by Louis Golino for Coin Week

If you enjoy collecting modern U.S. Mint coins, it is easy to be overwhelmed by all the choices available. Collectors frequently complain about how it is impossible to buy all of the Mint’s annual offerings unless one is very wealthy. But I have never understood why even a collector who specializes exclusively in modern coins needs every one issued by the Mint in a given year. It is far better to find a focus so you can build a collection, rather than an accumulation. Periodically a coin outside your main focus will attract you, but try as much as possible to stick with a specific focus. Doing so will allow you to enjoy your collection more thoroughly because it will encourage you to learn more about the coins, and your coins will be much easier to sell later if your collection has some coherence to it.

Since it is impractical to buy all the coins the Mint issues, or even in many cases to build a complete set a certain denomination, I like the idea of focusing on the lower mintage modern precious metal key coins within the American eagle and commemorative series. These offer the best long-term price appreciation potential of modern U.S. coins in my view. As new collectors enter the field and seek out the key coins, the demand for these limited-supply coins will increase.

Since it is impractical to buy all the coins the Mint issues, or even in many cases to build a complete set a certain denomination, I like the idea of focusing on the lower mintage modern precious metal key coins within the American eagle and commemorative series. These offer the best long-term price appreciation potential of modern U.S. coins in my view. As new collectors enter the field and seek out the key coins, the demand for these limited-supply coins will increase.

Try to get them from the Mint at issue price. The precious metal content offers good protection against the loss of a good part of your investment, at least if you believe as most people do that precious metals will continue rising in the future. The goal should be to pay no more than 50% over current melt if possible, but remember that modern precious metal collectible coins with low mintages usually spike in the first year or two after Mint sales end, and they tend to settle down before usually resuming upward price momentum later. But they rarely reach full price appreciation until more time has passed.

The 2008 gold Buffalo coins are a case in point. In 2009 and early 2010 prices were increasing every week for these coins, but then in mid-2010 prices began to moderate, and today some of these coins are less expensive than they were in 2009 such as the $5 (1/10th ounce) and $10 (1/4 ounce) coins. In addition to bearing one of the most beloved designs in coin history, the 2008 Buffaloes have certain advantages over the other Buffalo gold coins issued since 2006. The 2008 fractional Buffaloes are one-year only type coins, and the one ounce coins, especially the mint state coin, are the lowest mintage one-ounce gold Buffaloes. These coins have probably not yet peaked.

Some modern key coins have already reached price maturity and seen a price decrease in recent years like 1995 W proof-only American silver eagle, the key to the silver eagle series with a mintage of 30,125. But bear in mind that the discovery of the 2008 with reverse of 2007 mint state silver eagle has probably played a role in lowering prices of raw or PF-69 1995 W’s from $5,000 to $3,000 over the last five years or so. The 2008 with reverse of 2007, whose mintage is currently believed to be around 47,000, has also come down in price after spiking in 2008, except for MS70 coins whose prices have remained quite stable. I believe this coin is currently undervalued and offers good long-term potential since you can buy a raw or MS 69 coin for about $400 and the mintage is the second-lowest of the entire series. It costs about one-eighth the price of a 1995 W, but has a mintage only 17,000 higher, and the next key, the 2006 W burnished silver eagle, has a mintage of 466,573.

Some other “sleeper” moderns include silver and gold commemoratives issued in 1996. The 1996-D Paralympic coin, with a mintage of 14,497, is likely to remain the key to the commemorative silver dollar series since most commemoratives have sufficiently broad appeal to sell more than 15,000 coins, and is still very reasonable at about $300. The other 1996 Olympic dollars are the other keys (the High Jump, Tennis, and Rowing coins). These coins are today keys because at the time they were issued collectors were burned out on silver dollar commemoratives as so many were issued in the 1980’s and 1990’s, and few people bought the coins.

The 1996 Smithsonian $5 piece is the lowest mintage modern proof gold commemorative with 21,840 made, and it is a real bargain at its current price of about $500. The BU coin also has a very low mintage and is also undervalued when you compare it to other BU $5 coins with similar mintages that sell for twice as much or more.

The 1996 Smithsonian $5 piece is the lowest mintage modern proof gold commemorative with 21,840 made, and it is a real bargain at its current price of about $500. The BU coin also has a very low mintage and is also undervalued when you compare it to other BU $5 coins with similar mintages that sell for twice as much or more.

