by Louis Golino for Coin Week

In the past three days (August 8-10) the price of gold has seen the largest percentage and dollar increase ever in such a brief period. Gold has surpassed the $1800 level as I write this article. This bullish trend shows no sign of abating any time soon. And an increasing number of banks and analysts who predict precious metals prices expect the price of gold to increase by another 50% by year’s end.

The cause of this gold rally is quite simple. Investors are fleeing other asset classes like stocks, which are in free fall, and are seeking the safety of hard assets. Current financial and economic turmoil has been exacerbated by the August 5 S&P downgrade of the U.S.’ credit rating and the slowing U.S. economy, which many people believe is headed for a double dip recession. Stocks are declining even faster than they were in the fall of 2008/winter of 2009 because of electronic trading.

The cause of this gold rally is quite simple. Investors are fleeing other asset classes like stocks, which are in free fall, and are seeking the safety of hard assets. Current financial and economic turmoil has been exacerbated by the August 5 S&P downgrade of the U.S.’ credit rating and the slowing U.S. economy, which many people believe is headed for a double dip recession. Stocks are declining even faster than they were in the fall of 2008/winter of 2009 because of electronic trading.

In addition, on August 9 the Federal Reserve took the unprecedented step of pledging to keep interest rates low for two more years and issued an unusually bearish statement on the outlook for the U.S. economy in the coming months. Gold does well in a low interest rate/weak dollar environment, which was a catalyst for the movement in gold on Tuesday and Wednesday. These trends should continue to support a rally in gold prices.

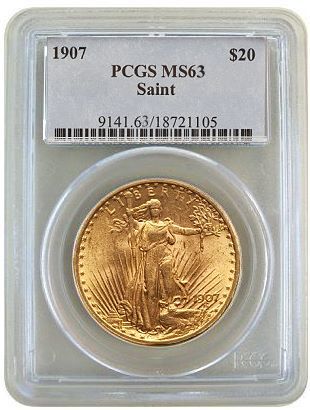

Those who followed my recent advice in this column (https://coinweek.com/news/featured-news/the-coin-analyst-inaugural-column/) to purchase pre-1933 generic PCGS and NGC graded gold coins have profited handsomely. After being in the doldrums for most of the past two years, the prices of these coins are now exploding even more than is the price of gold. Premiums have risen substantially and supplies of these coins appear to be tightening.

Those who followed my recent advice in this column (https://coinweek.com/news/featured-news/the-coin-analyst-inaugural-column/) to purchase pre-1933 generic PCGS and NGC graded gold coins have profited handsomely. After being in the doldrums for most of the past two years, the prices of these coins are now exploding even more than is the price of gold. Premiums have risen substantially and supplies of these coins appear to be tightening.

For example, many leading online numismatic and bullion gold dealers like Gainesville Coins (http://www.gainesvillecoins.com) and Provident Metals (http://www.providentmetals.com) are currently out of many types of pre-1933 gold coins. $10 Indians in MS63, which could be had for $1200 last year, are now selling for $1700 and more. $5 Indians in the same grade, which were about $1600 just a few weeks ago, are now selling for about $2100. Double eagles are seeing similar increases. MS63 and 64 Saint Gaudens are now trading at $2200 and $2300 and up, and MS63 Liberties, which were $2,000 or less a couple months ago, are now about $2400. Other grades and coins are also seeing major jumps.

Usually as bullion rises, bullion gold coin premiums decrease, but that is not the case now. Major bullion retailers like the American Precious Metals Exchange (http://www.apmex.com) are selling American gold eagles for a $100 premium over spot, which makes the coins $1900. Non-American gold coins like Maple Leafs and Krugerrands carry a smaller premium and sell for about $1850.

With these dramatic price increases in gold, on Tuesday the U.S. Mint (http://www.usmint.gov) temporarily suspended sales of all gold numismatic coins except the $5 gold commemoratives so that it could reprice them to reflect new bullion levels. Prices for coins like the first spouse $10 coins, proof Buffalo $50 pieces, and others have risen to their highest-ever levels. I would count on further increases next week unless there is a dramatic decrease in the price of gold.

As is usually the case when gold prices explode, collectors and investors are ramping up their purchases. In the past week sales of U.S. Mint numismatic products have picked up considerably, and I expect this week’s developments to result in further increases in sales of these coins.

If you are looking to increase your gold coin holdings because you believe prices will be higher in the coming months, as most analysts do, what is your best option? Which type of coin offers the best value in this situation? I would suggest avoiding bullion coins right now as premiums above spot are running high, and I would be cautious about pre-1933 gold, which has risen so much in the past two weeks that I would not discount the possibility of some downward adjustment in the near future. Nothing rises in a straight line.

