by Louis Golino for Coin Week

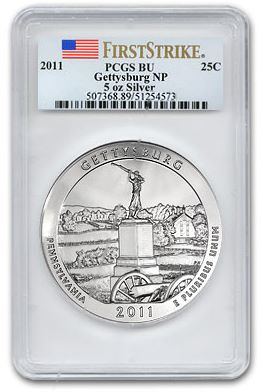

On August 30 the U.S. Mint’s online list of upcoming products was updated to include the first 2011 collector version in the five-ounce silver America the Beautiful (ATB) coin series. The coin, which will be released on September 22, is the 2011-P Gettysburg coin, which honors the national military park in Gettysburg, Pennsylvania.

On August 30 the U.S. Mint’s online list of upcoming products was updated to include the first 2011 collector version in the five-ounce silver America the Beautiful (ATB) coin series. The coin, which will be released on September 22, is the 2011-P Gettysburg coin, which honors the national military park in Gettysburg, Pennsylvania.

No price has been set yet, nor has any information been released regarding the maximum authorized mintage of the coin. Because of volatile silver prices, the price of the coin is likely not to be announced until a couple of days before the coin’s release, if not on the day of release.

Collectors of the ATB series are eagerly awaiting information on how many of these coins will be produced.

The 2010 numismatic ATB coins have sold a maximum of 27,000 units each. Although that is a small number for a numismatic silver coin, the 2010 coins have not seen the demand levels which many people expected for this series.

Nonetheless, the only 2010-P ATB coin which is still available for sale from the Mint is the Mount Hood coin. The Grand Canyon coin recently sold out.

Based on the U.S. Mint’s weekly sales report that was released on August 29, the Mount Hood coin has sold 19,645 pieces. It has been on sale since July 28.

The collector versions of these coins have a special matte finish that is produced through a process called vapor blasting, that uses water and cement mix, to give the coins a uniform look.

Following the release of the Grand Canyon numismatic version, some collectors and dealers discovered that they had coins of that release that had either a lighter than normal finish, or that totally lacked the special finish. NGC and PCGS, which at first only recognized the “light finish” variety, are now also identifying coins that lack the finish altogether. The later appear to be much scarcer, but the lighter finish coins also command substantial premiums in the marketplace, especially higher grade coins.

In the time since “light finish” and “no finish” Grand Canyon coins have been discovered and attributed by the grading services, other 2010 numismatic ATB coins that do not have the full vapor blast finish have also been found.

It remains very unclear what the longer term premium for these coins will be. When the earlier coins were released, buyers had no point of reference to compare coins with different degrees of vapor blasted finish. As more collectors review their earlier purchases, they may find more such coins, so it is very hard to gauge the extent to which such small variations in appearance will matter to future buyers.

The Mint has also produced 2010 and 2011 bullion versions of these coins, which do not have a vapor-blasted finish. Instead, the bullion coins come in three versions: regular mint state, proof-like, and deep proof-like. The bullion coins are distributed through the Mint’s network of authorized purchasers.

The Mint has also produced 2010 and 2011 bullion versions of these coins, which do not have a vapor-blasted finish. Instead, the bullion coins come in three versions: regular mint state, proof-like, and deep proof-like. The bullion coins are distributed through the Mint’s network of authorized purchasers.

With almost each successive 2010-P numismatic release, the rate of sales of the coins has slowed, and buyers and analysts have continued to question the future of these coins. So many different ATB coins have been released this year that some people have referred to what they call “ATB fatigue.”

Several factors are at play here. First, silver prices have been unusually volatile this year, hitting a high of almost $50 this spring, only to drop to the low $30 range following a succession of margin increases intended to reduce volatility and shake out the speculators who helped double silver prices in a brief period. Since then silver has remained in the $35-45 range.

As a result of the drop of almost $20 in silver prices in the spring, some ATB buyers worried that they were overpaying for these coins, which cost $285 from the Mint.

