By Charles Morgan and Hubert Walker for CoinWeek …..

In 1958, the bustling numismatic hobby experienced a grading revolution with the release of Martin R. Brown and John W. Dunn’s Guide to the Grading of United States Coins. In that book, Brown and Dunn laid out a set of adjectival grades that should be familiar to anybody who has ever cracked open a Red Book. Brown and Dunn were not the first to use terms Good, Very Good, Fine, Very Fine, Extremely Fine, and About Uncirculated, but they were the first to try to scientifically structure a grading system and communicate the basics of grading to the broader collecting community.

Eleven years later, seeing their system applied and learning from its shortcomings, Brown and Dunn rethought their model. The concept that grades exist within grades–something collectors likely realize by instinct–became tangible sticking points to the improvements they set out to make with the 1969 edition of their book, wherein a more complex system, appropriately named the “New B & D System”, was introduced. It was in this system that the first “plus grade”-type distinctions were introduced, with a series of attributions on a scale from “A” to “E”:

- A: The coin nearly meets the criteria of the next higher grade. For Proofs, the coin was basically perfect. For About Uncirculated coins, “A” was applied to mean the coin was “normal” for the grade.

- B: In Uncirculated, a coin with bag marks. For AU coins, a coin with a reverse that is not as nice. For circulated coins, normal for the grade. For Proofs, a coin with minor hairlines.

- C: For circulated coins, a normal obverse with a subpar reverse. For Good coins, rims have worn into the field. For AU coins, a subpar obverse but par reverse. For Uncirculated coins, a weak reverse strike. For Proofs, minor scratches.

- D: For circulated coins, a subpar obverse and normal reverse. For Uncirculated coins, a weak strike. And for Proof coins, minor wear.

- E: Proof coins only, featuring heavy circulation and graded as such.

But Brown and Dunn didn’t stop there. They also devised a well-thought-out numerical table representing 29 negative characteristics that could be applied to communicate specific issues with a coin. In Kurt Krueger’s excellent think piece “Grading: Bestial Pandemonium Unleashed”, published in the January 1976 issue of The Numismatist, the author gives us as an example of a coin graded VG-B-9-O-X. This coin, Krueger writes, is “very normal Very Good condition except that it has a single rim nick on the obverse at the ten o’clock position” (“9” being the number for “Single Rim Nick”).

The “O-X” threw us when we first saw it, as we weren’t expecting to see that degree of specificity within this system. In an age before home computing, this idea was delightfully specific, nerdy even.

So, as you might expect, it never caught on.

Even though Brown and Dunn’s ambitious grading system didn’t achieve widespread use, the incentives to establish a standardized grading regime were made clearer with each passing year as auction prices continued to set records. Astute dealers understood that the opaque nature of the market was holding premium rare coins back.

The Birth of Third-Party Grading

The groundwork for the Third-Party Grading (TPG) revolution was laid by the American Numismatic Association (ANA). A topic that dominated the conversation for much of the 1970s was the authentication of rare coins and coin grading. The ANA began to authenticate coins in 1972, certifying its first coin as genuine on June 15.

Later that year, at the ANA Convention in Los Angeles, California, ANA President Virgil Hancock appointed dealer Abe Kosoff to the position of Chairman of the ANA Grading Service Study Team. Serving alongside Kosoff on the Study Team was a who’s who of the leading dealers of the period. Included were Kamal Ahwash, Harry Bass, Del Bland, Larry Goldberg, Julian Leidman, Denis Loring, A. George Mallis, Joel Rettew, Don Taxay, and Leroy Van Allen, to name a few.

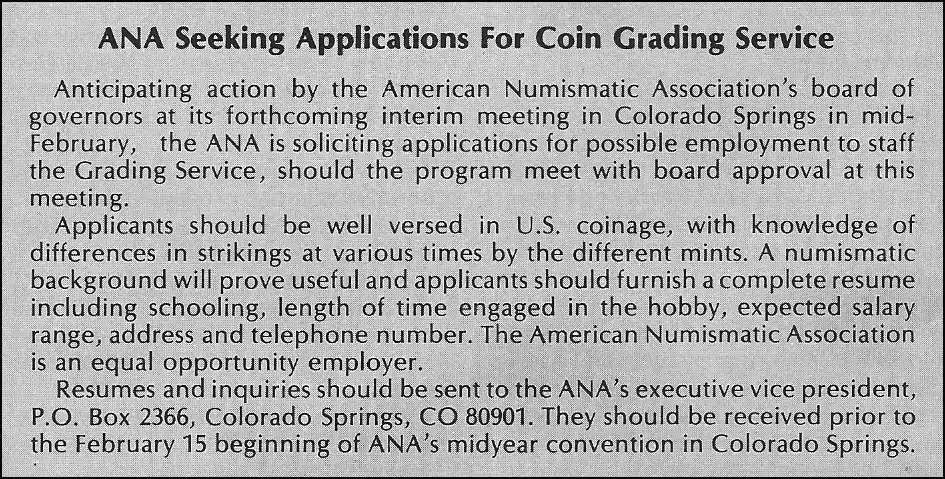

By 1976, the ANA had begun to lay the groundwork to set up a full-time grading service at its headquarters in Colorado Springs. But first, it needed to publish its grading standards.

