Upgrade your knowledge by studying a wealth of coin data available online for free

By Jeff Garrett for Numismatic Guaranty Corporation (NGC) ……

Decades ago, collectors and dealers relied on standard numismatic references, such as the Guide Book of United States Coins (the Red Book), for much of their information. Most of today’s collectors take the massive amount of numismatic information they have at their fingertips for granted.

With a few taps on your smartphone, you can know more about a coin than most experts of the past. There is an amazing set of tools available for collectors and dealers to use when making a purchase decision.

One of the most important tools for today’s collectors is the grading census of coins that have been certified since the inception of third-party grading. These are known as “population reports” among most users. It is hard to overstate the importance and impact of “pop reports” in numismatics. For many buyers, it is one of the first things they check.

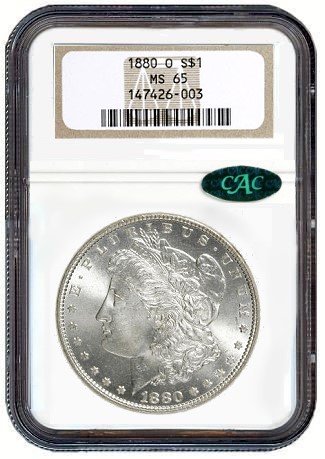

Since NGC was founded in 1987, they have certified over 43,000,000 coins. The NGC Census details each series, and how they have graded every coin submitted since 1987. This is an amazing store of vital information about coin rarity.

Over the last three decades, the true rarity, or lack thereof, has been revealed by the population reports. In general, common date Morgan Dollars are much more common than collectors and dealers thought 30 years ago. NGC has graded nearly 3.5 million Morgan Silver dollars over the years. Rare date Morgans are another story, as the true rarity of many of these was confirmed by three decades of submissions. As an example:

Over the last three decades, the true rarity, or lack thereof, has been revealed by the population reports. In general, common date Morgan Dollars are much more common than collectors and dealers thought 30 years ago. NGC has graded nearly 3.5 million Morgan Silver dollars over the years. Rare date Morgans are another story, as the true rarity of many of these was confirmed by three decades of submissions. As an example:

- 1881-S Morgan Dollar NGC MS 65 (56,305 graded)

- 1884-S Morgan Dollar NGC MS 65 (2 graded)

A student of numismatics can gain an amazing amount of knowledge about the rarity of the series they have chosen to collect by carefully studying pop reports. Before third-party grading, the best barometer of rarity was the study of auction records. David Akers’ groundbreaking books on United States gold coins that were published in the 1970s and ’80s noted auction records for different grades. For the first time, many collectors were enlightened on the true rarity of many United States gold coins. The standard references of the day all had prices for coins that did not exist in Mint State.

The pop reports are carefully studied now by those who compose pricing for a multitude of price guides. The value of a coin is greatly impacted by checking on how many have been graded. This is a moving target, as thousands more coins are graded by NGC daily. The number and pace of rare coins being graded have been a huge factor over the years.

The pop reports are carefully studied now by those who compose pricing for a multitude of price guides. The value of a coin is greatly impacted by checking on how many have been graded. This is a moving target, as thousands more coins are graded by NGC daily. The number and pace of rare coins being graded have been a huge factor over the years.

When third-party grading began in the 1980s, lots of coins had low population numbers and seemed very rare. This was one of the factors that attracted Wall Street money in the late ’80s and early ’90s. As third-party grading took a firm hold and millions of coins flooded in for grading, populations jumped sharply. This led to the rare coin crash of the early nineties. For amusement, check a Greysheet from 1989 and look at classic United States Commemorative prices. Coins that traded for $5,000 in 1989 can now list for under $250.

There are many anomalies that can be found in the population reports for United States coins. One of the more confusing situations is when the number of coins graded exceeds the stated mintage. This is not uncommon with many rare Proof United States gold coins. One explanation is that the mintage figures for some United States coins are incorrect. In the 1870s and ’80s, it is known that US Mint officials struck extra coins as collector demand dictated. More about this fascinating subject can found in the excellent books about Proof United States coins that have just been published by John Dannreuther.

A much more common explanation for strangely high population numbers are resubmissions. Over the decades there have been dozens of incredibly talented rare coin dealers who attempted to make a living by resubmitting coins; some have been quite successful. The subject of resubmissions is complicated and may be the subject of a future article soon.

A much more common explanation for strangely high population numbers are resubmissions. Over the decades there have been dozens of incredibly talented rare coin dealers who attempted to make a living by resubmitting coins; some have been quite successful. The subject of resubmissions is complicated and may be the subject of a future article soon.

One of the consequences of resubmissions is that many rare coins dealers do not return the labels so that the rare coin census can be updated. There have been attempts to financially entice submitters to return labels over the years, with mixed results. Some dealers are just too lazy or disorganized to send back labels once coins have been broken out and resubmitted. As can be imagined, this can greatly skew population numbers. For some “top pop” issues, this can have a dire financial impact.

But because labels are returned to the third-party grading services on a regular basis, the population numbers actually decrease occasionally. A dealer might save labels for years (not uncommon) and then send them to NGC for updating the census.