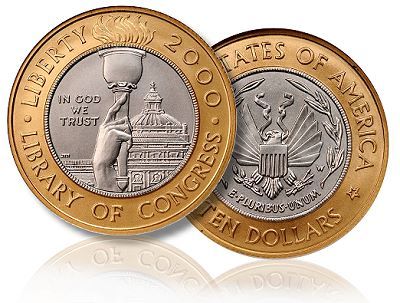

Another coin to consider is the 2000 Library of Congress $10 commemorative. It has one of most attractive Mint designs ever and is the only bimetal coin the US has issued. It also has a quarter ounce of gold and a quarter ounce of platinum. The BU coin runs $3,500 because of its low mintage, but the proof is still quite reasonably priced at $1100.

The 1997 Jackie Robinson $5 gold commemorative in BU is the key to the entire modern commemorative series as only 5,202 were issued. It has a modern and appealing design that depicts Robinson in three-quarter profile. It has dropped a little in price recent years from about $5,000 to about $3,500 probably because of larger trends in the economy and coin market, but is likely to do well long-term. Buy the proof, which costs $600, if the BU is too costly. It still offers good value because of the coin’s low mintage of 24,072, making it the second lowest after the Smithsonian coin.

Finally, within the American gold eagle series, the main keys are the 2008-W one-quarter ounce burnished coin, the lowest mintage of all the burnished eagles, with only 8,883 made, and 2007-W half ounce with a mintage of 11,455. These coins as well as several other issues from 2008 in burnished uncirculated and proof plus the 2008 burnished and proof American platinum eagles are all worth collecting. The key ounce coin, which is currently the 2008-W burnished at 11,908, is likely to be overtaken by the 2011-W once ounce coin, which so far has sold fewer than 3,000 examples probably because the Mint has issued so many coins this year. For the fractional denominations, the 2008 coins will remain the keys since the Mint has said it will no longer issue fractional burnished coins.

Louis Golino is a coin collector and numismatic writer, whose articles on coins have appeared in Coin World, Numismatic News, and a number of different coin web sites. He collects U.S. and European coins and is a member of the ANA, PCGS, NGC, and CAC. He has also worked for the U.S. Library of Congress and has been a syndicated columnist and news analyst on international affairs for a wide variety of newspapers and web sites.

Excellent article Louis!

Another aspect is looking at coins for a quality vs. quantity aspect. It is possible that there are modern coins that were produced in vast quantities; however, the quality of these coins could have been somewhat lacking. From a quality/grading perspective, some of these may be rare.

Please note that I do not refer to first strikes or early release as these are artificial slab rarities and not rare coin qualities.

Thanks a lot, Joe. And good point about quality vs. quantity. There are also coins which are not especially rare but which rarely come in good strikes like most S mint Walking liberty halves. If you have one that is a good strike, you have a scarce and desirable coin worth much more than what some price guide says.

I do like the AGBs, and the 2008 fractionals are especially beautiful. I normally prefer proofs, but the unc buffs are just so nice.

What are your thoughts on the 2009 UHR Gold Eagle? I know there were over 100K minted, but it is a one-of-a-kind coin. Also one of my favs. Hopefully the upcoming palladium coin will be just as nice or nicer when it is released.

The UHR is one of my favorite, if not most favorite, coins of all time. Its design, fact that it is a one-year type, and other factors should keep values strong. It’s a little like the 2001 Buffalo dollar. A lot were made, but the demand for them is very high.

Near the bottom of the article (in reference to platinum) it states: “The key ounce coin, which is currently the 2008-W burnished at 11,908, is likely to be overtaken by the 2011-W once ounce coin, which so far has sold fewer than 3,000 examples”

I am a little confused. The 2008-W burnished one ounce platinum coin sold a mere 2,826 coins, and according to various sources, the 2011, which is only available in proof, have exceeded 8,200 sold.

Could someone please verify?

I re-read and the text is confusing, but I understand. The numbers quoted are for gold (2011-W), etc. and not platinum. The reference to platinum in the former sentence threw me off. Please delete or ignore my former comment; I apologize for the confusion.

The longer I collect, the more I like the Unc varieties more than the Proof varieties. They just seem more natural.

I am also finding myself more interested in naturally toned coins. What’s up with that????