Numismatic Market Review by Jim Bisognani – NGC Weekly Market Report ……

As I type this morning, I am reminded by the calendar that, in about a fortnight, 2021 will pass the baton to 2022. It has been an awe-inspiring and eye-opening year in the world of numismatics.

Sales of coins realizing a million dollars each or more at auctions and via private sales have been record-breaking. Along for the ride, US and world coins of virtually every series and type have benefited from the publicity. As one well-known New Jersey dealer said: “Some series that were left on the back burner are now like a zombie that doesn’t know it’s dead yet… they just keep coming back.”

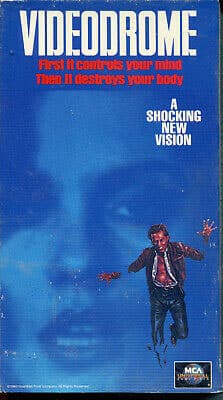

Well, that cuts quite the image, yet perhaps new waves of collectors are entering the marketplace. Some much-needed younger blood is helping to change our hobby’s aging demographic. Seemingly all established collectible genres–including comic books, sports cards, movie posters, lobby cards, and animation art–are commanding attention. I have to wonder what the next big collectible will be. Who better to ask than the co-chairman of the world’s largest collectible auction house? In a recent exchange with Jim Halperin, Co-Chairman at Heritage Auctions, I posed this question.

Initially tongue in cheek, Mr. Halperin’s response was:

Initially tongue in cheek, Mr. Halperin’s response was:

“Probably whatever CGC decides to start certifying next! Seriously, I’d suggest vintage VHS (and Betamax) tapes. Many rarities exist, especially iconic titles in early and/or first editions in still-sealed high grade. Their nostalgic appeal and cultural and historical importance are nearly impossible to overstate. Just think about how profoundly the ability to view movies at home instead of always in theaters changed our lives and social interactions beginning in the late 1970s.”

That seems highly plausible. I am especially excited since I still have quite a few early Betamax movies — still sealed, mostly from the early 1980s. Some classic early titles we all know were in the better format — Beta.

Anyway, that exchange prompts a minor drum roll to announce that it is time for my 11th Annual NGC Year in Review (Part 1). Once again, I have enlisted the sage commentary from numismatic experts for this exercise.

We’ve seen unprecedented growth seemingly everywhere in the coin market during the last few years. What are the biggest winners, and what might still be undervalued?

John Brush – President of David Lawrence Rare Coins

The biggest winners are collectors who started on their journey before COVID and over the past 10 years. If you bought quality coins during that period of time from reputable sources, you’re sitting on unrealized profits. The biggest winners recently have been gold collectors, specifically $20 Double Eagle collectors. Better date Saints have gone through the roof since the sale of the 1933 Double Eagle.

If I had built a collection of these prior to COVID, I’d be an aggressive seller right now! Also, those that have bought key dates across all series are sitting in a good position now as the prices and demand for these have gone up dramatically, especially when you’re talking about blue-chip key dates of the 20th Century like 1909-S VDB Cents and 1916-D Dimes. These things have been bringing crazy numbers, both privately and publicly. While these coins will always be rare, it’s hard to imagine recommending to a valued customer that the time to jump on these is now.

Bob Green – Owner of Park Avenue Numismatics

Growth this year was phenomenal in almost all areas of numismatics, and it’s hard to pick one area, but $20 Saint-Gaudens and $20 Liberty Gold were great movers. Key-date Saints at auction were at sky-high levels, and Carson City $20 Liberties were on fire! As always, US types are overlooked and undervalued.

Growth this year was phenomenal in almost all areas of numismatics, and it’s hard to pick one area, but $20 Saint-Gaudens and $20 Liberty Gold were great movers. Key-date Saints at auction were at sky-high levels, and Carson City $20 Liberties were on fire! As always, US types are overlooked and undervalued.

