By Jeff Garrett for Numismatic Guaranty Corporation (NGC) ……

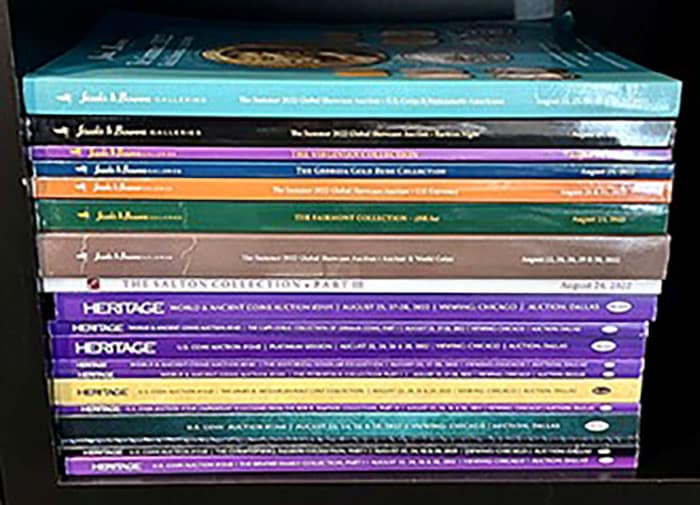

Each year about this time (leading up to the ANA World’s Fair of Money), Heritage Auctions and Stack’s Bowers Galleries send their catalogs for their summer auctions. This year’s editions feature over 20 separate catalogs covering ancient and world coins, colonial coinage, early copper coins, regular issue US coins, paper money, tokens, and medals. Several major specialty collections are being sold, with hundreds of six-figure-plus coins as well as a few multi-million-dollar coins offered. The combined sales this year will easily surpass $100 million.

Each year about this time (leading up to the ANA World’s Fair of Money), Heritage Auctions and Stack’s Bowers Galleries send their catalogs for their summer auctions. This year’s editions feature over 20 separate catalogs covering ancient and world coins, colonial coinage, early copper coins, regular issue US coins, paper money, tokens, and medals. Several major specialty collections are being sold, with hundreds of six-figure-plus coins as well as a few multi-million-dollar coins offered. The combined sales this year will easily surpass $100 million.

Like most of those who ponder the state of the rare coin market, the obvious question is: How can the market absorb so much material at once? The question is especially pointed this year as the stock market has slipped, cryptocurrencies have fallen sharply and the general public is being stressed by the rising costs of inflation.

Despite concerns by some observers, the rare coin market is much larger than many realize. The collector coins in the plethora of sales above will undoubtedly perform well, especially those needed for set registry competition. In a few weeks, the numismatic press will be singing the praises of the many auction records that were broken.

The major rarities that will sell for six and seven figures are finding homes with a new segment of the market — billionaire collectors.

One of the most interesting and impactful developments in numismatics in recent years has been the activity of a few incredibly affluent collectors. These collectors can spend more on one coin than your average collector spends in a lifetime. At least three or four of these mega-collectors have spent over $100 million on their rare coin collections in the last few years. We have all read the headlines about how rare coins at the high end of the market have been selling in record numbers and at record prices.

These so-called mega-collectors are not just buying million-dollars coins. They are actively building sets of United States, world, and ancient coins. They want the finest available and will spend to get them. These collectors have been very fortunate in the last several years as quite a few legacy collections have been offered at auction. These are collections that individuals spent many decades building. Collections such as that of Eric P. Newman saw coins offered that had not been available since the 1940s. Many individual coins in amazing condition were sold for stunning prices as a result of competition among these super-rich collectors.

Everyone likes to know what so-called “smart money” is doing in the way of investments. Stock market pundits listen and parse every statement from the “Oracle of Omaha”, Warren Buffett, looking for clues to his investment strategy. There is little doubt that these individuals who have invested vast sums in the rare coin market are “smart”. I have met a couple of these folks, and I can safely state that they are driven, super smart, and think long-term. The question is: Why have they invested so heavily in the “hobby of kings” — numismatics?

After speaking with one of these collectors, and others who know them, one common theme is a love of history. All seem to really appreciate the tangible links to history that numismatics provides. Whether it is a coin issued by Alexander the Great or a coin that had the personal involvement of George Washington, the historical aspect provides a strong magnet of interest. Rare coins are closely tied to many of the most important historical milestones of our country. Also, the financial history of our nation is closely reflected in these artifacts as well, which, for obvious reasons, is of interest to the extremely wealthy.