Second, collector budgets are strained to the breaking point by the plethora of numismatic coins released by the Mint this year. When combined with rapidly rising metal prices, that was bound to produce major swings in demand for 2011 gold and silver coins from the Mint.

Third, collectors looking ahead realize that with five releases a year, totaling 25 ounces of silver, and rising silver prices, it will be difficult to complete the entire series over the coming decade. This is causing a lot of collectors to evaluate their plans for collecting these coins.

Many feel they won’t be able to buy all the coins that will be released in the future and will focus instead on the specific releases that appeal to them because they like the design, or the national park being commemorated is a favorite. If over the course of the series, relatively few people decide to stick with it, demand for the coins will suffer.

Fourth, these coins are the most widely discussed modern U.S. coins of the year, but a lot of the earlier enthusiasm for them has been mitigated by the points mentioned above, which is affecting the way they are viewed by collectors and buyers.

I think it is possible to overstate this since we just do not know at this point what the future holds for these coins. Once all the numismatic versions have been absorbed by the marketplace, and depending on the extent to which they are in strong hands, meaning buyers who plan to keep them long-term, demand may increase again. Future collectors will need the first two year’s coins to complete their set.

The point is we just don’t know at this point how demand for the series will develop, and it is probably premature to make predictions now that the series is doomed. The key factors, apart from silver prices and what other coins are competing for collectors’ attention and budgets, will be mintage levels.

Most people thought 27,000 coins would sell-out quickly for each numismatic ATB release, but the household limit of one, even if some people found ways around it, has allowed anyone who wanted a coin to get one.

If the Mint keeps the maximum mintage at this level, and especially if it decreases the number, future demand for these coins should be relatively good. But if instead, more than 27,000 coins are released, then the series could be in trouble.

Louis Golino is a coin collector and numismatic writer, whose articles on coins have appeared in Coin World, Numismatic News, and a number of different coin web sites. He collects U.S. and European coins and is a member of the ANA, PCGS, NGC, and CAC. He has also worked for the U.S. Library of Congress and has been a syndicated columnist and news analyst on international affairs for a wide variety of newspapers and web sites.

Louis Golino is a coin collector and numismatic writer, whose articles on coins have appeared in Coin World, Numismatic News, and a number of different coin web sites. He collects U.S. and European coins and is a member of the ANA, PCGS, NGC, and CAC. He has also worked for the U.S. Library of Congress and has been a syndicated columnist and news analyst on international affairs for a wide variety of newspapers and web sites.

I really feel that if the usmint wants to sell these suckers, they had better get their marketing department to work. I know so many people that invest in bullion, but don’t know about the ATB series in P or bullion form. A couple of TV commercials or some mailings focusing on just the 5 ozers would go a long way. I realize you’d have to be blind not to know about the 5 ozers if you are a blogger, but I know so many people that are just not big online guys which leaves them in the dark. Just my opinion based on the folks around me.

Excellent point, Time. The Mint should do much more advertising of the P’s and the bullion coins as well as of the 2 million 9/11 medals. I got my medal Friday, and it is very nice.

Bullion investors should be jumping on the 2011 coins which can be purchased for lower premiums than silver eagles and they are made in much lower numbers. If you want to know more, check out a forthcoming column I am working on.

First if you think you have a light finish coin DO NOT send into pcgs, I have one of the first examples of a light finish grand canyon and it was refused by pcgs as they are only grading one without any Vapor Blast.After repeated attempts to makie them aware of the three differences fully matted light matted and no matted I realized they didn’t want to hear it, I will be sending mine to ngc as I know its the true Light finish variety, Its really sad to see those few from pcgs there calling light satin are in fact no satin at all. And there were others who have the light finish and set them in only to be returned graded……oh well good luck

Tom,

Thanks for the info. on your experience.

This is surprising since the PCGS web site says they grade

coins with a light satin finish.

Good luck with NGC,

Louis