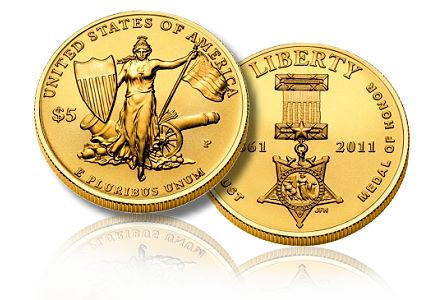

The best bets right now in my view are the Army and Medal of Honor $5 commemorative gold coins if purchased directly from the Mint. Everyone who follows these coins closely is surprised that the Mint has not yet (as of August 10) also removed these coins for repricing. Unlike proof and uncirculated American gold eagles and first spouse coins, whose prices are normally adjusted once a week according to a complicated formula, repricing the commemorative coins is a process that generally takes more time because it needs to be announced in the Federal Register.

The best bets right now in my view are the Army and Medal of Honor $5 commemorative gold coins if purchased directly from the Mint. Everyone who follows these coins closely is surprised that the Mint has not yet (as of August 10) also removed these coins for repricing. Unlike proof and uncirculated American gold eagles and first spouse coins, whose prices are normally adjusted once a week according to a complicated formula, repricing the commemorative coins is a process that generally takes more time because it needs to be announced in the Federal Register.

This is simply a function of the rules Congress sets for the Mint. In my view, the Mint should work with Congress to implement a real-time pricing system for its coins similar to what bullion retailers use on their web sites. Of course, collectors looking for a bargain will be disappointed, but the fact is the Mint is run as a profit-making business, and that is what any other business would do.

In addition, the $5 gold commemoratives are currently the single best value in the gold market. With almost a quarter ounce of gold, these coins currently have a gold content that is identical to the price the Mint charges (approximately $450) for each coin. Bullion quarter ounce coins are running $500 at retailers and they have no numismatic value.

The $5 coins are very attractive, especially the Medal of Honor coin, which will help support future demand, and final mintage levels for these coins are likely to be much lower than they are for bullion American eagle coins. Sales of these coins will undoubtedly see further increases as gold rallies, but the final mintage levels are still likely to be relatively low, especially compared to bullion coins with the same gold content. I see little downside risk for these coins.

Finally, keep in mind that while the long-term outlook for gold remains very bullish, any time anything goes up so much so quickly, there is a very high risk that in the short-term it could correct substantially in the other direction. One specific cause for concern is that margin requirements for gold futures traders could be raised soon, and this is what drove the price of silver from $50 to $35 earlier this year.

Therefore, I would suggest buying over time rather than at once, and holding for the long-term. If the economic situation continues to worsen, gold will remain the only real safe haven other than U.S. Treasuries, and if the economy finally recovers substantially, inflation will pick up, which will support gold prices.

Update: On August 11 gold declined a little over 1% as equities rebounded sharply and the CME (Chicago Mercantile Exchange) raised margin requirements for gold futures trades. The fact that gold did not decline more sharply (as of mid-afternoon) is a healthy sign, and corrections like this bode well for long-term bullishness in gold.

Louis Golino is a coin collector and numismatic writer, whose articles on coins have appeared in Coin World, Numismatic News, and a number of different coin web sites. He collects U.S. and European coins and is a member of the ANA, PCGS, NGC, and CAC. He has also worked for the U.S. Library of Congress and has been a syndicated columnist and news analyst on international affairs for a wide variety of newspapers and web sites.

At what point should the deferential between rarer date coins in lower grades be measured against higher grade coins with common dates. For example if you hold a 1904 MS63, would it be smart to trade it in for a semi-common 1913-P in MS63 even though the latter is technically worth less?

Fleat,

That’s a tough call. In general, when gold rises sharply there are good opportunities to buy better date coins at lower than normal premiums because most people are chasing common bullion coins.

So you would recommend those of us with decent pre-1993 gold (local shop offered $1800 for my $5 1858-C) should pay to get them slabbed?

Bill, I would definitely get them slabbed especially if you have better dates. This will make the coins even more liquid. You can take your coin to a show and get several different offers, which could be higher than what your local shop can pay. Personally, I will not buy any raw pre-1933 gold because there are many counterfeit coins out there, which fool even established dealers.

FYI: The Mint has removed the gold commemoratives for repricing.

L & C coin must have just got a hold of this article.

Yesterday afternoon I bought a “generic date” MS63 St. Gaudens Double Eagle from L & C coin. Today the order was cancelled and they called to ask me if I wanted the coin for $300 more. At the time of purchase gold was $1790 at the time of cancellation it dropped to $1735.

Today’s price at APMEX for the same MS63 coin was only $35 more than the price I paid yesterday. Hmmmm