Jim Stoutjesdyk — Vice President of Numismatics, Heritage Auctions

Many prices are up 20%, 30%, or higher from a few years ago, but one of the biggest winners has to be 1921-dated Morgan and Peace Dollars. Telemarketers promoted the new 2021-dated Morgan and Peace Dollars by offering centennial sets that included examples of the vintage dollars and the new reboot. As a result, prices of vintage coins have doubled or nearly tripled in the past few years. For example, 1921-D Morgan Dollars in MS 64 that had a CDN bid price of $120 at the beginning of 2020 are now bid for $310. The 1921 Peace Dollars in MS 63 that had a CDN bid price of $375 at the beginning of 2020 now bid for $975.

The price of “trophy coins” has also exploded. Although many series have already seen a strong rise in prices, I think there is still a lot of room for growth in things like Proof Barber and Seated coinage and classic gold and silver commemoratives, just to name a few.

Ian Russell – President and Owner, GreatCollections Coin Auctions

We started to see an uptick almost immediately after COVID hit. The first wave was from people who used to collect coins coming back into the market. We saw prices creeping up. Then in January of this year, there was a significant number of new collectors coming into the market. The 1933 Saint-Gaudens selling for almost $19 million was the next milestone that I think helped attract the next wave of new collectors, and then it’s just been building ever since. The ANA and Long Beach in the second half of 2021 saw many younger people in attendance.

We started to see an uptick almost immediately after COVID hit. The first wave was from people who used to collect coins coming back into the market. We saw prices creeping up. Then in January of this year, there was a significant number of new collectors coming into the market. The 1933 Saint-Gaudens selling for almost $19 million was the next milestone that I think helped attract the next wave of new collectors, and then it’s just been building ever since. The ANA and Long Beach in the second half of 2021 saw many younger people in attendance.

Also, look at Carson City gold coins. They are always popular, even in weaker markets, yet in 2017 through 2019, a large hoard of circulated CC coinage came back to the States from overseas, causing pricing pressure. In 2020 and particularly 2021, prices went up sharply in this area, to new highs. And they seem to be getting stronger by the month as there is a lack of supply and only increased demand.

What we’re seeing as undervalued coins are ones that rarely trade on the market. They are difficult to price, as you can’t just apply a set percentage over the last sale. If one has traded in many years, then there’s likely increased demand to take into account as well.

Charles Morgan – Editor of CoinWeek

Collectors have been the biggest winners of this growth period. We see numismatic collecting taking off beyond the traditional markets that we are used to covering. Ancient and world coins are doing well! Tokens and medals are on solid ground. Paper money is doing well. Even modern coins are primed for growth in 2022. The US Mint will offer the best slate of designs it has offered in years. This is a great time for collectors.

Collectors have been the biggest winners of this growth period. We see numismatic collecting taking off beyond the traditional markets that we are used to covering. Ancient and world coins are doing well! Tokens and medals are on solid ground. Paper money is doing well. Even modern coins are primed for growth in 2022. The US Mint will offer the best slate of designs it has offered in years. This is a great time for collectors.

Brian Hodge – Partner of Lee Minshull Rare Coins (LMRC)

I’ve been focusing on foreign coins this year. I think about half our inventory now consists of foreign and ancient coinage. We have seen an unprecedented number of sales from all over the world in those categories this year. Certainly, when you can buy a Pillar Dollar from the 18th century representing the beginnings of trade in the New World for a fraction of the cost of a US Mint issue of a later date, it seems like a no-brainer!

Kevin Lipton – Owner of Kevin Lipton Rare Coins

The biggest winners are “finest graded” CAC coins. We have seen bidding wars at auction for these coins. Of special note was the amazing short set of Walkers sold by Stack’s Bowers this fall. Any “trophy coin or painting” is going to set the world on fire.

James Sibley – Collector

I believe that the segments of the numismatic market that have benefited most during the COVID-era are precious metals and the rarest of the rarities (e.g., 1894-S Barber Dime, 1804 Draped Bust Dollar, and 1913 Liberty Head Nickel). Lagging the market have been 19th-century copper, nickel, and silver type coins, particularly Proofs (Seated Liberty Proof Quarters and Halves are great examples of market laggards).

