By Greg Reynolds for CoinWeek …..

There is no doubt that the vast majority of scarce classic U.S. coins, and thousands of common coins, valued at more than $250 each, are PCGS or NGC certified. Indeed, the mainstream of markets for rare or scarce U.S. coins, and for prize condition rarities, is characterized by PCGS and NGC certified coins. Will this always be true? Are numerical grades assigned by PCGS or NGC interpreted differently now than they were in the past? How will coins already graded by PCGS and NGC be viewed in 2015 and beyond?

If a rare or scarce U.S. coin that is valued at above $500 is not PCGS or NGC certified, some interested collectors may tend to figure that there must be something wrong with such a coin. While there is general agreement that most rare or scarce U.S. coins should be certified before being sold to collectors, experts often disagree with the assigned numerical grades and have major concerns about the consistency of each grading service. Surely, experts who recommend PCGS or NGC certified coins sometimes do not agree with or have doubts about some grades assigned by PCGS and NGC.

Over the past fifteen years, many doctored coins have been mistakenly graded and grade-inflation of never-doctored coins is a serious matter. Moreover, if the same coin is sent to the same service on different occasions during the same era, it may receive different grades or no grade at all in some cases. What are the factors that should be taken into consideration when interpreting PCGS or NGC assigned grades?

Over the past fifteen years, many doctored coins have been mistakenly graded and grade-inflation of never-doctored coins is a serious matter. Moreover, if the same coin is sent to the same service on different occasions during the same era, it may receive different grades or no grade at all in some cases. What are the factors that should be taken into consideration when interpreting PCGS or NGC assigned grades?

In 2009, I wrote about the ‘widening gap’ in value and quality among two coins of the same date, mint, design type and certified grade. (Clickable links are in blue.) Although a coin that is certified as grading MS-65 might grade 65.9 or 65.1, that was not my primary theme. There are some coins that are graded as MS-65 that most relevant experts would grade MS-63 at best or would regard as non-gradable because of doctoring or other problems. There are other certified MS-65 coins that almost all relevant experts would agree grade at least MS-65, and some higher.

Suppose that a coin is PCGS or NGC graded MS-65 and is of interest to a particular collector. Further suppose that this collector is told by experts that the coin is overgraded or has problems. Perhaps it is a coin that was earlier graded MS-64 or -63 by PCGS or NGC. Should such a collector avoid the coin, be willing to pay a MS-64 level price for a coin in a MS-65 holder, or spend an amount for the coin that makes sense to the individual collector, without taking too seriously grades assigned by others?

In Feb. 2012, I analyzed the sale of a PCGS graded MS-66 1799 silver dollar. It is a primary example of an overall point, as a majority of interviewed experts agreed that it was overgraded by PCGS, and there was an explainable reason; it has a large, distracting fingerprint on the obverse (front). Nonetheless, the consensus was that it merits a grade of MS-65. I wholeheartedly agree. That 1799 silver dollar is a wonderful, MS-65 grade coin. No one expects a coin from 1799 to be perfect. Such a fingerprint is perfectly acceptable, given the other characteristics of that coin, for a MS-65 grade, though not for a MS-66 grade.

As was then reported, this 1799 brought $260,000 at auction Jan. 2012, which was then a mid range ‘MS-65’ level price rather than a $350,000 to $425,000 price that a true MS-66 grade 1799 dollar probably would have commanded. An essential concept is that leading bidders rejected the assigned PCGS grade on the holder and instead bid based upon an underlying ‘true’ grade, which was not mentioned on the holder or in the auction catalogue description.

As was then reported, this 1799 brought $260,000 at auction Jan. 2012, which was then a mid range ‘MS-65’ level price rather than a $350,000 to $425,000 price that a true MS-66 grade 1799 dollar probably would have commanded. An essential concept is that leading bidders rejected the assigned PCGS grade on the holder and instead bid based upon an underlying ‘true’ grade, which was not mentioned on the holder or in the auction catalogue description.

