices for most of these BU coin rolls have remained suppressed because of nostalgia. Dealers and collectors remember when multi-roll and even bag quantities of many early dates were easily obtained. Fifty years ago most coin dealers, collectors and investors believed that we’d never run out of these beautiful uncirculated rolls of coins. However, they didn’t factor in the future unknowns. The effects of the great silver coin melt, new collectors entering the market, and the needs of mass marketers would work to make these once-common coins quite scarce, and some rare.

I believe that prices for most of these BU coin rolls have remained suppressed because of nostalgia. Dealers and collectors remember when multi-roll and even bag quantities of many early dates were easily obtained. Fifty years ago most coin dealers, collectors and investors believed that we’d never run out of these beautiful uncirculated rolls of coins. However, they didn’t factor in the future unknowns. The effects of the great silver coin melt, new collectors entering the market, and the needs of mass marketers would work to make these once-common coins quite scarce, and some rare.

Numerous companies through the years have consumed untold Brilliant Uncirculated rolls of these coins. They took what they could find in the coin market, broke them up, and used the coins therein contained to fill their sets to sell to collectors.

If I am correct, the time is approaching when coin dealers and collectors will recognize that many supposedly-common Brilliant Uncirculated rolls are actually scarce if not rare. When that time arrives, I believe the 1963-1964 experience will be repeated. Unlike the boom years, however, they will discover that many dates do not exist in important or needed quantities. Then another scramble will occur and, I believe, the tide will rise, carrying the entire pricing landscape of these vanishing Brilliant Uncirculated rolls far higher with it.

Disclaimer: This article is written by Dr. Richard S. Appel, editor and publisher of the former Financial Insights newsletter. It is made available for informational purposes only. He makes every effort to obtain information from sources believed to be reliable and to present correct ideas and beliefs, but the accuracy and completeness of his work cannot be guaranteed. You should thoroughly research and consult with a professional investment advisor before making any investments based upon the contents of this or any of Dr. Appel’s commentaries. Use of any information contained herein is at the risk of the reader without responsibility on our part. Dr. Appel does not purport to offer personalized investment advice and is not a registered investment advisor.

Copyright 2016 by Dr. Richard S. Appel. All rights are reserved. Parts of the above may be reproduced in context for inclusion in other publications if Dr. Appel’s name and company are also included for credit. Dr. Appel is a rare coin consultant for his company UniqueRareCoins.com.

Photos Used with Permission and supplied by APMEX Inc

I was not around in 1963-1964 but know of this speculation. I don’t believe it will be repeated except temporarily as in the past because it is exactly that, speculation. Speculation is not collecting and collectors do not “collect” unopened rolls except as a speculation.

I see no reason why collectors actually care for these rolls but only the quality of the single coins in it. Moreover, they only need one (or maybe a few) for their set, not 20 to 50. Speculators may still care but ultimately, these coins still have to be sold to real collectors because they have no value above bullion or face to anyone else.

Taking into account this prior hoarding, when I look at the TPG population counts, I presume that the actual survivors across the grade distribution are an undefined multiple (in many instances a large one) to the number recorded. None of these coins are remotely scarce, only “grade rare”.

If the demand for these coins in the higher grades is so much greater than the current population counts, my assumption is that more coins will be graded. But except for the highest grades (usually a 67 but sometimes a 68), the price level is “low” under the US price structure which is why it hasn’t happened. .

There is no reason to believe that any roll scarcity will lead to a permanently higher price level unless the collector demand for the coins in them also substantially increases. Considering that these coins are already the most widely collected and how common they are, what reason is there to believe that the collector base will increase enough to realize this outcome?

Bunch of clap trap….