In your opinion, just why has the coin market taken off? Nothing initially became scarce overnight; was it just a flight to all collectibles?

John Brush

It has been a perfect storm, really. The COVID-19 pandemic lit a fire under folks to start collecting once again and as that continued to slowly burn, more and more collectors got into the hobby. Eventually, the economy started making some moves that also made it far more interesting to buy tangible items like coins and bullion instead of investing in the stock market or putting your money in your typical savings instruments.

All of these things fueled the fire and as the grading services became bogged down and turnaround times became slower, fewer freshly graded coins entered the market, as well as the lack of coin shows slowing the flow of certified coins throughout the marketplace. It wasn’t one event, but a chain of dominos that occurred that kept stoking the fire so that it eventually turned the campfire into a booming coin economy.

Bob Green

Two years with no coin shows due to COVID-19 brought about a collecting frenzy for stay-at-home collectors. Once shows opened, the swell of demand was insatiable to dealers.

Lianna Spurrier – Creative Director of Numismatic Marketing

I’m sure there were other factors at play, but the most obvious influence is COVID-19. Everyone suddenly found themselves stuck at home with nothing to do. Those who didn’t spend time on hobbies previously found themselves in need of some, and coin collecting is an easy one to do without leaving home. The circulating coin shortage last year may have also driven some interest our way.

James Sibley

We have witnessed a “perfect storm” in the numismatic market since COVID reached our shores, which has led to the price escalation we see in many, but not all, market segments. First, people have had more time on their hands to devote to their hobbies. Second, more money in their pockets, due to both deferred discretionary spending, such as travel and entertainment, and government stimulus, to spend on these hobbies.

Finally, and perhaps most importantly, there has been a flight to hard assets as people seek to protect their wealth from the impact of inflation. It would not surprise me at all that the money behind Ian Russell’s (GreatCollections) recent mega acquisitions came from folks who are entirely new to coins and not from traditional collectors. The smart money is converting dollars, which they deem will depreciate, into assets that they feel will appreciate. It’s not rocket science.

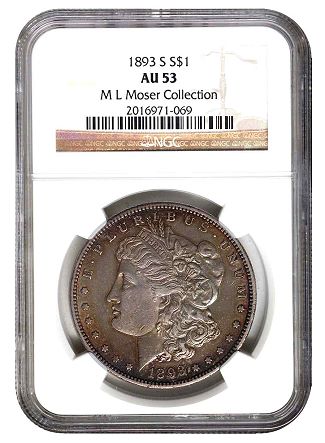

Ian Russell

If anything, the coin market has lagged compared to other collectibles over the past two years. With COVID, there was a definite supply-chain issue for the rare coin market (for example, no shows were taking place), and it didn’t take a lot of new collectors to move the market. We also found a lot of existing collectors were focused on completing their collections and stretching for a 1909-S VDB Lincoln Cent or 1893-S Morgan Dollar that perhaps previously they were going to wait years to buy. For several years, coin prices were stagnant, and you can’t say that anymore.

If anything, the coin market has lagged compared to other collectibles over the past two years. With COVID, there was a definite supply-chain issue for the rare coin market (for example, no shows were taking place), and it didn’t take a lot of new collectors to move the market. We also found a lot of existing collectors were focused on completing their collections and stretching for a 1909-S VDB Lincoln Cent or 1893-S Morgan Dollar that perhaps previously they were going to wait years to buy. For several years, coin prices were stagnant, and you can’t say that anymore.

Brian Hodge

A lot of wealth has been generated in the last couple of years across many sectors in our economy. COVID had a lot to do with that, I think. There are vast droves of money coming in from stock market gains, crypto gains, and so on. I think many of the people who have invested in those vehicles understand the need to diversify and have looked to the rare coin market as that piece of their portfolio.