During 2014, in my analytical articles of auction results in the sales of the Gene Gardner Collection, the Stack’s-Bowers sale of the “1853 Collection,” and other events, various examples are provided where a coin brings a price that suggests leading bidders regarded the respective coin as being overgraded or worse. In several cases coins that were graded MS-67, realized prices that were in tune with the market value of a 66 grade coin of the same type, date and mint that is certified by the same service. (Rather than list examples here, I hope that people will click and read some of those those reviews: Eight Gem Unc. 1853 Half Dimes; Gardner, Part 4 & Part 5; Auction Results for Newman’s U.S. silver coins, etc.)

This discussion is aimed at contributing towards attaining an understanding of grading interpretations and to stimulating thoughts about strategies for adjusting valuations for grading issues. Also, it is hoped that the grading services will become even more consistent, thus lessening grade-inflation, and that they will ‘buy back’ more doctored coins. To an extent, grading services respond to collector demands and market forces. There is also the possibility that new grading services might be started in the future.

Grade-Inflation

Is grade-inflation of non-doctored coins a more serious issue than coin doctoring? So far, it seems that there were fewer classic U.S. coins doctored in 2014 than there were in any one year from 1997 to 2007. Furthermore, CAC has identified and rejected many doctored coins, since CAC was founded in 2007. In addition, some doctored coins have been “restored” by the removal of putty or other additives at the grading services. A problem that has worsened in 2013 and 2014, and may worsen further in 2015, is grade-inflation.

In my opinion, grade-inflation is a much less serious problem than coin doctoring. Many people take certified grades too seriously. Experts and intermediate-level coin enthusiasts will always tend to argue about grades in a healthy manner. Coin doctoring however, amounts to an epidemic that threatens the health of coins and of the coin community. Others disagree with my view, however, and hold grade-inflation to be a much more serious problem.

In my opinion, grade-inflation is a much less serious problem than coin doctoring. Many people take certified grades too seriously. Experts and intermediate-level coin enthusiasts will always tend to argue about grades in a healthy manner. Coin doctoring however, amounts to an epidemic that threatens the health of coins and of the coin community. Others disagree with my view, however, and hold grade-inflation to be a much more serious problem.

Kathleen Duncan, principal of Pinnacle Rarities, was recently interviewed by Maurice Rosen for his annual Crystal Ball Survey. In an RNA newsletter, Duncan said that grade-inflation is a “major concern.” She points towards “grading changes” for “Walking Liberty halves and Washington quarters, the populations explode, driving down prices. This is only good for the grading services, which get more submissions, as dealers and collectors will resubmit hoping for upgrades,” Kathleen emphasizes. (For information about Rosen’s newsletter, call 516 483-3500.)

In this same issue of the RNA (Dec. 2014 – Vol. 39: No. 6, p. 8), Leo Frese says, “From the gradeflation that swept the industry over the past decade, to the modern issue ’70 game,’ to the disparity in grading of the same coin, all are factors which cast doubt on the services.” Frese worked for Heritage for more than a quarter of a century before joining a coin firm in California in 2011 and then starting his own business in 2012.

Frese is also concerned that a coin might have to be submitted to the same service five or six times to be assigned the “right grade.” If I am interpreting his point correctly, this is not a new phenomenon.

When I covered Stack’s (New York) auctions in the early to mid 1990s, there were many collector or estate consignments of non-certified, high quality, classic U.S. coins. As Internet bidding was not a factor and these auctions were dominated by wholesalers in attendance, the prices realized were often a function of projections of eventual PCGS or NGC grades of the coins that were auctioned, not the grades that would be awarded when these coins were first submitted. Put differently, if a non-certified coin realized a MS-65 level price at the auction, experts then would not have been surprised if that coin was graded MS-64 when it was first submitted; usually, a wholesaler who graded a coin in such an auction as MS-65 would figure that the coin would eventually be PCGS or NGC certified as grading 65, even if five or more submissions were required before a MS-65 grade is finally assigned.

“Consistency,” Kathleen Duncan declares, “isn’t something that is a benefit for the grading services, so there isn’t much incentive for them to change in this area” (RNA, same Dec. 2014 issue, p. 8).

“After the Eliasberg sale in 1997, there was the most grade-inflation that I ever noticed. Some Eliasberg and Pittman coins received surprisingly high grades from PCGS and NGC,” Richard Burdick recollects.