To do so, the ANA turned to Kenneth Bressett, a talented writer and coin grader who was working alongside R.S. Yeoman on the popular Guide Book. Bressett was tasked with putting together the written descriptions of the ANA’s newly adopted grading standards. In 1977, the work was finished and the ANA published Official A.N.A. Grading Standards for United States Coins. A year and a half later, the service–ANACS–was ready to accept its members’ coins for grading.

In March 1979, ANACS’ first month of grading, it reported having graded 174 coins, with an average turnaround time of six to eight weeks. It was a slow and inefficient process, with a majority of the coins being sent to outside consultants for an “expert” opinion. In March 1980, ANACS was grading over a thousand coins a month, with an average turnaround time of three or four weeks.

By contemporary grading service standards, these are minuscule numbers.

But several problems bogged down the ANA’s grading service. For starters, the sheer scope of the project quickly overwhelmed the Association, and it didn’t take long before cracks appeared in the ANA Board of Governors’ support for the program. Even at the outset, Board support for ANACS and the publication of an “official” grading standard was not universal.

To some, ANACS had become a boondoggle. Grading, some argued, was not a key part of the ANA’s educational mission. The costs associated with hiring and retaining staff were high, and it’s hard not to imagine that some opposition to the service was based on jealousy.

The ANA also had to answer to the many complaints that were lodged from those who accused ANACS of being inconsistent with their grading decisions. A sophisticated collector in today’s market would probably not be surprised to learn that the grading process is not entirely scientific, and grading opinions are just that: opinions.

Another factor facing the ANA was the need to continuously invest in technology. ANACS holders were not airtight or tamper-resistant. Coins could be switched out by the unscrupulous and it’s likely that some unsuspecting buyers bought ersatz coins from time to time.

The Board was also given bad legal advice, which led it to believe that a successful and growing ANACS business would endanger the Association’s non-profit status. This belief failed to consider that the association could funnel all of its profits into its educational mission, something the majority of the Board didn’t consider

Ultimately, the ANA decided to sell ANACS. The repercussions of this decision reverberate to this day.

The TPG Revolution

Few people in the history of the hobby have understood how to truly unlock the potential of “common” rare coins like David Hall did. Through his showmanship and his Inside View newsletter, Hall spread the gospel of conditional rarity and the importance of coin grading.

Few people in the history of the hobby have understood how to truly unlock the potential of “common” rare coins like David Hall did. Through his showmanship and his Inside View newsletter, Hall spread the gospel of conditional rarity and the importance of coin grading.

Here Hall exclaimed:

THE BIGGEST MISTAKE A RARE COIN INVESTOR CAN MAKE IS TO BUY LESS THAN THE BEST QUALITY COINS.

and

If you want to maximize your participation in the coming coin boom, you must buy the right coins!

and

… the whole coin grading problem, the whole question of value, and the major reason why product misrepresentation was possible, is that THERE WAS NO GRADING STANDARD IN THE COIN INDUSTRY and, in fact, THERE NEVER HAD BEEN!!!

Not only did Hall understand that the grading issue was standing in the way of explosive growth in the rare coin market but he also clearly got the fact that the only way to establish a standard was through dealer buy-in.

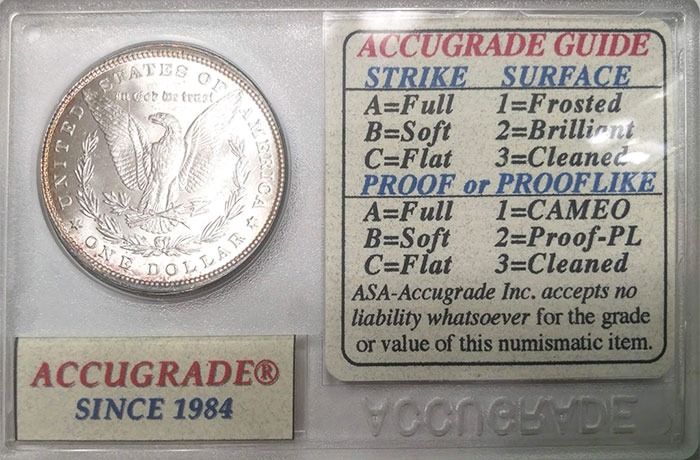

Around the same time, coin dealer Alan Hagar offered up his own set of grading standards, built around the Sheldon numerical system but complemented by additional notes for strike, surface, and degree of cameo frost (Hagar was an early adopter of this nomenclature). It wasn’t exactly the new Brown and Dunn system, but it did try to account for aspects of a coin’s appearance that could not be communicated with a simple adjective plus number grade.

Hagar was first to market with his grading service, but the Accugrade product didn’t resonate with dealers in the same way that Hall’s PCGS did. With dealer support, PCGS-graded coins began to enter the investment portfolios of rare coin speculators and collectors. A year later, NGC was established by John Albanese and Mark Salzberg.

Since then other companies have came and went, and some have even managed to stick around servicing specialty clientele. But for the better part of 35 years, the market would be driven by the two major grading services, which combined have certified nearly 100 million coins.