Kevin Lipton

There has never been more cash floating around the world. Between government stimulus and “Bitcoin” billionaires diversifying, it is the ultimate time for almost all high-end collectibles. Throw in a Democratic president, and you have all the conservatives running back to gold again!

Charles Morgan

Coins are routinely traded online, and given the changes to commerce over the course of the past year, I think most collectors have completely bought into e-commerce. The auction companies feel the same way as they have transitioned to online sales. Given the scope and scale of the online market, I expect to see growth in the online experience in the coming years.

Jim Stoutjesdyk

I think the pandemic played a big role in igniting the huge demand for rare coins and collectibles. The vast majority of Americans were either quarantined, stayed at home, or worked from home during most of 2020 and 2021. With vacations canceled, eating out at restaurants halted, and recreational activities almost non-existent, people had a lot of extra time at home and a lot of extra disposable income.

At Heritage Auctions, I remember some very serious discussions that occurred in March 2020 debating the possibility that the rare coin and collectibles market could crash. Instead, the exact opposite occurred. We began noticing a big spike in online bidding activity with more bidders participating in auctions and stronger prices realized across the board in all of our categories. In addition to people being stuck at home and having extra money to spend, the looming threat of inflation, and the general feeling of wealth people are experiencing from the value of their homes skyrocketing and their 401(k)s at record highs, it’s the perfect storm for the rare coin and collectibles market to explode.

What was the first coin or series that was the catalyst for you to get started in this hobby and business?

John Brush

My first collection was a Franklin Half Dollar collection that I worked on with my dad. After we completed it, he worked on Peace Dollars while I built a circulated Buffalo Nickel set. I just came across this set the other week and REALLY enjoyed looking over it once again.

My first collection was a Franklin Half Dollar collection that I worked on with my dad. After we completed it, he worked on Peace Dollars while I built a circulated Buffalo Nickel set. I just came across this set the other week and REALLY enjoyed looking over it once again.

Bob Green

Morgan Dollars got me started. Today helping collectors build and complete a Morgan Dollars set still excites me.

Lianna Spurrier

Like many others, my first interest was in wheat pennies. I received a jar of them when I was 11 and soon had them all laid out by date and mintmark on my living room floor, kick-starting a hobby that turned into a career. My focus has since shifted, but like most, I still have that incomplete Dansco album of wheat pennies that I sorted through bulk lots and eBay listings to buy.

James Sibley

Way back, when I was a paperboy in the suburbs of New Haven, Connecticut, somewhere around age 10, I started to look at the pennies, nickels, and dimes I would receive from my customers (at the astounding sum of 47 cents per week for seven daily papers), which led me to start filling Whitman folders. A while later, my friends and I got the idea that we could become rich socking away rolls of contemporary BU Lincolns and “rarities” we pulled from circulation – remember the 1960-D Small Date Cent? One of the first things I did when I returned to collecting three years ago was to deposit nearly a hundred rolls of them at my local bank.

Jim Stoutjesdyk

I remember one rainy weekend, when I was about nine or 10 years old, my father went to his safe deposit box and brought home his coin collection and spread it out on the kitchen table. I had no idea he was a coin collector, but I was immediately fascinated by all of the coins spread out in front of me. I asked him why there were some coins missing and he explained to me that some he couldn’t find in circulation (he got his 1916-D Dime in change working at a concession stand at a movie theater in the 1950s), and others he had to sell to help pay for college and his wedding.

We started going to the local coin shop and filling in the missing coins. I remember I really liked nickel coinage, especially Liberty Nickels, and we eventually completed the set in nice, circulated condition. When I got older, I put together a complete set of Liberty Nickels in Mint State condition and then a complete set of Shield Nickels with major varieties in Mint State condition. My Shield Nickel set was the third all-time finest set on the PCGS Set Registry when Heritage auctioned it for me. Now it’s the fifth all-time finest set — thanks to those darn billionaires!

Ian Russell

Outside of bullion, the first coin I bought was an 1885-S Morgan Dollar with really nice toning. I still have it today. I’m now collecting Australian paper money.