The grading situation was never the same as it was before 1997. The 1907 Trompeter-Morse, Ultra High Relief Saint was PCGS graded 67 before Aug. 1992 and NGC graded 69 before 2000. It was later PCGS graded 69 as well. A researcher could spend a lifetime finding examples of coins that have been ‘upgraded.’

Some people have theorized about a future non profit grading service employing excellent graders and run by dealer-owners who would be willing to post sight-unseen buy prices for all coins certified by their service, on an easy to access public web site. I would suggest including ‘buy’ offers for extreme rarities and for thousands of specific coins, such as some of those that were in the Eliasberg Collection.

Whether such a service would be successful depends upon a multitude of factors. Nevertheless, there would be a tremendous incentive for maintaining a high level of consistency and a strong motive for identifying doctored coins. For example, if the owner of a grading service is contractually and publicly committed to paying a serious, MS-66 level price for a coin, he has a motive to reduce the likelihood of a MS-65 or MS-64 grade coin being overgraded by his service as MS-66, and certainly has a motive to try to prevent a doctored coin from being graded as MS-66!

CAC

CAC places a green sticker on a coin in a PCGS or NGC holder if experts at CAC determined that the coin is ‘solid’ for the grade already assigned by PCGS or NGC. In another words, if John Albanese and another grading expert at CAC determine that the grade of a submitted coin is in the middle OR ‘high end’ of the grade range indicated by the already certified grade, the holder housing that coin will receive a green CAC sticker. In many cases, a coin that is upgraded by PCGS or NGC may fail to receive a green sticker of approval from CAC.

“Since our inception in 2007, if CAC was just an approving and stickering company, we would have operated at a loss. Most of our profits are derived from trading coins, not from stickering them,” John Albanese reveals.

CAC posts ‘sight unseen’ bid prices for many CAC approved coins on CoinPlex, a members-only trading network. Generally, though, such commitments to buy CAC approved coins ‘sight unseen’ relate to generics or type coins rather than to ‘better dates’ or true rarities.

CAC posts ‘sight unseen’ bid prices for many CAC approved coins on CoinPlex, a members-only trading network. Generally, though, such commitments to buy CAC approved coins ‘sight unseen’ relate to generics or type coins rather than to ‘better dates’ or true rarities.

I estimate that 30% to 40% of all rare or at least somewhat scarce, PCGS or NGC graded, classic U.S. coins either have been CAC approved or would be, if submitted. Suppose that grade-inflation continues? Will the percentage of CAC approved coins fall dramatically in the future? I know two wholesalers who frequently ‘crack out’ CAC approved coins and re-submit them to PCGS and NGC. Will the premiums paid, on average, for CAC approved coins rise in the future?

Two additional concerns must be addressed, the imperfections of top experts and the time required to grade coins. Although John Albanese has, in my view, the highest batting average among coin graders, he does ‘strike out’ sometimes.

No one can ‘bat one-thousand,’ so to speak. I apologize to those who are not comfortable with sports analogies. I find them to be extremely applicable to coin grading and thus educational in this context. The greatest of basketball players cannot make every shot. The best goalie cannot stop all balls or pucks. The best chess players in the world will each probably lose many games each year. It is impossible for leading experts to adjust for all pertinent variables that affect outcomes.

Besides, leading coin doctors are ‘throwing’ curve balls, sliders, sinkers and spit-balls. Indeed, human body fluids are often used on Morgan Dollars. It is difficult for expert graders, even those with the sharpest eyes, to detect doctored coins.

By his own admission, Albanese is analyzing “400 to 500 coins every day” in addition to all of his other responsibilities, which are vast. Although CAC does an impressive job and has contributed greatly to the coin collecting community, CAC does not provide a solution for all problems relating to coin doctoring and grade-inflation.

Time & Grading

When I view auction lots, it is not unusual to see a coin that, for thirty seconds, appears as though it is nearly flawless, very attractive and merits a gem grade in the 65 to 67 range, and then, during another thirty seconds of viewing, I notice that there are hairlines or significant contact marks being covered by material on the surface, which often seemed at first to be toning or films that naturally form on a coin. In some cases, the covering substances are truly natural and develop while coins stored in albums or envelopes.