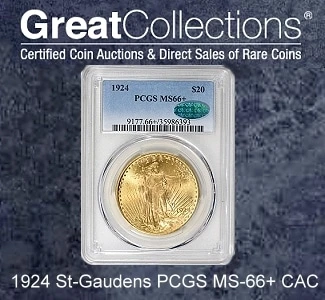

There is little doubt that these individuals think rare coins are an underpriced asset class. It would be hard to imagine anyone spending these huge sums on rare coins unless they thought it was a good investment. They may be buying the coins due to a love of history, but like all serious collectors, they hope their financial commitment to the hobby will prove to one day be a great investment.

There are ample reasons to think rare coins are underpriced at current levels. Truly great coins sell for millions of dollars, but truly great art sells for hundreds of millions. One super-rich collector stated that he could purchase a world-class coin collection, but a world-class art collection is beyond the reach of even the average billionaire. It’s an interesting perspective that only the super-rich would ponder.

I believe that one of the biggest factors in the interest in rare coins of the super-rich has been the incredible increases in net worth among the wealthy. The stock market, real estate, and business, in general, are at all-time highs in many cases. One wealthy collector stated to me that he was selling assets that he thought were overpriced and buying assets that he thought were underpriced — rare coins.

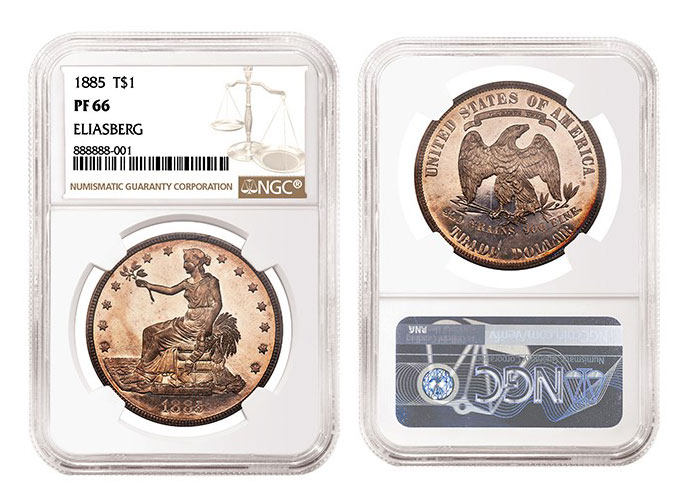

Finally, as incredible as it seems, these collectors also like competing with one another for having the best sets in the set registry programs. One collector’s stated goal is to surpass Eliasberg as the No. 1 collection of all time. This is ambitious, to say the least, but there is little doubt about his commitment. When “top pop”, finest-known examples of even mundane coins show up at auction, the prices realized can stun everyone. These serious collectors love the competition and recognition that set registry collecting provides.

The average collector may think this has little to do with their collecting activity, but as stated above, it’s always good to observe the activity of “smart money”. The gigantic sums these collectors have infused into the hobby in recent years have impacted nearly every part of the rare coin market. Many wonder how the rare coin market would look if these folks had not fallen in love with coins. I hope their investments prove to be wise, and other wealthy individuals follow their lead.

* * *

If Warren Buffet ever expresses an opinion on coins as “investments”, it will be the opposite of this article. His views on gold are well known and coins have even less practical utility.

There is no analogy between any coin and the type of art inferred in this article. There is also no basis to claim coins are undervalued versus this unspecified art either, as it’s an invalid comparison.

The art inferred here is unique and typically with a cultural appeal which no coin possesses. By unique, I am not referring to date rarity either, as to the non-collector this is irrelevant other than the impact on the price.

The coin market isn’t a viable alternative to “mainstream” asset classes. The “market capitalization” of all “investment” candidate coinage is a low to tiny fraction of (the largest) individual large cap stocks. Any attempt to further financialize coin collecting (what’s actually being discussed and hoped for in this article) at any meaningful scale would send the prices soaring out of the reach of actual collectors, as opposed to financial buyers. Since only actual collectors derive any utility from coin collecting (not “investors” buying coins as “investments”), any sucess in doing so will be temporary.

Coin collecting is a hobby. A low proportion can and do make money but that doesn’t make it a compelling “investment” or a viable alternative to “mainstream” asset classes which actually serve a useful economic purpose, funding the provision of goods and services.

More generally, the primary if not only cause behind the record prices described in this article is an unprecedented global asset mania and the loosest credit conditions and lowest credit standards in human history. That’s the source of most “wealth” making these prices possible.

AF,

I’m not going to bother challenging any of your claims about rare coins. I will say that for someone who doesn’t believe in or like this hobby, you sure spent a lot of time bashing our hobby (in my case it’s my profession)

Hopefully your day gets better