TPG Evolution

Despite the widespread acceptance of the two major Third-Party Grading services, inefficiencies remained. Part of the problem was owed to natural disagreements between knowledgable people. Part of the problem was self-interest. And part of the problem lay within the limits of the system.

Brown and Dunn’s complicated new system of the 1970s was built on the understanding that coins in “similar” conditions may vary in meaningful ways that grades such as MS62 and AU55 can’t describe.

In various interviews with David Hall that we have conducted over the years, we got the sense that Hall understood the issue. Some coins are snowflakes, he told us. Snowflakes, whether beautiful and pure, or dirty and gross, are hard to commoditize, and the TPG 70-point scale is nothing if not an attempt to commodify collectible coins.

In reality, the grade and attributions printed on coin inserts often leave off information that is of vital interest to the collector.

In a fantastic article published in the February 1992 issue of The Numismatist, ANA member Kenneth L. Cable wrote about the ambiguity of color classifications as it pertains to copper coins. Here he makes a fantastic point:

“Slabbing has, to a degree, cleared up some of the grading controversy. However, today you can look at two encapsulated Lincoln cents of the same date/mint graded MS-65 “Red,” yet one can be clearly more desirable than the other. Why? Because there is more to color of quality copper.”

Cable’s analysis is spot on, and probably obvious to all but those who are entrenched in a system where Red, Red Brown, and Brown are the three market-acceptable attributes. Coin dealer Lee Bellisario, one of the first graders at PCGS, understood this and came up with his own in-between attributes of Red Red Brown and Red Brown Brown. Outside of Lee’s orbit, it’s unlikely that collectors would have ever encountered these terms – but the gist of the idea is often seen by way of prices realized.

Cable’s solution was that the services implement a grading scale based on measuring the progressive states of color preservation. The idea is that coins that exhibit mellowed copper color should be clearly labeled. Today, these coins are still called Red.

Also called Red are coins with copper spots, stains, and fingerprints.

The mellowing of color and the development of issues on the surfaces of copper coins has always been a headache for the grading services. This is why, in 2009, PCGS announced that it would no longer guaranty the color of coins in its holders graded or sold after January 1, 2010. In light of this, a further investment in a more sophisticated attribution of color is unlikely.

Others have advocated for computerized grading. With all of the recent talk about machine learning and AI (premature, we believe), nothing has yet to emerge to supplant the processes that have been utilized since the mid-1980s.

Back to Grading by Instinct

Despite being 35 years into the current system, dealers and collectors more or less find themselves back at the instinctual level. Those with finely tuned grading skills and sufficient levels of capital have made careers off of purloining “undergraded’ coins from the marketplace and getting them in higher graded holders. While those who are simply “in the ballpark” are keenly aware that the current 70-point Sheldon system has been gamed, usually to someone else’s benefit.

To the unsuspecting and uninitiated, the system comes across as much more serious business than it is (i.e., the shock of discovering that supposedly perfect “70” coins have problems like planchet flaws and milk spots). Few can muster the cognitive dissonance necessary to explain away why a coin graded 64 turns up years later as a 67. Or how certain grades were never given out for a particular coin, only for that grade to become so commonplace now as to collapse the market for that issue.

All of this has happened, and still happens.

At some point in 2023, CAC will enter the market as a viable third major service. The company has built its reputation on a similar model that built PCGS and NGC: dealer buy-in. It has been at least a decade since CAC-stickered coins reached a level of critical mass so as to establish a reputation of being premium coins within the assigned grade. Other services have attempted and failed to match the CAC product, while others have found limited usage amongst specialists.

CAC’s premise appears to rely on trust in the graders and their standards. Collectors should note that trust is what built PCGS and NGC. Over time, the currency of trust loses some of its value as human error and inconsistencies manifest in the product.

It’s hard to say how things will shake out. The hobby is lingering too long, we feel, on antiquated practices and perspectives. The largest emerging generation of collectors are more sophisticated than ever before, and the market makers and grading services will have no choice but to answer the needs of their clientele, eventually.

We would like to get to the point where the grade on the slab is short hand for a plethora of additional information about that specific coin that can be reviewed online. As a collector, one wants to know if a coin was netgraded and for what reasons. Did graders believe that one’s MS62 Capped Bust quarter was cleaned “a long time ago”?. Will an attractive 1889-CC Morgan dollar not upgrade because of a rim issue that is concealed by the gasket in the slab? And what exactly is keeping a certain MS69 American Silver Eagle from earning that perfect 70? Many if not most rare coins have been processed in some way. Surely “world-class” graders know this. Shouldn’t buyers as well?

This level of service is possible. Is it practical? Is it affordable? That remains to be seen. But a system that shortchanges the collector by not communicating what the graders see is a system that could be improved upon.

Some in the hobby have always thought so.

Nice article. Another area where problems exist in grading is wear vs appearance. I have an AU58 coin with wear you can only see under magnification and a MS62 coin with spots and a bag mark, but no wear. The AU 58 coin appears much nicer. Perhaps separate wear and appearance grades are needed.

Great article.