In many instances, coin doctors select substances and colors that appear to be like the substances and colors that might naturally ‘come about’ on a respective coin. For example, there are coin doctors who do amazing jobs of generating artificial coatings that appear very much like the medium brown-russet toning that often naturally develops on old silver coins and they place such material over contact marks, hairlines and other imperfections.

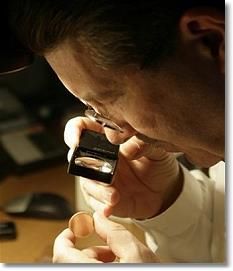

Graders at PCGS and NGC tend to grade more than 800 coins per day. One former NGC grader told me that he often graded more than 1200. At least one day, he graded around 1500 coins. Although I cannot draw firm conclusions about that which transpires in the minds of graders, in my experience, it often takes two to four minutes to conclude that a coin has been doctored. In many cases, some feel a need to examine the same coin on two different days.

Graders at PCGS and NGC tend to grade more than 800 coins per day. One former NGC grader told me that he often graded more than 1200. At least one day, he graded around 1500 coins. Although I cannot draw firm conclusions about that which transpires in the minds of graders, in my experience, it often takes two to four minutes to conclude that a coin has been doctored. In many cases, some feel a need to examine the same coin on two different days.

Yes, I realize that there are very sharp graders who are putting forth efforts to identify doctored coins. If I was the manager of a major league baseball team, however, I would never assume that my lead-off batter will always safely reach first base, even if he was destined for the hall of fame. In thousands of innings in major league baseball games, both the lead-off batter and the second batter will fail to ‘get on base.’

I have interviewed many experts graders over a period of more than twenty years. I theorize that a major reason why many doctored coins are not detected is that most leading graders, at the services and elsewhere, just spend a few seconds on each coin.

Additionally, there are other forms of doctoring besides the deliberate adding of substances to cover or deflect attention from imperfections. The consequences of some methods require a considerable level of magnification to detect.

While coins that are doctored may remain stable, many ‘turn’; apparent and annoying chemical reactions occur. For example, when automobile putty is added to a gold coin, the putty is usually about the same color as the area of metal to which it is added. Soon after such doctoring is done, it is very difficult to see that putty has been added. Later, however, the putty may change color and/or may be moved around when the coin is moved. Depending upon the chemical composition of the additives and storage conditions of coins, this could happen in a matter of days or not for more than ten years. So, in instances where experts are deceived by a doctored coin shortly after it was doctored, it might become obvious in the future that there is something wrong with such a coin.

Is Coin Doctoring Less of a Problem?

Of course, the vast majority of graded coins have never been doctored. Literally, millions of coins have been graded by PCGS and NGC. So, the number of doctored coins that actually make it into holders is statistically very small. Even so, I have seen thousands of graded coins that I believe have been doctored.

It is true that coin doctoring was a more serious problem during the era from 1997 to 2007 or so than it is now? That was the ‘dark age’ of coin doctoring and grade-inflation in the U.S. Coin doctoring continues to be a serious problem, however, that is not being addressed to the extent that I believe it must be for the long-term health of the coin community.

“Fewer coins are being doctored since the PCGS lawsuit against alleged coin doctors was filed in 2010. That lawsuit scared some coin doctors,” John Albanese remarks. “I have seen a lot less doctored coins over the last four years than I did from 2007 to 2010,” John adds.

To be fair, it should be noted that part of that lawsuit was dismissed by a judge and the remainder was settled privately. So far as I know, it was never proved in a court of law that any of the defendants were involved in coin doctoring or had harmed PCGS. I am not commenting here about the merits of specific allegations. When a particular coin is identified as having been doctored, it is usually very difficult, and sometimes impossible, to find out who doctored it.

As for definitions of coin doctoring, the PCGS definition, the PNG definition and my definitions are all close enough for present purposes. My definitions are superior in that they are not directly connected to the ‘value’ of coins. Some people doctor coins primarily for egotistical reasons, rather than just for financial reasons. Also, some definitions focus on the notion of an ‘improved’ appearance. There is no improvement when a coin is doctored.

