By Ron Drzewucki – www.moderncoinwholesale.com …..

The American Silver Eagle, which has a nominal face value of one dollar and contains one troy ounce of silver, was first struck in 1986. More than 400 million American Silver Eagles were produced over the first three decades of the program, and silver eagles have long reigned as one of the world’s most popular bullion coins.

Both investors and coin collectors enjoy collecting American Silver Eagles, but they’ve become so ubiquitous that many buyers forget to spend some amount of time researching prices to get the best deal. Retail costs can fluctuate based on a variety of factors, including shifts in prevailing spot price and availability. Not to mention the fact that every coin dealer and silver distributor sells Silver Eagles at a small markup over bullion. Oftentimes, volume buyers can take advantages of special discounts to take the edge off of these markups – otherwise known as premiums.

And while most bullion sellers will try to hook you in based on their premium over spot, savvy buyers would do well to look closer in order to get the best deal.

Paying close attention to live spot prices, advertised spot premiums and ordering criteria provides the biggest pay off in the end.

To reiterate:

- Spot price – Any coin with silver content has intrinsic value. This intrinsic value is referred to as the coin’s spot price, and is an expression of the coin’s worth based solely on its metal content (not collectible, or numismatic, value). In the case of an American Silver Eagle, “spot price” refers to the market value only of the silver content within the coin. A Silver Eagle, which has a 0.999-fine silver content, weighs 31.103 grams and contains 31.072 grams of silver.

- Premium – A bullion coin’s premium is the price of the coin above its spot value. Virtually all American Silver Eagles carry a premium based on the numismatic collectibility of the coin; the premium on brand new Silver Eagles largely covers the United States Mint’s production costs and the distributor’s transactional fees.

Additionally, when it comes to buying silver bullion coins there are a few points that many investors bear in mind:

- Newer American Silver Eagles tend to have the lowest premiums

- Buying in bulk (usually 10 to 20 coins or more) slashes the per-coin spot premiums

- Cash, check, and wire purchases often yield the lowest price per coin

- Cleaned, cull, or otherwise damaged Silver Eagles generally have the lowest spot premiums

Of course, none of the above pointers assume the buyer is looking to assemble a crisp collection of American Silver Eagles spanning from the first year of of issue in 1986 to the present. The information applies solely to silver bugs and others who want to stack their coins as high as possible and as cheaply as possible.

For them, the game is not finding one premium specimen of every date but finding the cheapest possible deal regardless of date and condition.

For them, the game is not finding one premium specimen of every date but finding the cheapest possible deal regardless of date and condition.

Interestingly, the ever-growing popularity of Silver Eagles has pushed the United States Mint to break records almost every consecutive year for much of the past decade. Why? Because the buyers fueling the demand for silver don’t necessarily want to buy older American Silver Eagles that carry lofty numismatic premiums. Instead, they prefer the new coins, which generally boast lower premiums over spot. A 2016 American Silver Eagle with a $2.40 premium over spot looks much better to the garden variety silver bug than an inaugural year 1986 ASE that appeals more to collectors and carries a $30 numismatic premium.

Spot Premiums Vary Among Dealers

That said, Dealer A might be selling their 2016 American Silver Eagles for $2.40 each over spot for credit card orders and $2.25 for wire transactions while Dealer B charges $2.35 regardless of the form of payment.

Or, Dealer C might charge $2.50 for the first 19 Eagles and then drop the premium to $2.25 for the 20th on.

Or maybe any order over 25 American Silver Eagles at Dealer D qualifies for the $2.22 premium. Spot premiums vary from one dealer to the next, but there could be a catch in each case that makes any of the dealers’ offers the “best” based on how many coins are ordered, which dates are ordered, the method of payment used, and so on.

The key? Check out multiple silver coin dealers and exercise scrutiny when buying any quantity of Silver Eagles, anywhere.

There are several major bullion distributors in the industry who each handle thousands of orders per day, and each of these distributors offers different pricing guidelines for American Silver Eagles. Some companies allow customers to choose dates when ordering; in such cases numismatic demand and availability must also be taken into consideration. When possible, the pricing examples below are for 2016 American Silver Eagles, but some companies will ship random date examples. In those cases, the spot premium is not based on numismatic value.

The per-ounce silver ask price at the time of writing is $16.37.

Just looking around the internet, I found six competitor websites that offer American Silver Eagles to investors and collectors. I did not cherry pick these or find outliers. These are major name brand companies and dealers. In fact, if you are a silver stacker you have probably already bought from them!

