By Charles Morgan for CoinWeek….

Obviously, the Kennedy gold half dollar release was the big story of the American Numismatic Association World’s Fair of Money and CoinWeek was on the ground as it happened. Expect to see that report by Monday.

In the interim, I’m going to take this opportunity to talk about numismatic topics beyond this noteworthy and controversial modern coin, because I feel that it’s important to share with you some of the more nuanced experiences I had at the biggest and most exciting coin show in the world.

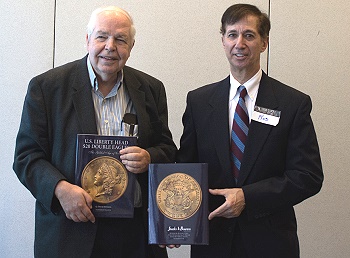

Bowers and Galiette Revisit $20 Liberty Head Double Eagles

Q. David Bowers and Robert Galiette, authors of U.S. Liberty Head $20 Double Eagles (2014), reprised the presentation they gave at the spring Whitman Expo in Baltimore. At that event, 10 lucky collectors snagged free copies, courtesy of Stack’s Bowers. No such luck in Rosemont, although the authors graciously signed books for those that purchased them. The book was offered at a discounted price of $25. It regularly retails for $49.95.

For Robert Galiette, the 2014 American Numismatic Association World’s Fair of Money signaled the end of an era.

The New York-based collector par excellence chose this venue to sell his amazing collection of 19th century U.S. gold.

The “Gilded Age” Collection, as Stack’s Bowers called it, was offered at the Wednesday night auction and attracted heavy interest from collectors of the challenging series.

“No one has ever completed the set in uncirculated condition,” Galiette told me. “It’s still an exciting frontier for collectors. The set I put together has more Mint State double eagles than all of the great collections combined. But I still did not complete the set. I hope someone else will take up the challenge and do that.”

Galiette’s collection brought $1.4 million and the collector seemed satisfied with the number. “Some sold higher than I thought, some sold lower,” he told me, “but all in all, it was a good mix.”

At the Bowers / Galiette symposium, Bowers was joined by his two grandsons John and Matthew.

Ed Reiter Is a Funny Guy

Ed Reiter is an institution in the field of numismatic writing, having spent more than 20 years as Executive Director of the Numismatic Literary Guild and having a long and distinguished career as a writer and editor for COINage Magazine.

He’s also a bit of a jokester.

On more than one occasion I stumbled upon Reiter motoring around the bourse with the help of a power chair.

My personal introduction to him came on Tuesday when he stopped and asked me, “Are you Charles Morgan?”

“Yes,” I replied.

Finally, on Thursday, Reiter took a different tack. Playing on the fact that Hubert hasn’t accompanied me on the coin show circuit yet, Reiter stopped his motorized chair in front of the CoinWeek booth and presented his cane.

“Charles Morgan, I’d like to introduce you to Hubert Walker.”

Austrian Mint Soirée

The ANA is such a large undertaking that it’s always a give-and-take when it comes to deciding how to spend your time. I so badly wanted to watch the Stack’s Bowers auctions on Wednesday night, but at the same time I couldn’t turn down an exclusive invite to the Austrian Mint’s Annual Soirée, held at the historic Chicago Firehouse Restaurant.

Prime rib sliders, lamb chops, miniature pizza squares, and all manner of appetizers were offered by the restaurant’s attentive and professional staff. The Austrian Mint also had several cakes made in the likeness of the Austrian Philharmonic bullion coin.

Austrian Mint CEO Gerhard Starsich hosted the event, which brought together officials from several foreign mints, international distributors of Austrian Mint products, and a contingent of figures from the U.S. numismatic media.

I was joined by Coin World’s Steve Roach and former editor Beth Deisher, the Numismatic News’ Dave Harper, and the Numismatist’s Barbara Gregory. And while I did try to mingle (I chatted with Modern Coin Wholesale CEO Ron Drzewucki and shared my fondness for the classic “Woman of Wachau” design of the Austrian 10 Schilling coins with Gerhard Starsich), I found myself gravitating mostly towards my peers in the writing industry… and I couldn’t have asked for better company.

The Men Behind the Camera

The ANA was so jam-packed with programming that David Lisot and I took turns shooting video. I’m told that we burned through more than 11 32-gigabyte memory cards. The bulk of my footage was shot at the ANA’s Money Talk Lecture Series, although I did get some one-on-one interviews with Galiette and CoinWeek Contributing Author and former Mint Director Philip Diehl.

The ANA was so jam-packed with programming that David Lisot and I took turns shooting video. I’m told that we burned through more than 11 32-gigabyte memory cards. The bulk of my footage was shot at the ANA’s Money Talk Lecture Series, although I did get some one-on-one interviews with Galiette and CoinWeek Contributing Author and former Mint Director Philip Diehl.

On Tuesday, I recorded several excellent lectures about Canadian Numismatics put on by members of the Royal Canadian Numismatic Association.

Brett Irick gave a lecture entitled “Introduction to Canadian Numismatics”. Eugene Freeman followed with an interesting presentation on “The Coins of New France”.

One of my favorite lectures of the entire show was “Some Early History of Canadian Numismatics and Its Relationship with the American Numismatic Association”, given by Paul Johnson.