Coin doctors harm coins in such ways that experts are often deceived into thinking that the harmed coins are of higher quality than they were before they were harmed. Dipping, though harmful, is not coin doctoring because, months or even years after a coin has been dipped, it is obvious to experts, and even to most non-expert collectors, that such a coin has been or was probably dipped. More than a few coin buyers are knowingly accepting of dipping. Coin doctoring relates to deception.

Coin doctors harm coins in such ways that experts are often deceived into thinking that the harmed coins are of higher quality than they were before they were harmed. Dipping, though harmful, is not coin doctoring because, months or even years after a coin has been dipped, it is obvious to experts, and even to most non-expert collectors, that such a coin has been or was probably dipped. More than a few coin buyers are knowingly accepting of dipping. Coin doctoring relates to deception.

Some coin doctoring activities result in irreparable damage being done to a coin. Other consequences are reversible. Generally, putty and films can be removed with acetone or similar products. The harm done to a doctored coin may be permanent or temporary, depending upon scientific factors.

Experts who I interviewed and declined to be quoted believe that grade-inflation was a more pressing problem than coin doctoring in 2014 and will be so in 2015. More and more PCGS and NGC certified coins are being upgraded.

How should coin buyers strategize?

John Albanese says, “buy the coin, not the holder. A service that is a leader now might not be the leader in ten years. The grading situation will be different ten or twenty years from now. Don’t buy a coin just because its graded by one service or has a sticker. Think about the quality of the coin. Truly nice coins are always demanded.”

Although Albanese and I disagree about the effects and desirability of dipping, we are substantially in agreement that sophisticated coin collectors tend to be consistent over time, to a large extent, about the characteristics of quality. There are quite a few, specific, ‘mint state’ coins that will always be regarded as scarce and terrific (unless they are modified). As for coins with readily apparent wear, the criteria that defined great circulated coins in the past remains largely the same in the present and probably will be so in the future.

In my view, there is continuity over time regarding the demands of serious collectors, despite changes in the coin business climate, trends in marketing coins to the general public, or in the policies of grading services. I draw attention to the quality and rarity of many (not all) of the coins in the Thomas Cleneay sale in 1890, the Matthew Stickney sale in 1907, the George Earle sale in 1912, the Jenks sale in 1921, the Garrett sales of 1979 to 1981, the Norweb sales of 1987 and 1988, the Pittman sales of 1997 and 1998, and multiple auctions of various Clapp-Eliasberg coins. No expert would endorse every single coin in the just mentioned collections.

There were serious collectors in the past who had very high batting averages in terms of selecting coins and/or were advised by very knowledgeable, coin professionals. To understand coins and the culture of coin collecting, it is important to recognize traditions and refer to coins that stood the test of time, especially those that were always understood to be important and exceptionally appealing.

* * *

Good article.

As a collector/investor/hip pocket dealer I have really grown tired of the grading game. One thing I did not see you mention was grade deflation, a period when the TPG’s tighten their grades and traditionally what is accepted as a 65 is now being certified as a 64. This sets a new standard over time that virtually wipes thousands of dollars of value out of someones portfolio if they need to sell during the period of deflation.

I summarize it is the graders way of creating a market of never-ending submissions. At some point in time as grades return to the acceptable standard, all those coins will be coming back for regrades… The same way you see so many dealers cracking out coins from the first generation PCGS holders.

I am all for a non profit grading service. When ANACS left the ANA, it has been all down hill since then for collectors and a fantastic ride for all the dealers and market makers. Guess it depends on what side of the fence you are on, the collector/investor or the guy selling them the coins…… As with everything else it is the individual that gets hurt, not the business that provide the supply.

Good thoughts, Roy.

I sincerely hope the future collectors will be intelligent enough to see the grading systems as some of us did when they first started: a scam and money making scheme (reference P.T. Barnum’s famous statement)

When the first TPG started out, the US had a lot more disposable income than most other (if not all) countries – so it was the perfect place to start such a business.

So a few people set themselves up as being THE experts who could PROPERLY grade a coin, and most of the world outside the US laughed while asking why in the world anyone with intelligence would actually PAY someone to tell them what they could do for themselves if they just looked at the grading criteria extensively outlined for each coin type inside their own Red Book? But THE experts knew the American people had/have been programmed greatly into non-self sufficiency, and most Americans emotionally “need” that “stamp of approval” from someone labeled as an “expert.”