Brian Hodge

Mercury Dimes and Lincoln Cents were my first drive into the coin market. I loved Proof Mercuries, especially for their scarcity and overall beauty. You can still buy some of them in PF 69 for not a whole ton of money!

Kevin Lipton

I had a Dansco type coin album I filled. The magic moment for me was when I was 12 years old, I purchased an 1840 Half Dime from a dealer in Paramus, New Jersey for $10 and immediately resold the coin to another dealer for $35! My life had changed at that moment.

Charles Morgan

The 1976 Quarter was the first coin I ever handled that I didn’t want to spend. From there, it was Indian Head Cents and V Nickels that got me hooked!

What numismatic item is still on your personal wish list?

Bob Green

A 1933 $20 Saint-Gaudens — a guy can dream!

Lianna Spurrier

Shotoku ichibu, anyone? My main collection now is Japanese bar money, a series of rectangular pieces from 1599-1869. The Shotoku ichibu is one of two or three real key types, but it will be quite a while before I can afford one. Even so, they don’t come up for sale very often. I’ve only seen about 20 sales worldwide in the past 13 years, and only two of those would have a chance at straight grading.

James Sibley

Many, but a couple are an 1883 black/white Trade Dollar in Proof 65 or 66 and a 1916 Standing Liberty Quarter in MS 65. In the 2020 version of NGC’s Annual Market Review, I answered the same question with the SLQ and a 1913-S Barber Quarter both in MS 65. I picked up Larry Miller’s 1913-S last February in an auction, but the price of the 1916 SLQs got away from me before I could pull the trigger on a specimen with the eye appeal I was looking for. So, a goal for 2022 is to hopefully pick up the 1916 SLQ.

Ian Russell

An Una and the Lion — the iconic British issue. It has gone up in value significantly over the past 10 years, so still out of my reach, but maybe one day.

Brian Hodge

There are a few. If money was no object, I’d like to have a key-date set of US coins. You know, a 1909-S VDB, a 1955 Doubled Die, a 1916-D, I don’t even need to mention the denominations as they’re so famous. Beyond that, I’d love to have a complete set of 12 Caesars gold and a few major world rarities. I don’t think I’d be the type that would put together a complete collection of dates and mints of any series. I just love the cool stuff.

Kevin Lipton

A Brasher Doubloon would be nice to own.

Jim Stoutjesdyk

I am determined that one day, I will own a nice 1794 Dollar and 1792 Half Disme. Those are two of my favorite US coins, and despite being jaded working with fabulous rarities at Heritage all day long, I still get excited when one of those coins crosses my desk. If I had to pick my dream coin to own it would probably be Judd-1776, with the unique MCMVII Indian Head Double Eagle Pattern. In my 28 years at Heritage Auctions, I’ve seen just about everything, but that one eludes me. It last appeared at auction in 1981, and if it was sold at auction today, I think it would set a new record for the most valuable rare coin ever sold and surpass $20 million.

I am determined that one day, I will own a nice 1794 Dollar and 1792 Half Disme. Those are two of my favorite US coins, and despite being jaded working with fabulous rarities at Heritage all day long, I still get excited when one of those coins crosses my desk. If I had to pick my dream coin to own it would probably be Judd-1776, with the unique MCMVII Indian Head Double Eagle Pattern. In my 28 years at Heritage Auctions, I’ve seen just about everything, but that one eludes me. It last appeared at auction in 1981, and if it was sold at auction today, I think it would set a new record for the most valuable rare coin ever sold and surpass $20 million.

Charles Morgan

I may never own one, but I have always wanted to have a Bar Copper. I just love them!

* * *

Thanks to my learned coin comrades for their insights. Stay tuned as I can’t wait to share Part II with my fellow coindexters for my next installment!

Until next time, be safe, happy holidays, and happy collecting.

Jim Bisognani is an NGC Price Guide Analyst having previously served for many years as an analyst and writer for another major price guide. He has written extensively on US coin market trends and values.