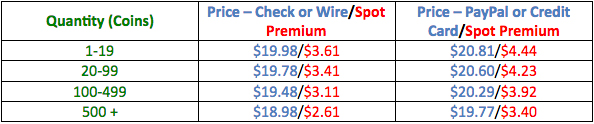

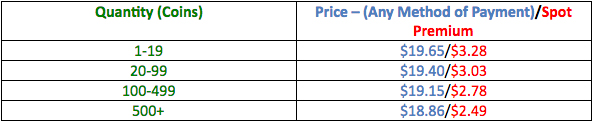

Dealer A was established nearly 20 years ago and has since become one of the largest silver and gold dealers in the world. Here is a breakdown of prices for its 2016 American Silver Eagles:

In other words, the spot premium at Dealer A varies from between $2.61 to $4.44 over spot – a difference of nearly $2 per coin – based on the quantity of 2016 silver eagles being ordered and how the customer pays for those coins.

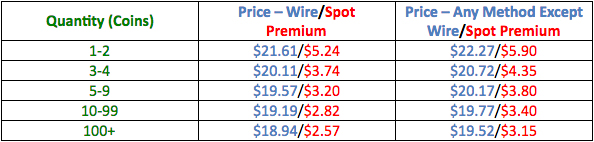

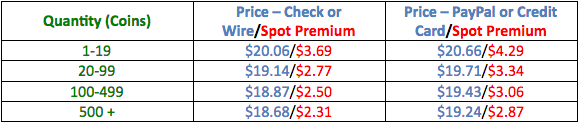

Meanwhile, here are the premiums for 2016 American Silver Eagles at Dealer B:

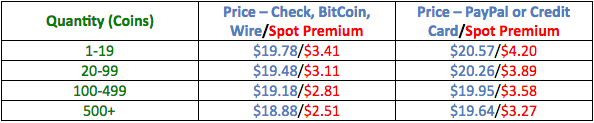

Another major bullion dealer, Dealer C, offers American Silver Eagles at price tiers similar to its competitors:

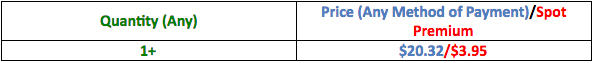

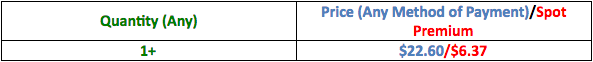

Dealer D spends hundreds of thousands of dollars every year on TV and radio ads. They offer an array of gold and silver products but does not offer its customers a choice of dates. While the company has a simple pricing structure for its American Silver Eagles – any quantity and method of payment results in the same premium over spot – its website is not geared toward collectors building date sets or those who might benefit from a discount on a large purchase.

Here is the price structure for American Silver Eagles (any date) at Dealer D:

Dealer E sells American Silver Eagles and a wide array of other bullion coins, but like several other investor-focused bullion distributors the company does not offer a choice of dates.

They do, however, offer bulk quantity discounts:

Dealer F figures prominently in the bullion marketplace. Founded in the 1960s, the company offers a large selection of bullion products and even provides free shipping and insurance.

However, like many other metals distributors, Dealer F mainly caters to individuals assembling large bullion portfolios, and thus this firm does not offer customers a choice of dates:

And finally, here’s a price and spot premium table for my company, Modern Coin Wholesale:

Tips Silver Bullion Coin Buyers Should Remember

The pricing scenarios above provide only a cursory overview of each company’s price and ordering guidelines. The information does, however, provide insight into the differences in premiums charged by major bullion dealers and the different factors those premiums are based on.

The bottom line? There are several variables one must take into account when ordering American Silver Eagles, and this is why buyers should read between the lines when it comes to premiums over spot.

Here are some more tips one should remember when buying silver bullion coins:

–Advertisements with price-over-spot expressed in the words “as low as” mean that is the lowest possible price one will pay for a given coin. Chances are, lower-quantity orders or those for which a credit card is used will ultimately mean paying much higher prices per coin.

–Shipping fees can make a significant difference, especially on smaller orders. While Dealer A may charge $2.55 over spot per coin and Dealer B offers ASEs for $2.70 each, Dealer A charges $15 flat shipping fees, while Dealer B charges $5.95 on orders under $100 and free on orders $101 and above; Dealer B is therefore the better option for a small order, regardless of its spot premium being higher; Dealer A is the better choice on extremely large orders.

–When buying silver bullion coins regularly, consider registering as a member of bullion distributors that offer special deals and discounts to their customers; one may earn free shipping, small discounts and other valuable perks that way.

–Buying coins on a whim is risky, especially when doing so for investment purposes. While no coin ever guarantees a return on investment, buyers who practice due diligence in researching bullion distributors, coin prices and ordering guidelines stand a better chance of paying the lowest possible price for their coins.

Variable spot price premiums can be a silver stacker’s best friend or worst enemy, depending on what side of the deal the customer falls on. With a little research, careful decision-making and shopping around, any bullion investor can score the American Silver Eagle coins he or she wants for a lustrous deal.