Serious collectors should check population reports on a regular basis. Much can be gleaned from these reports that can have a serious impact on your collection. As mentioned in my last article, there has been an influx of United States gold coins into the country over the last several years. Hoards and coin finds might quietly enter the market, but they eventually are revealed in the population numbers. Last year, at least one roll (50 coins) of 1909-S VDB cents entered the market. The coins were amazing, and the number of coins at the top end of the grading reports increased dramatically.

Population reports are also very carefully watched by those who participate actively in Registry Set collecting. The population numbers are vital to those trying to assemble the top set of any series. When a new ‘finest known” coin is graded, the grading census reports the information, and the status of someone’s set could be impacted.

In my opinion, the creation of grading population reports has been one of the most important advances in numismatic knowledge. Collectors and dealers would be lost without them. The hobby is fortunate that NGC and others spend the money needed to maintain this vital pool of information. Collectors should spend time going over the census for coins they collect – it will be time well spent!

This important information and disclaimer about the grading census is found on the NGC website:

- The utilization of this report as a tool for assessing the population and value of certified numismatic coins in any character or grade is unreliable. The following characteristics inherent in the marketplace undermine the accuracy of this report:

- Inexpensive coins which are not generally submitted for certification may appear scarce but are not.

- Numismatic coin certification services are predominantly utilized for higher grade coins.

- Certified coins are often removed from their holders without notice to the grading service. Therefore, computer tallies utilized to provide population reports may be misleading.

- Rarity is only one factor which must be weighed in determining the market value of a numismatic coin.

Numismatic Guaranty Corporation of America encourages all coin collectors to seek the counsel of qualified numismatists familiar with the certified coin marketplace before making any purchase based on this report.

Gentlemen”

I read the full article by Jeff Garrett and as a old time professional dealer, who relied

on “how many coins were NOT SLABBED’ over the decades that slabbing existed

must disagree with the advice that Jeff set forth.

Considering the 40 plus million that NGC slabbed , (or reslabbed the same coin more

than once) and the same holds true fo PCGS, compared with number that are still

“RAW” , that could be sitting in many old time collections, museums, albums given

from one member of a family to an other, the stock of unslabbed coins in dealers

hands this day, compared with the Billions of coins already struck from the inception

of the Mint, all 7 of them, the numbers that have already been slabbed are but a

small part that MIGHT STILL EXIST.

JUST AS AN EXAMPLE, THE 3 MILLION SILVER DOLLARS, found at West Point,

whiich never circulated, and then sold by the GSA , that number of Silver dollars, could

easily disturb the Population Report as to how many still exist and what grade the are.

Surely if all were graded, the POPULATION REPORTS would change dramatically.

Also many a dealer has Rolls and some bags sitting in their vaults, never graded , and

therefore the “KNOWN NUMBER” AND THEIR “GRADE” IS NOT PART OF ANY

POPULATION REPORT.

SURELY AS IT OCCURRED IN YEARS GONE BY, old small banks nationwide, still have

unopened and distributed old coins, which were not needed when received, and got buried

in safe deposit storage , as these banks all received new coins, and just kept track of old

ones, without putting them into circulation.

Then, as Jeff wrote, there were many dealers who did not like the first “go through” a Grading

service, BROKE OUT THE COIN, never turned in the LABEL to any service, and the count

could surely be wrong.

Also , what was common in the 1980’s could become in demand in the present records and

there is a chance that many more exist than the Reports indicate.

So depending on demand, depending on what was and was not graded, what is the FINEST KNOWN

when others could likely exist, the information from both NGC and PCGS has to be weighed against

what may still exist.

I personally know of at least a dozen collections, formed decades ago, never been auctioned or

sold privately that NEVER WERE GRADED BY ANY SERVICE that , when offered could really

upset the market calculations is only the Populatioin reports were relied on.

Also, there are many collections in existance today that most if not all the coins were sold privately

by good dealers, and never were slabbed. As Mr. Dupont always told me in the 1960’s the “Thrill

of hold a coin by the edges, being able to rotate it in ones hand, feel the edges, is the art and beauty

of collecting.is part if the attraction to collect, and if it is an early coin, to think who might have handled

the coin before, was the excitement that collectors like Dupont , as well as thousands of others had

and “had the PRIDE OF POSSESSION as he examined his coin :” That feeling is no longer available

to the “slabbed coin” which is removed from possession and feeling the “real thing” because of the

HARD PLASTIC ENCASEMENT.

As has been selected by others, one must learn more about what he is collecting, reading and deciding

how rare one coin is against others seen and that is what made collectors ” better collectors and

numismatists” rather than the opinion of a service, although helpful, but away from the personal feeling

of the posessor.

With the more than 7 decades of dealing, I feel that what I have learned and realize, that a coin must fill

a gap in the buyer’s collection, and have “the eye appeal” that satisfies. Not every collector sees what

others see, so when one is dependant on a POPULATION REPORT, OR CONDITION CENSUS or a

REGISTERED DECLARATION BY A SERVICE, there results in a major differnce in value to me and my

clients than to those who rely solely of the “slab” and its place, by the service involved, of a catagory

that could be readily amended.

Respectfully Submitted

Harvey G. Stack

Co-Founder Stack’s Bowers

What about the counterfeit coins that are flooding the market? And what about the millions of coins melted or lost?