Johnson focused on the early history of the American Numismatic Association and the vital role that Canadian numismatists played in its development. It’s doubtful that there are many numismatists left who remember the two ANA Conventions held in Montréal, but the impact that Canadian numismatists have had on the growth of the hobby both in Canada and in the United States cannot be overstated.

Daniel Gosling, with whom I had the pleasure of sitting at the ANA Banquet on Friday night, gave an impressive presentation entitled “Certificates for a New Prosperity”, in which he discussed the rise to power of William Aberhart and the Alberta Social Credit Party. Aberhart sought to bring relief to those stricken by the Great Depression by issuing “Prosperity Certificates”, notes that depreciated in time and were, therefore, meant to be spent and not saved.

The theory didn’t work out quite so well in practice, and the issuance of Prosperity Certificates ended after a short run.

I was back behind the camera on Thursday and Friday, recording lectures on obsolete paper money, civil war tokens, the Louis G. Kaufman collection, the statuary of Brookgreen Gardens, American Arts Medallions, and much, much more.

David will have DVDs of these presentations available for purchase at the next ANA Show.

Liberty Bonds of the World Wars

Situated across the aisle from the CoinWeek booth was New Jersey-based dealer Larry Schuffman, who had at his table a small but interesting collection of Liberty Bonds from World War I and II.

Few today may realize that the United States resorted to selling bonds in order to fund American war efforts during this pivotal time in world history. Today, the federal income tax supports America’s national defense and funds any military action authorized by Congress.

Few today may realize that the United States resorted to selling bonds in order to fund American war efforts during this pivotal time in world history. Today, the federal income tax supports America’s national defense and funds any military action authorized by Congress.

In the 1910s and 1940s, Americans were encouraged to invest in “Victory” by buying bonds. Many people actually borrowed money from the bank in order to invest in these instruments, Schuffman told me.

What was really interesting about Schuffman’s explanation was a point he made about the Liberty Bonds of World War I.

“The United States went into a conditional default of its debt obligations,” Schuffman said, “when it went off of the gold standard in 1933. The Liberty Bonds sold during World War I were repayable in gold. After ’33, they were no longer redeemable in gold and the government was unwilling to repay its obligations in gold’s new $35 value; it conditionally defaulted on its debt.”[interesting point… court cases? if so, could be an article. How about writing Herb Hicks and seeing what he thinks?]

Schuffman specializes in all manner of government-issued bonds, but warns those entering into this area to avoid the types of scams that CoinWeek contributing writer Joshua Herbstman discussed in his article “A Nigerian General’s Dream… A Cautionary Tale of Historical Bond Fraud”.

Herbstman and Schuffman warn against sellers who represent historic bonds as redeemable investment instruments. “Some can be redeemed,” Schuffman says, “but most can’t and should be collected only for their history and artwork.” Of those that can be redeemed, Schuffman explains that most wouldn’t view redeeming these as a good investment because “they are worth more as numismatic items than their redemption value.”

Baseball Hall of Fame Coins

The 2014 Baseball Hall of Fame coins were present at the show, but they certainly lacked the prominence they held just a few months ago. Dealer Lee Minshull takes home the prize for having the most Hall of Fame coins on display, with more than 200 (by my estimation) PR70 examples (all NGC) at his primary booth location.

Other dealers offered a basic representation of the coin at their tables, so anyone interested in picking up one or a couple hundred examples of the coin in gold or silver would have had no problem at this show.

What does this means in the short-term? My guess is a continued decline as it approaches a plateau at about 20% above issue price.

Wheels Up

I expected to be busy when I arrived, but I had no idea how busy.

The World’s Fair of Money is a show within a show. From the wide breadth of educational programs to the multiple auctions and a bourse made up of more than 500 vendors, there is no show that I’ve been to that compares.

The best part of the big event isn’t the coins, it’s the people. There are folks who only come to the ANA show. For them, the ANA is special. Getting to meet them and build bonds of friendship based on a mutual love of numismatics is what makes attending the show so rewarding.

I’m the first to admit that the ANA has squandered much goodwill in recent years, with a seemingly never-ending stream of lawsuits and internal strife. But this event had none of that. The governors seemed to get along well and the ANA staff was gracious and friendly.

It’ll take several more shows like this to get the ANA back to where they need to be–where they should be–but as I reflect on the hobby’s busiest week of the year, a story that deserves attention is the fact that the ANA acquitted itself quite well.

For an organization at the core of the American numismatic experience, that’s a good sign.

***

Charles Morgan is a member of the American Numismatic Association, the American Numismatic Society, the Numismatic Literary Guild, Central States Numismatic Society, and the Richmond Coin Club. Together with his co-writer Hubert Walker, they have written numerous articles for publication online and in print, including four NLG award-winning articles for CoinWeek.com.

Charles Morgan is a member of the American Numismatic Association, the American Numismatic Society, the Numismatic Literary Guild, Central States Numismatic Society, and the Richmond Coin Club. Together with his co-writer Hubert Walker, they have written numerous articles for publication online and in print, including four NLG award-winning articles for CoinWeek.com.

Want to know what we’re up to? Follow Charles on Twitter.

© August 2014 COINWeek.com, LLC.