I remember joking, while seriously knowing no one would ever be so foolish as to be suckered by it, that one day someone would start a grading service to verify THE experts who graded/slabbed the coins were actually expert enough to have done their work properly. Nah – this could never happen, people are not so gullible!

And… here we are. If the green sticker concept had started at the slabbing inception – it would have been laughed at. But people know when a generation (which is what it took) is brought up with a questionable concept from the start, that new generation is likely to embrace the concept and be ready to PAY for even more (uneeded) “experts” for their blessings.

Doesn’t the very existence of the sticker service already show the original money was, or was not wasted by paying the TPG? And in that last sentence I used the words “was not wasted” only in context of the mindset of those who pay for a TPG to grade their coins. Authentic verification is another matter. However, them cleaning coins (oops – “preserving or conserving”) and then grading them but again saying they are the only ones who can properly clean (oops – conserve) a coin is again a pretty one-sided claim.

I think it was last year someone even tried to start a sticker to verify the present ones. What was it? Well, they tried too early. Give it another 20 years and it will be reality.

The technology to keep humans out of the equation and use scanners and computers to make truly objective grades has been around since the 1990s – twenty years ago! I used a scanning machine very capable of this job in a QR department in the plastic injection molding industry. We had a machine scan down to 1/1000 of an inch and check areas of the part against a norm to make sure the quality of the part was what it was supposed to be. The machine could examine/compare/report on as many index points on the part as we wanted it to with accuracy so much more precise than just the 3X-10X magnification TPGs use that the tech even back then was overkill for what would be needed. And the machine we used could easily have been scaled way back to accommodate the much lower resolution.

Lo and behold, research shows the TPGs invested large amounts of money into such a system back in the 90s. Then they suddenly abandoned it Why?

The following is only speculation (note that), but a business like this is after one major thing – profit. The tech was available for removing human error in coin grading back in the 90s. But the implementation of such a system would make even more profits if it would be held until such a time when business slows — such as in the future when there are not as many unslabbed coins anymore.

The new CCGS (Computer Coin Grading System) could be made with such statements/adverts/propaganda as,”NEW! Computer coin grading totally free from human error! How can you possibly sleep at nights knowing your MS 69 Morgan may actually qualify for MS 70? We NOW can remove all doubt from human error!” Just send in (yet another) 30.00 each (and any priceless heirloom) and we will be able to guarantee to cure your insomnia (with our now antique, 30 year old technology we could have been using before but wanted to preserve our profitable future).”

Oh, but wait! There’s more! Just like the sticker concept, another company will later arise saying that CCGS use an (ahem) outdated computer, and that their computer is programmed with a much more accurate algorithm to perform an ACTUAL, FACTUAL computer grading (there’s will employ the same tech as your iphone does – face recognition tech adapted to coins). So for only 10.00 each, our newer (old) computer will verify their (antique) computer did its job! Don’t let a possible software error keep you awake at night!

And people will go for it.

Those spending all the money will naturally be prodded by their emotions to not want the facts and criticize those who see through, and lived during the process inception, what has happened. It is human nature to admit personal error – especially when a lot of money is involved.

Another way the hobby has been hurt due to TPGs is that they have shifted the focus away from each coin’s availability and individual values (due to mintages etc.) and have shifted the focus onto their key dates. In other words, it its not slab-worthy, the hobby sees it as just junk silver to fill a hole. Only the keys matter in a collection anymore. It used to be fun finding a coin in circulation and then looking it up to see its grade and value – and not just for the keys!

Nowadays if someone has a good coin they want to sell, they know a piece of plastic around it with a sticker affixed adds an artificial value to it. And then, people go as far as to assign higher values to the paper included with the plastic that describes the coin (special labels). So the TPGs have enabled people to make an extra amount from being payed to do the work anyone could do anyway if they did a tiny bit of self application.

Authenticating is a different story. But again, it just takes a little self application.

Snake oil. Einstein was right when he said only two things are infinite… google it.